Citibank 2013 Annual Report Download - page 275

Download and view the complete annual report

Please find page 275 of the 2013 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.257

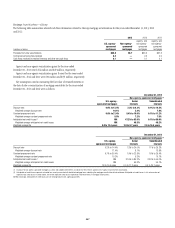

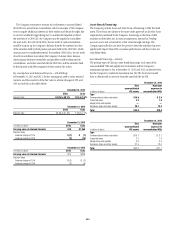

Municipal Investments

Municipal investment transactions include debt and equity interests in

partnerships that finance the construction and rehabilitation of low-income

housing, facilitate lending in new or underserved markets, or finance

the construction or operation of renewable municipal energy facilities.

The Company generally invests in these partnerships as a limited partner

and earns a return primarily through the receipt of tax credits and grants

earned from the investments made by the partnership. The Company may

also provide construction loans or permanent loans for the development or

operations of real estate properties held by partnerships. These entities are

generally considered VIEs. The power to direct the activities of these entities

is typically held by the general partner. Accordingly, these entities are not

consolidated by the Company.

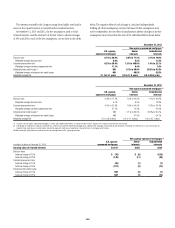

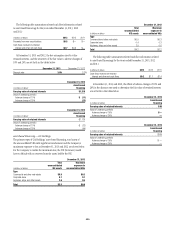

Client Intermediation

Client intermediation transactions represent a range of transactions

designed to provide investors with specified returns based on the returns

of an underlying security, referenced asset or index. These transactions

include credit-linked notes and equity-linked notes. In these transactions,

the VIE typically obtains exposure to the underlying security, referenced

asset or index through a derivative instrument, such as a total-return swap

or a credit-default swap. In turn the VIE issues notes to investors that pay a

return based on the specified underlying security, referenced asset or index.

The VIE invests the proceeds in a financial asset or a guaranteed insurance

contract that serves as collateral for the derivative contract over the term of

the transaction. The Company’s involvement in these transactions includes

being the counterparty to the VIE’s derivative instruments and investing in a

portion of the notes issued by the VIE. In certain transactions, the investor’s

maximum risk of loss is limited and the Company absorbs risk of loss above

a specified level. The Company does not have the power to direct the activities

of the VIEs that most significantly impact their economic performance and

thus it does not consolidate them.

The Company’s maximum risk of loss in these transactions is defined

as the amount invested in notes issued by the VIE and the notional amount

of any risk of loss absorbed by the Company through a separate instrument

issued by the VIE. The derivative instrument held by the Company may

generate a receivable from the VIE (for example, where the Company

purchases credit protection from the VIE in connection with the VIE’s

issuance of a credit-linked note), which is collateralized by the assets

owned by the VIE. These derivative instruments are not considered variable

interests and any associated receivables are not included in the calculation of

maximum exposure to the VIE.

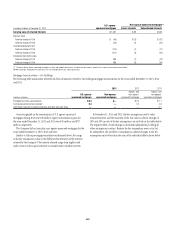

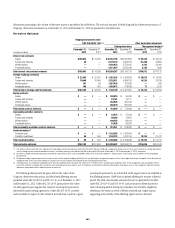

Investment Funds

The Company is the investment manager for certain investment funds

and retirement funds that invest in various asset classes including private

equity, hedge funds, real estate, fixed income and infrastructure. The

Company earns a management fee, which is a percentage of capital under

management, and may earn performance fees. In addition, for some of these

funds the Company has an ownership interest in the investment funds. The

Company has also established a number of investment funds as opportunities

for qualified employees to invest in private equity investments. The Company

acts as investment manager to these funds and may provide employees with

financing on both recourse and non-recourse bases for a portion of the

employees’ investment commitments.

The Company has determined that a majority of the investment entities

managed by Citigroup are provided a deferral from the requirements of SFAS

167, Amendments to FASB Interpretation No. 46(R), because they meet the

criteria in Accounting Standards Update No. 2010-10, Consolidation (Topic

810), Amendments for Certain Investment Funds (ASU 2010-10). These

entities continue to be evaluated under the requirements of ASC 810-10, prior

to the implementation of SFAS 167 (FIN 46(R), Consolidation of Variable

Interest Entities), which required that a VIE be consolidated by the party with

a variable interest that will absorb a majority of the entity’s expected losses or

residual returns, or both.

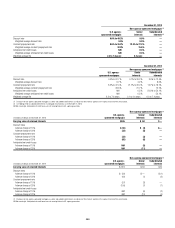

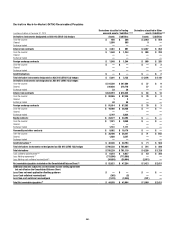

Trust Preferred Securities

The Company has raised financing through the issuance of trust preferred

securities. In these transactions, the Company forms a statutory business trust

and owns all of the voting equity shares of the trust. The trust issues preferred

equity securities to third-party investors and invests the gross proceeds in

junior subordinated deferrable interest debentures issued by the Company.

The trusts have no assets, operations, revenues or cash flows other than those

related to the issuance, administration and repayment of the preferred equity

securities held by third-party investors. Obligations of the trusts are fully and

unconditionally guaranteed by the Company.

Because the sole asset of each of the trusts is a receivable from the

Company and the proceeds to the Company from the receivable exceed

the Company’s investment in the VIE’s equity shares, the Company is not

permitted to consolidate the trusts, even though it owns all of the voting

equity shares of the trust, has fully guaranteed the trusts’ obligations, and

has the right to redeem the preferred securities in certain circumstances.

The Company recognizes the subordinated debentures on its Consolidated

Balance Sheet as long-term liabilities. For additional information, see Note

18 to the Consolidated Financial Statements.