Citibank 2013 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2013 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

118

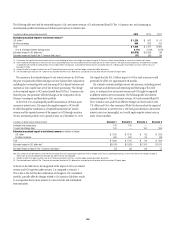

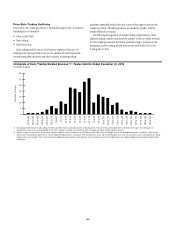

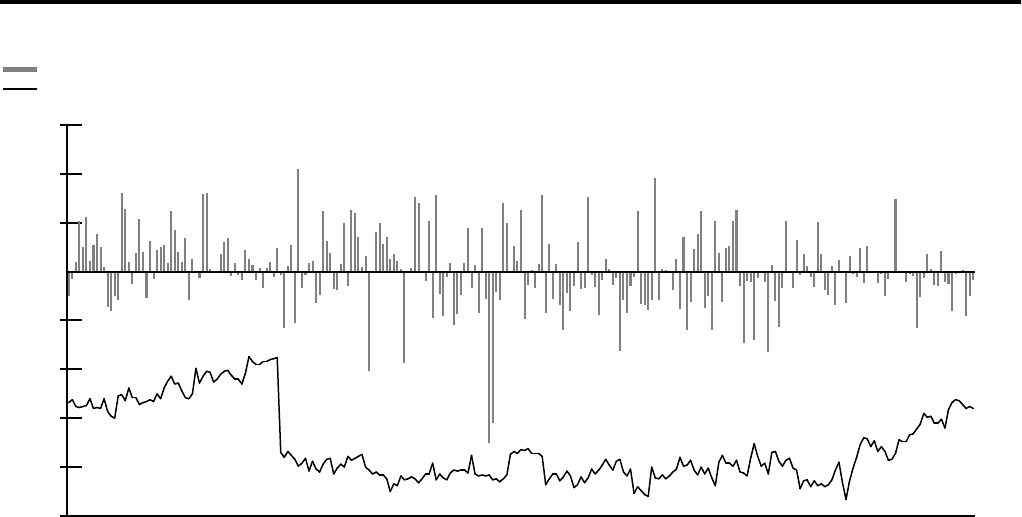

Regulatory VAR Back-testing

In accordance with Basel II.5, Citi is required to perform back-testing to

evaluate the effectiveness of its VAR model and to determine the capital

multiplier used in the calculation of market risk-weighted-assets. Regulatory

VAR back-testing is the process in which the daily one-day VAR, at a 99%

confidence interval, is compared to the buy-and-hold profit and loss (e.g., the

profit and loss impact if the portfolio is held constant at the end of the day

and re-priced the following day) as required under Basel II.5. Based on a 99%

confidence level, Citi would expect two to three days in any one year where

buy-and-hold losses exceeded the Regulatory VAR. Given the conservative

calibration of Citi’s VAR model (as a result of taking the greater of short- and

long-term volatilities and fat tail scaling of volatilities), Citi would expect fewer

exceptions under normal and stable market conditions. Periods of unstable

market conditions could increase the number of back-testing exceptions.

The following graph shows the daily buy-and-hold profit and loss

associated with Citi’s covered positions under Basel II.5 compared to Citi’s

one-day Regulatory VAR during 2013. As the graph indicates, for the twelve

month period ending December 31, 2013, there were no back-testing

exceptions observed for Citi’s Regulatory VAR. Citi posted buy-and-hold gains

in 49% of days where daily Regulatory VAR back-testing was performed.

The difference between the 49% of buy-and-hold gains for Regulatory VAR

back-testing and the 92% of gains shown in the histogram of daily trading

related revenue above reflects, among other things, that a significant portion

of Citi’s trading related revenue is not generated from daily price movements,

on these positions and exposures as well as differences in the portfolio

composition of Regulatory VAR and Risk Management VAR.

Regulatory Trading VAR and Associated Buy-and-Hold Profit and Loss(1) — Twelve Months Ended December 31, 2013

In millions of dollars

-250

-200

-150

-100

-50

0

50

100

150

Buy-and-Hold Profit and Loss

Regulatory Trading VAR

Jan-13 Feb-13 Mar-13 Apr-13 May-13 Jun-13 Jul-13 Aug-13 Sep-13 Oct-13 Nov-13 Dec-13

(1) Buy-and-hold profit and loss, as defined by the banking regulators under Basel II.5, represents the daily mark-to-market revenue movement attributable to the trading position from the close of the previous business

day. Buy-and-hold profit and loss excludes realized trading revenue, net interest, intra-day trading profit and loss on new and terminated trades, as well as changes in reserves. Therefore it is not comparable to the

trading-related revenue presented in the previous histogram of Daily Trading-Related Revenue.

Stress Testing

Citi performs stress testing on a regular basis to estimate the impact of

extreme market movements. It is performed on individual positions and

trading portfolios, as well as in aggregate inclusive of multiple trading

portfolios. Citi’s independent market risk management organization, after

consultations with the businesses, develops both systemic and specific stress

scenarios, reviews the output of periodic stress testing exercises, and uses the

information to assess the ongoing appropriateness of exposure levels and

limits. Citi uses two complementary approaches to market risk stress testing

across all major risk factors (i.e., equity, foreign exchange, commodity,

interest rate and credit spreads): top-down systemic stresses and bottom-

upbusinessspecificstresses.Systemicstressesaredesignedtoquantifythe

potential impact of extreme market movements on a firm-wide basis, and are

constructed using both historical periods of market stress and projections of

adverse economic scenarios. Business specific stresses are designed to probe

the risks of particular portfolios and market segments, especially those risks

that are not fully captured in VaR and systemic stresses.

Factor Sensitivities

Factor sensitivities are expressed as the change in the value of a position for

a defined change in a market risk factor, such as a change in the value of a

Treasury bill for a one-basis-point change in interest rates. Citi’s independent

market risk management ensures that factor sensitivities are calculated,

monitored, and in most cases, limited, for all material risks taken in a

trading portfolio.