Citibank 2013 Annual Report Download - page 319

Download and view the complete annual report

Please find page 319 of the 2013 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327 -

328

328 -

329

329 -

330

330 -

331

331 -

332

332 -

333

333 -

334

334 -

335

335 -

336

336 -

337

337 -

338

338 -

339

339 -

340

340 -

341

341 -

342

342

|

|

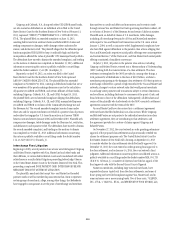

301

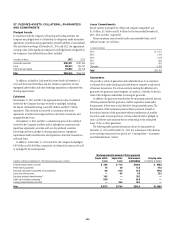

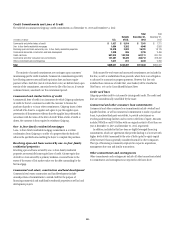

Credit Commitments and Lines of Credit

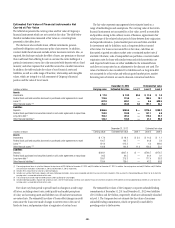

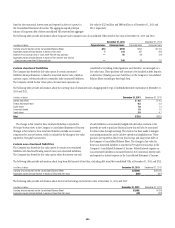

The table below summarizes Citigroup’s credit commitments as of December 31, 2013 and December 31, 2012:

In millions of dollars U.S.

Outside

of U.S.

Total

December 31,

2013

Total

December 31,

2012

Commercial and similar letters of credit $ 1,427 $ 5,914 $ 7,341 $ 7,311

One- to four-family residential mortgages 1,684 3,262 4,946 3,893

Revolving open-end loans secured by one- to four-family residential properties 13,879 2,902 16,781 18,176

Commercial real estate, construction and land development 1,830 895 2,725 3,496

Credit card lines 507,913 133,198 641,111 620,700

Commercial and other consumer loan commitments 141,287 95,425 236,712 228,492

Other commitments and contingencies 1,611 611 2,222 2,259

Total $669,631 $242,207 $911,838 $884,327

The majority of unused commitments are contingent upon customers’

maintaining specific credit standards. Commercial commitments generally

have floating interest rates and fixed expiration dates and may require

payment of fees. Such fees (net of certain direct costs) are deferred and, upon

exercise of the commitment, amortized over the life of the loan or, if exercise

is deemed remote, amortized over the commitment period.

Commercial and similar letters of credit

A commercial letter of credit is an instrument by which Citigroup substitutes

its credit for that of a customer to enable the customer to finance the

purchase of goods or to incur other commitments. Citigroup issues a letter

on behalf of its client to a supplier and agrees to pay the supplier upon

presentation of documentary evidence that the supplier has performed in

accordance with the terms of the letter of credit. When a letter of credit is

drawn, the customer is then required to reimburse Citigroup.

One- to four-family residential mortgages

A one- to four-family residential mortgage commitment is a written

confirmation from Citigroup to a seller of a property that the bank will

advance the specified sums enabling the buyer to complete the purchase.

Revolving open-end loans secured by one- to four-family

residential properties

Revolving open-end loans secured by one- to four-family residential

properties are essentially home equity lines of credit. A home equity line

of credit is a loan secured by a primary residence or second home to the

extent of the excess of fair market value over the debt outstanding for the

first mortgage.

Commercial real estate, construction and land development

Commercial real estate, construction and land development include

unused portions of commitments to extend credit for the purpose of

financing commercial and multifamily residential properties as well as land

development projects.

Both secured-by-real-estate and unsecured commitments are included in

this line, as well as undistributed loan proceeds, where there is an obligation

to advance for construction progress payments. However, this line only

includes those extensions of credit that, once funded, will be classified as

Total loans, net on the Consolidated Balance Sheet.

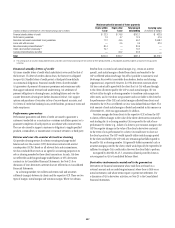

Credit card lines

Citigroup provides credit to customers by issuing credit cards. The credit card

lines are unconditionally cancellable by the issuer.

Commercial and other consumer loan commitments

Commercial and other consumer loan commitments include overdraft and

liquidity facilities, as well as commercial commitments to make or purchase

loans, to purchase third-party receivables, to provide note issuance or

revolving underwriting facilities and to invest in the form of equity. Amounts

include $58 billion and $53 billion with an original maturity of less than one

year at December 31, 2013 and December 31, 2012, respectively.

In addition, included in this line item are highly leveraged financing

commitments, which are agreements that provide funding to a borrower with

higher levels of debt (measured by the ratio of debt capital to equity capital

of the borrower) than is generally considered normal for other companies.

This type of financing is commonly employed in corporate acquisitions,

management buy-outs and similar transactions.

Other commitments and contingencies

Other commitments and contingencies include all other transactions related

to commitments and contingencies not reported on the lines above.