Citibank 2013 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2013 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.6

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

EXECUTIVE SUMMARY

Overview

2013—Steady Progress on Execution Priorities and Strategy

Despite Continued Challenging Operating Environment

2013 represented a continued challenging operating environment for

Citigroup in several respects, including:

•changing expectations regarding the Federal Reserve Board’s tapering of

quantitative easing and the impact of this uncertainty on the markets,

trading environment and customer activity;

•the increasing costs of legal settlements across the financial services

industry as Citi continued to work through its legacy legal issues; and

•a continued low interest rate environment.

These issues significantly impacted Citi’s results of operations, particularly

during the second half of 2013. Despite these challenges, however, Citi made

progress on its execution priorities as identified in early 2013, including:

•Efficient resource allocation, including disciplined expense

management—During 2013, Citi completed the significant repositioning

actions announced in the fourth quarter of 2012, which resulted in

the exit of markets that do not fit Citi’s strategy and contributed to the

reduction in its operating expenses year-over-year (see discussion below).

•Continued focus on the wind down of Citi Holdings and getting Citi

Holdings closer to “break even”—Citi Holdings’ assets declined by

$39 billion, or 25%, during 2013, and the net loss for this segment

improved by approximately 49% (see discussion below). Citi also was able

to resolve certain of its legacy legal issues during 2013, including entering

into agreements with Fannie Mae and Freddie Mac relating to residential

mortgage representation and warranty repurchase matters.

•Utilization of deferred tax assets (DTAs)—Citi utilized approximately

$2.5 billion of its DTAs during 2013, including $700 million in the

fourth quarter.

While making good progress on these initiatives in 2013, Citi expects the

operating environment in 2014 to remain challenging. Short-term interest

rates likely will remain low for some time, and thus spread compression

could continue to impact most of Citi’s major geographies during the

year. (As used throughout this Form 10-K, spread compression refers to

the reduction in net interest revenue as a percentage of loans or deposits,

as applicable, driven by either lower yields on interest-earning assets or

higher costs to fund such assets, or a combination thereof). Given the

current litigation and regulatory environment, Citi expects its legal and

related expenses will likely remain elevated in 2014. There continues to

be uncertainty regarding tapering by the Federal Reserve Board and its

impact on the markets, including the emerging markets, and global trading

environment. In addition, despite an improved economic environment in

2013, there continues to be questions about the sustainability and pace of

ongoing improvement in various markets. Finally, Citi continues to face

significant regulatory changes, uncertainties and costs in the U.S. and

non-U.S. jurisdictions in which it operates. For a more detailed discussion of

these and other risks that could impact Citi’s businesses, results of operations

and financial condition during 2014, see “Risk Factors” below.

Despite these ongoing challenges, however, Citi remains highly focused

on the continued execution of the priorities discussed above and its strategy,

which continues to be to wind down Citi Holdings as soon as practicable in

an economically rational manner and leverage its unique global network to:

•be a leading provider of financial services to the world’s largest multi-

national corporations and investors; and

•be the preeminent bank for the emerging affluent and affluent consumers

in the world’s largest urban centers.

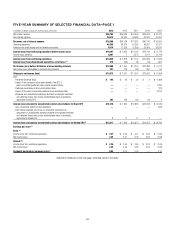

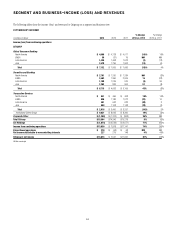

2013 Summary Results

Citigroup

Citigroup reported net income of $13.7 billion and diluted earnings per share

of $4.35 in 2013, compared to $7.5 billion and $2.44 per share, respectively,

in 2012. In 2013, results included a credit valuation adjustment (CVA)

on derivatives (counterparty and own-credit), net of hedges, and debt

valuation adjustment (DVA) on Citi’s fair value option debt of a pretax loss

of $342 million ($213 million after-tax) as Citi’s credit spreads tightened

during the year, compared to a pretax loss of $2.3 billion ($1.4 billion

after-tax) in 2012. Results in the third quarter of 2013 also included a

$176 million tax benefit, compared to a $582 million tax benefit in the

third quarter of 2012, each of which related to the resolution of certain

tax audit items and were recorded in Corporate/Other. In addition, 2013

results included a $189 million after-tax benefit related to the divestiture

of Credicard, Citi’s non-Citibank branded cards and consumer finance

business in Brazil (Credicard), recorded in Corporate/Other (see Note 2 to

the Consolidated Financial Statements). Citigroup’s 2012 results included

a pretax loss of $4.6 billion ($2.9 billion after-tax) related to the sale of

minority investments (for additional information, see “Corporate/Other”

below), as well as approximately $1.0 billion of fourth quarter 2012 pretax

repositioning charges ($653 million after-tax).

Excluding the items above, Citi’s net income was $13.5 billion, or $4.30

per diluted share in 2013, up 11% compared to $11.9 billion, or $3.86

per share, in the prior year, as higher revenues, lower operating expenses and

lower net credit losses were partially offset by a lower net loan loss reserve

release and a higher effective tax rate in 2013 (see Note 9 to the Consolidated

Financial Statements). (Citi’s results of operations excluding the impact

of CVA/DVA, the impact of the Credicard divestiture, the impact of minority

investments, the repositioning charges in the fourth quarter of 2012 and the

impact of the tax benefits, each as discussed above, are non-GAAP financial

measures. Citi believes the presentation of its results of operations excluding

these impacts provides a more meaningful depiction of the underlying

fundamentals of its businesses.)

Citi’s revenues, net of interest expense, were $76.4 billion in 2013, up

10% versus the prior year. Excluding CVA/DVA and the impact of minority

investments in 2012, revenues were $76.7 billion, up 1%, as revenues in

Citi Holdings increased 22% compared to the prior year, while revenues in