Citibank 2013 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2013 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.52

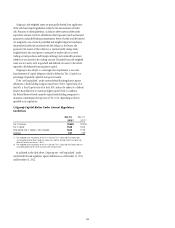

Risk-Based Capital Ratios

Under the Final Basel III Rules, when fully phased in by January 1, 2019,

Citi will be required to maintain stated minimum Tier 1 Common, Tier 1

Capital and Total Capital ratios of 4.5%, 6% and 8%, respectively, and will

be subject to substantially higher effective minimum ratio requirements

due to the imposition of an additional 2.5% Capital Conservation Buffer

and a surcharge of at least 2% as a global systemically important bank

(G-SIB). Accordingly, Citi currently anticipates that its effective minimum

Tier 1 Common, Tier 1 Capital and Total Capital ratio requirements as of

January 1, 2019 will be at least 9%, 10.5% and 12.5%, respectively.

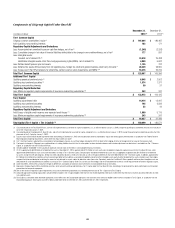

Further, the Final Basel III Rules implement the “capital floor provision”

of the so-called “Collins Amendment” of the Dodd-Frank Act. This provision

requires Advanced Approaches banking organizations to calculate each of the

three risk-based capital ratios under both the Standardized Approach starting

on January 1, 2015 (or, for 2014, prior to the effective date of the Standardized

Approach, the existing Basel I and Basel II.5 capital rules) and the Advanced

Approaches and publicly report the lower (most conservative) of each of

the resulting capital ratios. The Standardized Approach and the Advanced

Approaches primarily differ in the composition and calculation of total risk-

weighted assets, as well as in the definition of Total Capital.

Advanced Approaches banking organizations such as Citi and Citibank,

N.A. are required, however, to participate in, and must receive Federal Reserve

Board and OCC approval to exit a parallel run period with respect to the

calculation of Advanced Approaches risk-weighted assets prior to being able

to comply with the capital floor provision of the Collins Amendment. During

such period, the publicly reported ratios of Advanced Approaches banking

organizations (and the ratios against which compliance with the regulatory

capital framework is to be measured) would consist of only those risk-based

capital ratios calculated under the Basel I and Basel II.5 capital rules (or,

after January 1, 2015, under the Standardized Approach). During the parallel

run period, Advanced Approaches banking organizations are required to

report their risk-based capital ratios under the Advanced Approaches only

to their primary federal banking regulator, which for Citi is the Federal

Reserve Board. Upon exiting parallel run, an Advanced Approaches banking

organization would then be required to publicly report (and would be

measured for compliance against) the lower of each of the risk-based capital

ratios calculated under the capital floor provision of the Collins Amendment,

as set forth above.

On February 21, 2014, the Federal Reserve Board and OCC granted

permission for Citi and Citibank, N.A., respectively, to exit the parallel run

period and to begin applying the Advanced Approaches framework in the

calculation and public reporting of risk-based capital ratios, effective with

the second quarter of 2014. Such approval is subject to Citi’s satisfactory

compliance with certain commitments regarding the implementation of

the Advanced Approaches rule, as well as general ongoing qualification

requirements.

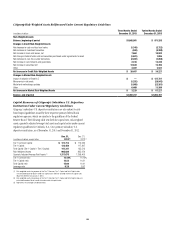

Capital Buffers

The Final Basel III Rules establish a 2.5% Capital Conservation Buffer

applicable to substantially all U.S. banking organizations and, for Advanced

Approaches banking organizations, a potential additional Countercyclical

Capital Buffer of up to 2.5%. An Advanced Approaches banking organization’s

Countercyclical Capital Buffer would be derived based upon the weighted

average of the Countercyclical Capital Buffer requirements, if any, in those

national jurisdictions in which the banking organization has private

sector credit exposures. Moreover, the Countercyclical Capital Buffer would

be invoked upon a determination by the U.S. banking agencies that the

market is experiencing excessive aggregate credit growth, and would be an

extension of the Capital Conservation Buffer (i.e., an aggregate combined

buffer of potentially between 2.5% and 5%). While Advanced Approaches

banking organizations may draw on the Capital Conservation Buffer and, if

invoked, the Countercyclical Capital Buffer, to absorb losses during periods

of financial or economic stress, restrictions on earnings distributions (e.g.,

dividends, equity repurchases, and discretionary executive bonuses) would

result, with the degree of such restrictions greater based upon the extent to

which the buffer is drawn upon.

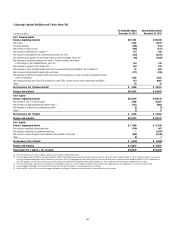

Under the Final Basel III Rules, the Capital Conservation Buffer for

Advanced Approaches banking organizations, as well as the Countercyclical

Capital Buffer, if invoked, must be calculated in accordance with the Collins

Amendment, and thus be based on a comparison of each of the three

reportable risk-based capital ratios as determined under both the Advanced

Approaches and the Standardized Approach (or, for 2014, the existing Basel

I and Basel II.5 capital rules) and the stated minimum required ratios for

each (i.e., 4.5% Tier 1 Common, 6% Tier 1 Capital and 8% Total Capital),

with the reportable Capital Conservation Buffer (and, if applicable, also the

Countercyclical Capital Buffer) being the smallest of the three differences.

Both of these buffers, which are to be comprised entirely of Tier 1 Common

Capital, are to be phased in incrementally from January 1, 2016 through

January 1, 2019.