Citibank 2013 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2013 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.53

G-SIB Surcharge

In July 2013, the Basel Committee issued an update of its G-SIB framework,

incorporating a number of revisions relative to the original rules published

in November 2011. Among the revisions are selected refinements to the

methodology for assessing global systemic importance, clarifications related

to the imposition of additional Tier 1 Common Capital surcharges, and

certain public disclosure requirements.

Under the Basel Committee rules, the methodology for assessing G-SIBs

is based primarily on quantitative measurement indicators underlying five

equally weighted broad categories of systemic importance: (i) size; (ii) global

(cross-jurisdictional) activity; (iii) interconnectedness; (iv) substitutability/

financial institution infrastructure; and (v) complexity. With the exception of

size, each of the other categories are comprised of multiple indicators also of

equal weight, and amounting to 12 in total. The initial G-SIB surcharge, which

is to be comprised entirely of Tier 1 Common Capital, ranges from 1% to 2.5%

of risk-weighted assets. Moreover, under the Basel Committee’s rules, the G-SIB

surcharge will be introduced in parallel with the Basel III Capital Conservation

Buffer and, if applicable, any Countercyclical Capital Buffer, commencing

phase-in on January 1, 2016 and becoming fully effective on January 1, 2019.

Separately, the Final Basel III Rules do not address G-SIBs. Nonetheless,

the Federal Reserve Board is required by the Dodd-Frank Act to issue rules

establishing a quantitative risk-based capital surcharge for financial

institutions deemed to be systemically important and posing risk to

market-wide financial stability, such as Citi, and the Federal Reserve Board

has indicated that it intends for these rules to be consistent with the Basel

Committee’s G-SIB rules. Although no such rules have yet been proposed by

the Federal Reserve Board, Citi anticipates that it will likely be subject to at

least a 2% initial additional Tier 1 Common Capital surcharge.

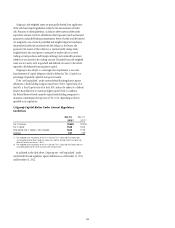

Regulatory Capital Adjustments and Deductions

Substantially all of the regulatory capital adjustments and deductions

required under the Final Basel III Rules are to be applied in arriving at Tier 1

Common Capital.

Assets required to be fully deducted from Tier 1 Common Capital

include, in part, goodwill (both standalone and embedded) and identifiable

intangible assets (other than MSRs), net assets of certain defined benefit

pension plans, and DTAs arising from tax credit and net operating loss carry-

forwards. Additionally, DTAs arising from temporary differences, significant

investments in the common stock of unconsolidated financial institutions,

and MSRs are subject to potential partial deduction under the so-called

“threshold deductions” (i.e., the portions of these assets that individually

and, in the aggregate, initially exceed 10% and subsequently collectively

exceed 15%, respectively, of adjusted Tier 1 Common Capital). Furthermore,

any assets required to be deducted from regulatory capital are also excluded

from risk-weighted assets, as well as adjusted average total assets and Total

Leverage Exposure for leverage ratio purposes.

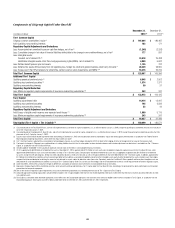

The Final Basel III Rules also require that principally all of the

components of AOCI be fully reflected in Tier 1 Common Capital, including

net unrealized gains and losses on all AFS securities and adjustments to

defined benefit plan liabilities. Conversely, the rules permit the exclusion

of net gains and losses on cash flow hedges included in AOCI related to the

hedging of items not recognized at fair value on a banking organization’s

balance sheet. Moreover, an Advanced Approaches banking organization

must adjust its Tier 1 Common Capital for the cumulative change in the

fair value of financial liabilities attributable to the change in the banking

organization’s own creditworthiness. Apart from Tier 1 Common Capital

effects, the minimum regulatory capital requirements of insurance

underwriting subsidiaries are required to be deducted equally from both

Additional Tier 1 Capital and Tier 2 Capital.

The impact of these regulatory capital adjustments and deductions,

with the exception of goodwill, which is required to be deducted in full

commencing January 1, 2014, are generally to be phased in incrementally

at 20% annually beginning on January 1, 2014, with full implementation

by January 1, 2018.

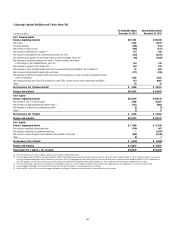

Non-Qualifying Trust Preferred Securities

As for non-qualifying capital instruments, the Final Basel III Rules require

that Advanced Approaches banking organizations phase-out from Tier 1

Capital trust preferred securities issued prior to May 19, 2010 by January 1,

2016 (other than certain grandfathered trust preferred securities), with

50% of these non-qualifying capital instruments includable in Tier 1

Capital in 2014 and 25% includable in 2015. The carrying value of trust

preferred securities excluded from Tier 1 Capital may be included in full

in Tier 2 Capital during those two years (i.e., 50% and 75% in 2014 and

2015, respectively), but must be phased out of Tier 2 Capital by January 1,

2022 (declining in 10% annual increments starting at 60% in 2016).

Moreover, under the Final Basel III Rules, any nonconforming Tier 2 Capital

instruments issued prior to May 19, 2010 will also be required to be phased

out by January 1, 2016, with issuances after May 19, 2010 required to be

excluded entirely from Tier 2 Capital as of January 1, 2014.

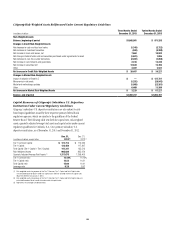

Standardized Approach Risk-Weighted Assets

The Standardized Approach for determining risk-weighted assets is applicable

to substantially all U.S. banking organizations, including Citi and Citibank,

N.A. and, as of January 1, 2015, will replace the existing regulatory capital

rules governing the calculation of risk-weighted assets. Although the

mechanics of calculating risk-weighted assets remains largely unchanged

from Basel I, the Standardized Approach incorporates heightened risk

sensitivity for calculating risk-weighted assets for certain on-balance-sheet

assets and off-balance-sheet exposures, including those to foreign sovereign

governments and banks, corporate and securitization exposures, and

counterparty credit risk on derivative contracts. Total risk-weighted assets

under the Standardized Approach exclude risk-weighted assets arising from

operational risk, require more limited approaches in measuring risk-

weighted assets for securitization exposures, and apply the standardized risk

weights to arrive at credit risk-weighted assets. As required under the Dodd-

Frank Act, the Standardized Approach relies on alternatives to external credit

ratings in the treatment of certain exposures.