Citibank 2013 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2013 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.127

Redenomination and Devaluation Risk

As referenced above, the ongoing Eurozone debt crisis and other

developments in the EMU could lead to the withdrawal of one or more

countries from the EMU or a partial or complete break-up of the EMU (see

also “Risk Factors—Market and Economic Risks” above). If one or more

countries were to leave the EMU, certain obligations relating to the exiting

country could be redenominated from the Euro to a new country currency.

While alternative scenarios could develop, redenomination could be

accompanied by immediate devaluation of the new currency as compared to

theEuroandtheU.S.dollar.

Citi, like other financial institutions with substantial operations in

the EMU, is exposed to potential redenomination and devaluation risks

arising from (i) Euro-denominated assets and/or liabilities located or held

within the exiting country that are governed by local country law (“local

exposures”), as well as (ii) other Euro-denominated assets and liabilities,

such as loans, securitized products or derivatives, between entities outside of

the exiting country and a client within the country that are governed by local

country law (“offshore exposures”). However, the actual assets and liabilities

that could be subject to redenomination and devaluation risk are subject to

substantial legal and other uncertainty.

Citi has been, and will continue to be, engaged in contingency planning

forsuchevents,particularlywithrespecttotheGIIPS.Generally,tothe

extent that Citi’s local and offshore assets are approximately equal to its

liabilities within the exiting country, and assuming both assets and liabilities

are symmetrically redenominated and devalued, Citi believes that its risk

of loss as a result of a redenomination and devaluation event would not be

material. However, to the extent its local and offshore assets and liabilities

are not equal, or there is asymmetrical redenomination of assets versus

liabilities, Citi could be exposed to losses in the event of a redenomination

and devaluation. Moreover, a number of events that could accompany

a redenomination and devaluation, including a drawdown of unfunded

commitments or “deposit flight,” could exacerbate any mismatch of assets

and liabilities within the exiting country.

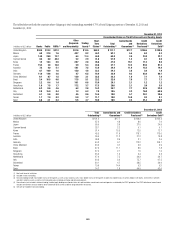

Citi’sredenominationanddevaluationexposurestotheGIIPSasof

December 31, 2013 are not additive to the risk exposures to such countries

described above. Rather, Citi’s credit risk exposures in the affected country

would generally be reduced to the extent of any redenomination and

devaluation of assets.

As of December 31, 2013, Citi estimates that it had net asset exposure

subject to redenomination and devaluation in Italy, principally relating to

derivatives contracts. Citi also estimates that, as of such date, it had net asset

exposuresubjecttoredenominationanddevaluationinSpain,principally

related to offshore exposures related to held-to-maturity securitized retail

assets(primarilymortgage-backedsecurities)(see“Retail,SmallBusiness

and Citi Private Bank” above) and government bonds. However, as of

December 31, 2013, Citi’s estimated redenomination and devaluation

exposure to Italy was less than Citi’s net current funded credit exposure to

Italy (before purchased credit protection) as reflected in the table above.

Further, as of December 31, 2013, Citi’s estimated redenomination and

devaluationexposuretoSpainwaslessthanCiti’snetcurrentfundedcredit

exposuretoSpain(beforepurchasedcreditprotection)asreflectedunderin

the table above. As of December 31, 2013, Citi had a net liability position in

each of Greece, Ireland and Portugal.

As referenced above, Citi’s estimated redenomination and devaluation

exposure does not include purchased credit protection. As described above,

Citi has purchased credit protection primarily from investment grade, global

financialinstitutionspredominantlyoutsideoftheGIIPS.Totheextentthe

purchased credit protection is available in a redenomination/devaluation

event, any redenomination/devaluation exposure could be reduced.

Any estimates of redenomination/devaluation exposure are subject to

ongoing review and necessarily involve numerous assumptions, including

which assets and liabilities would be subject to redenomination in any

given case, the availability of purchased credit protection and the extent

of any utilization of unfunded commitments, each as referenced above.

In addition, other events outside of Citi’s control-such as the extent of any

deposit flight and devaluation, the imposition of exchange and/or capital

controls,therequirementbyU.S.regulatorsofmandatoryloanlossandother

reserve requirements or any required timing of functional currency changes

and the accounting impact thereof could further negatively impact Citi in

such an event. Accordingly, in an actual redenomination and devaluation

scenario, Citi’s exposures could vary considerably based on the specific facts

and circumstances.