Citibank 2013 Annual Report Download - page 269

Download and view the complete annual report

Please find page 269 of the 2013 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

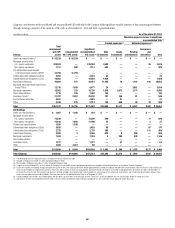

251

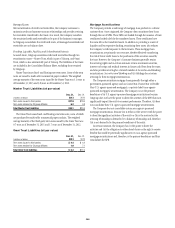

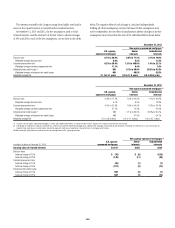

Mortgage Servicing Rights

In connection with the securitization of mortgage loans, the Company’s

U.S. Consumer mortgage business generally retains the servicing rights,

which entitle the Company to a future stream of cash flows based on the

outstanding principal balances of the loans and the contractual servicing

fee. Failure to service the loans in accordance with contractual requirements

may lead to a termination of the servicing rights and the loss of future

servicing fees.

The fair value of capitalized mortgage servicing rights (MSRs) was

$2.7 billion and $1.9 billion at December 31, 2013 and 2012, respectively.

The MSRs correspond to principal loan balances of $286 billion and $325

billion as of December 31, 2013 and 2012, respectively. The following

table summarizes the changes in capitalized MSRs for the years ended

December 31, 2013 and 2012:

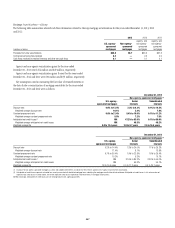

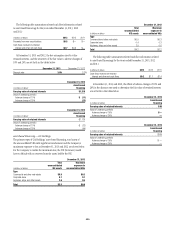

In millions of dollars 2013 2012

Balance, beginning of year $1,942 $ 2,569

Originations 634 423

Changes in fair value of MSRs due to changes

in inputs and assumptions 640 (198)

Other changes (1) (496) (852)

Sale of MSRs (2) —

Balance, as of December 31 $2,718 $ 1,942

(1) Represents changes due to customer payments and passage of time.

The fair value of the MSRs is primarily affected by changes in

prepayments of mortgages that result from shifts in mortgage interest rates.

In managing this risk, the Company economically hedges a significant

portion of the value of its MSRs through the use of interest rate derivative

contracts, forward purchase and sale commitments of mortgage-backed

securities and purchased securities classified as Trading account assets.

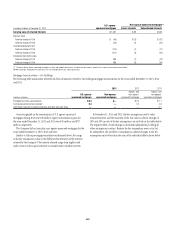

The Company receives fees during the course of servicing previously

securitized mortgages. The amounts of these fees for the years ended

December 31, 2013, 2012 and 2011 were as follows:

In millions of dollars 2013 2012 2011

Servicing fees $ 800 $ 990 $1,170

Late fees 42 65 76

Ancillary fees 100 122 130

Total MSR fees $ 942 $1,177 $1,376

These fees are classified in the Consolidated Statement of Income as

Other revenue.

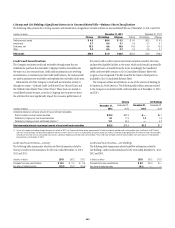

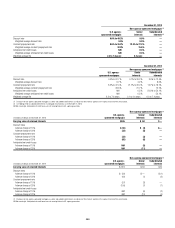

Re-securitizations

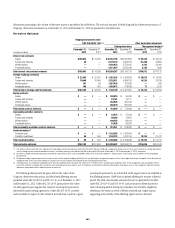

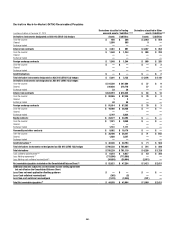

The Company engages in re-securitization transactions in which debt

securities are transferred to a VIE in exchange for new beneficial interests.

During the years ended December 31, 2013 and 2012, Citi transferred non-

agency (private-label) securities with an original par value of approximately

$955 million and $1.5 billion, respectively, to re-securitization entities. These

securities are backed by either residential or commercial mortgages and are

often structured on behalf of clients.

As of December 31, 2013, the fair value of Citi-retained interests in private-

label re-securitization transactions structured by Citi totaled approximately

$425 million ($131 million of which related to re-securitization transactions

executed in 2013), and are recorded in Trading account assets. Of this

amount, approximately $58 million was related to senior beneficial

interests, and approximately $367 million was related to subordinated

beneficial interests. As of December 31, 2012, the fair value of Citi-retained

interests in private-label re-securitization transactions structured by

Citi totaled approximately $380 million ($128 million of which related

to re-securitization transactions executed in 2012). Of this amount,

approximately $11 million was related to senior beneficial interests, and

approximately $369 million was related to subordinated beneficial interests.

The original par value of private-label re-securitization transactions in

which Citi holds a retained interest as of December 31, 2013 and 2012 was

approximately $6.1 billion and $7.1 billion, respectively.

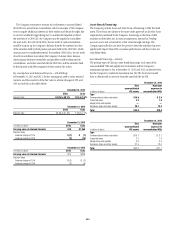

The Company also re-securitizes U.S. government-agency guaranteed

mortgage-backed (agency) securities. During the years ended

December 31, 2013 and 2012, Citi transferred agency securities with a fair

value of approximately $26.3 billion and $30.3 billion, respectively, to

re-securitization entities.

As of December 31, 2013, the fair value of Citi-retained interests in agency

re-securitization transactions structured by Citi totaled approximately

$1.5 billion ($1.2 billion of which related to re-securitization transactions

executed in 2013) compared to $1.7 billion as of December 31, 2012

($1.1 billion of which related to re-securitization transactions executed in

2012), which is recorded in Trading account assets. The original fair value

of agency re-securitization transactions in which Citi holds a retained interest

as of December 31, 2013 and 2012 was approximately $75.5 billion and

$71.2 billion, respectively.

As of December 31, 2013 and 2012, the Company did not consolidate any

private-label or agency re-securitization entities.