Citibank 2013 Annual Report Download - page 291

Download and view the complete annual report

Please find page 291 of the 2013 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.273

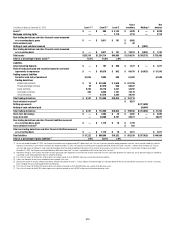

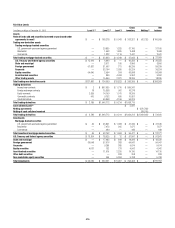

Trading account assets and liabilities—derivatives

Exchange-traded derivatives are generally measured at fair value using

quotedmarket(i.e.,exchange)pricesandareclassifiedasLevel1ofthefair

value hierarchy.

The majority of derivatives entered into by the Company are executed

over the counter and are valued using internal valuation techniques, as no

quoted market prices exist for such instruments. The valuation techniques

and inputs depend on the type of derivative and the nature of the underlying

instrument. The principal techniques used to value these instruments are

discounted cash flows and internal models, including Black-Scholes and

Monte Carlo simulation. The fair values of derivative contracts reflect cash

the Company has paid or received (for example, option premiums paid

and received).

The key inputs depend upon the type of derivative and the nature

of the underlying instrument and include interest rate yield curves,

foreign-exchange rates, volatilities and correlation. The Company uses

overnight indexed swap (OIS) curves as fair value measurement inputs

for the valuation of certain collateralized derivatives. Citi uses the relevant

benchmarkcurveforthecurrencyofthederivative(e.g.,theLondon

Interbank Offered Rate for U.S. dollar derivatives) as the discount rate

for uncollateralized derivatives. Citi has not recognized any valuation

adjustments to reflect the cost of funding uncollateralized derivative positions

beyond that implied by the relevant benchmark curve. Citi continues

to monitor market practices and activity with respect to discounting in

derivative valuation.

ThederivativeinstrumentsareclassifiedaseitherLevel2orLevel3

depending upon the observability of the significant inputs to the model.

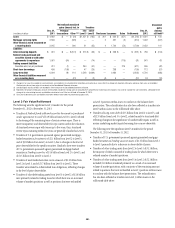

Subprime-related direct exposures in CDOs

The valuation of high-grade and mezzanine asset-backed security (ABS)

CDO positions utilizes prices based on the underlying assets of each high-

grade and mezzanine ABS CDO. The high-grade and mezzanine positions

are largely hedged through the ABS and bond short positions. This results in

closer symmetry in the way these long and short positions are valued by the

Company. Citigroup uses trader marks to value this portion of the portfolio

and will do so as long as it remains largely hedged.

For most of the lending and structured direct subprime exposures, fair

value is determined utilizing observable transactions where available, other

market data for similar assets in markets that are not active and other

internal valuation techniques.

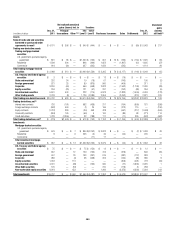

Investments

The investments category includes available-for-sale debt and marketable

equity securities, whose fair value is generally determined by utilizing similar

procedures described for trading securities above or, in some cases, using

consensus pricing as the primary source.

Also included in investments are nonpublic investments in private equity

and real estate entities held by the S&B business. Determining the fair

value of nonpublic securities involves a significant degree of management

resources and judgment, as no quoted prices exist and such securities are

generally very thinly traded. In addition, there may be transfer restrictions

on private equity securities. The Company’s process for determining the fair

value of such securities utilizes commonly accepted valuation techniques,

including comparables analysis. In determining the fair value of nonpublic

securities, the Company also considers events such as a proposed sale of

the investee company, initial public offerings, equity issuances or other

observable transactions. As discussed in Note 14 to the Consolidated Financial

Statements, the Company uses net asset value to value certain of these

investments.

PrivateequitysecuritiesaregenerallyclassifiedasLevel3ofthefair

value hierarchy.

Short-term borrowings and long-term debt

Where fair value accounting has been elected, the fair value of non-

structured liabilities is determined by utilizing internal models using the

appropriate discount rate for the applicable maturity. Such instruments are

generallyclassifiedasLevel2ofthefairvaluehierarchy,asallinputsare

readily observable.

The Company determines the fair value of structured liabilities (where

performance is linked to structured interest rates, inflation or currency risks)

and hybrid financial instruments (where performance is linked to risks

other than interest rates, inflation or currency risks) using the appropriate

derivative valuation methodology (described above in “Trading account

assets and liabilities—derivatives”) given the nature of the embedded risk

profile.SuchinstrumentsareclassifiedasLevel2orLevel3dependingonthe

observability of significant inputs to the model.

Alt-A mortgage securities

The Company classifies its Alt-A mortgage securities as held-to-maturity,

available-for-sale and trading investments. The securities classified as trading

and available-for-sale are recorded at fair value with changes in fair value

reported in current earnings and AOCI, respectively. For these purposes, Citi

defines Alt-A mortgage securities as non-agency residential mortgage-backed

securities (RMBS) where (i) the underlying collateral has weighted average

FICO scores between 680 and 720 or (ii) for instances where FICO scores

are greater than 720, RMBS have 30% or less of the underlying collateral

composed of full documentation loans.

Similar to the valuation methodologies used for other trading securities

and trading loans, the Company generally determines the fair values of

Alt-A mortgage securities utilizing internal valuation techniques. Fair value

estimates from internal valuation techniques are verified, where possible, to

prices obtained from independent vendors. Consensus data providers compile

prices from various sources. Where available, the Company may also make

use of quoted prices for recent trading activity in securities with the same or

similar characteristics to the security being valued.

The valuation techniques used for Alt-A mortgage securities, as with other

mortgage exposures, are price-based and yield analysis. The primary market-

derived input is yield. Cash flows are based on current collateral performance

with prepayment rates and loss projections reflective of current economic

conditions of housing price change, unemployment rates, interest rates,

borrower attributes and other market indicators.

Alt-A mortgage securities that are valued using these methods are

generallyclassifiedasLevel2.However,Alt-Amortgagesecuritiesbacked

by Alt-A mortgages of lower quality or subordinated tranches in the capital

structurearemostlyclassifiedasLevel3duetothereducedliquiditythat

exists for such positions, which reduces the reliability of prices available from

independent sources.