Citibank 2013 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2013 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.69

MANAGING GLOBAL RISK

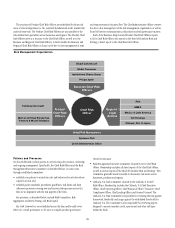

Risk Management—Overview

Citigroup believes that effective risk management is of primary importance to

its overall operations. Accordingly, Citi’s risk management process has been

designed to monitor, evaluate and manage the principal risks it assumes

in conducting its activities. Specifically, the activities that Citi engages

in—and the risks those activities generate—must be consistent with Citi’s

underlying commitment to the principles of “Responsible Finance.” For

Citi, “Responsible Finance” means conduct that is transparent, prudent and

dependable, and that delivers better outcomes for Citi’s clients and society.

In order to achieve these principles, Citi establishes and enforces

expectations for its risk-taking activities through its risk culture, defined

roles and responsibilities (the “Three Lines of Defense”), and through its

supporting policies, procedures and processes that enforce these standards.

Citi’s Risk Culture. Citi’s risk management framework is designed to

balance business ownership and accountability for risks with well defined

independent risk management oversight and responsibility. Citi’s risk

management framework is based on the following principles established by

Citi’s Chief Risk Officer:

•a defined risk appetite, aligned with business strategy;

•accountability through a common framework to manage risks;

•risk decisions based on transparent, accurate and rigorous analytics;

•a common risk capital model to evaluate risks;

•expertise, stature, authority and independence of risk managers; and

•risk managers empowered to make decisions and escalate issues.

Significant focus has been placed on fostering a risk culture based on

a policy of “Taking Intelligent Risk with Shared Responsibility, without

Forsaking Individual Accountability”:

•“Taking intelligent risk” means that Citi must identify, measure and

aggregate risks, and it must establish risk tolerances based on a full

understanding of concentrations and “tail risk.”

•“Shared responsibility” means that all individuals collectively bear

responsibility to seek input and leverage knowledge across and within the

“Three Lines of Defense.”

•“Individual accountability” means that all individuals must actively

manage risk, identify issues, and make fully informed decisions that take

into account all risks to Citi.

Roles and Responsibilities. While the management of risk is the collective

responsibility of all employees, Citi assigns accountability into three lines

of defense:

•First line of defense: The business owns all of its risks, and is responsible

for the management of those risks.

•Second line of defense: Citi’s control functions (e.g., Risk, Compliance,

etc.) establish standards for the management of risks and effectiveness

of controls.

•Third line of defense: Citi’s Internal Audit function independently provides

assurance, based on a risk-based audit plan approved by the Board

of Directors, that processes are reliable, and governance and controls

are effective.

The Chief Risk Officer, with oversight from the Risk Management and

Finance Committee of the Board of Directors, as well as the full Board of

Directors, is responsible for:

•establishing core standards for the management, measurement and

reporting of risk;

•identifying, assessing, communicating and monitoring risks on a

company-wide basis;

•engaging with senior management on a frequent basis on material

matters with respect to risk-taking activities in the businesses and related

risk management processes; and

•ensuring that the risk function has adequate independence, authority,

expertise, staffing, technology and resources.

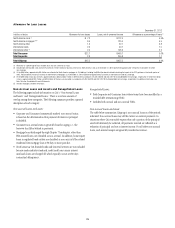

Risk Management Organization

As set forth in the chart below, the risk management organization is

structured so as to facilitate the management of risk across three dimensions:

businesses, regions and critical products.

Each of Citi’s major business groups has a Business Chief Risk Officer who

is the focal point for risk decisions, such as setting risk limits or approving

transactions in the business. The majority of the staff in Citi’s independent

risk management organization report to these Business Chief Risk Officers.

There are also Chief Risk Officers for Citibank, N.A. and Citi Holdings.

Regional Chief Risk Officers, appointed in each of Asia, EMEA and

Latin America, are accountable for all the risks in their geographic areas

and are the primary risk contacts for the regional business heads and

local regulators.