Citibank 2013 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2013 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

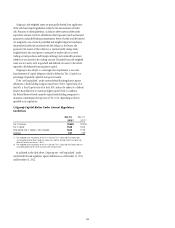

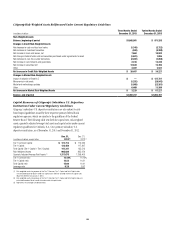

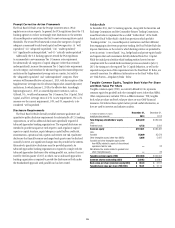

Impact of Changes on Citigroup and Citibank, N.A. Capital

Ratios Under Current Regulatory Guidelines

The following table presents the estimated sensitivity of Citigroup’s and

Citibank, N.A.’s capital ratios to changes of $100 million in Tier 1 Common

Capital, Tier 1 Capital and Total Capital (numerator), and changes of

$1 billion in risk-weighted assets or quarterly adjusted average total assets

(denominator) as of December 31, 2013. This information is provided for the

purpose of analyzing the impact that a change in Citigroup’s or Citibank,

N.A.’s financial position or results of operations could have on these ratios.

These sensitivities only consider a single change to either a component

of capital, risk-weighted assets, or quarterly adjusted average total assets.

Accordingly, an event that affects more than one factor may have a larger

basis point impact than is reflected in this table.

Tier 1 Common ratio Tier 1 Capital ratio Total Capital ratio Leverage ratio

Impact of

$100 million

change in

Tier 1

Common

Capital

Impact of

$1 billion

change in

risk-weighted

assets

Impact of

$100 million

change in

Tier 1

Capital

Impact of

$1 billion

change in

risk-weighted

assets

Impact of

$100 million

change in

Total

Capital

Impact of

$1 billion

change in

risk-weighted

assets

Impact of

$100 million

change in

Tier 1

Capital

Impact of

$1 billion

change in

quarterly

adjusted

average total

assets

Citigroup 0.9 bps 1.2 bps 0.9 bps 1.3 bps 0.9 bps 1.5 bps 0.5 bps 0.5 bps

Citibank, N.A. 1.1 bps 1.5 bps 1.1 bps 1.5 bps 1.1 bps 1.7 bps 0.8 bps 0.7 bps

Citigroup Broker-Dealer Subsidiaries

At December 31, 2013, Citigroup Global Markets Inc., a U.S. broker-dealer

registered with the SEC that is an indirect wholly owned subsidiary of

Citigroup, had net capital, computed in accordance with the SEC’s net

capital rule, of $5.4 billion, which exceeded the minimum requirement by

$4.5 billion.

In addition, certain of Citi’s other broker-dealer subsidiaries are subject

to regulation in the countries in which they do business, including

requirements to maintain specified levels of net capital or its equivalent.

Citigroup’s other broker-dealer subsidiaries were in compliance with their

capital requirements at December 31, 2013.

Basel III

For additional information on Citi’s estimated Basel III ratios, see “Risk

Factors—Regulatory Risks” below.

Tier 1 Common Ratio

Citi’s estimated Basel III Tier 1 Common ratio was 10.6% at December 31,

2013, compared to 10.5% at September 30, 2013 and 8.7% at December 31,

2012 (all based on the “Advanced Approaches” for determining total risk-

weighted assets).

The marginal increase quarter-over-quarter in Citi’s estimated Basel III

Tier 1 Common ratio reflected continued growth in Tier 1 Common

Capital resulting from quarterly net income and further DTA utilization

of approximately $700 million (see “Significant Accounting Policies and

Significant Estimates—Income Taxes” below), the effect of which was

largely offset by higher risk-weighted assets, principally driven by an increase

in estimated operational risk-weighted assets. Citi increased its estimate of

operational risk-weighted assets during the fourth quarter due to an ongoing

review, refinement and enhancement of its Basel III models, as well as in

consideration of the evolving regulatory and litigation environment within

the banking industry.

The significant year-over-year increase in Citi’s estimated Basel III Tier 1

Common ratio was primarily due to net income and other improvements

to Tier 1 Common Capital, including a sizable reduction in Citi’s minority

investments principally resulting from the sale of Citi’s remaining interest

in the MSSB joint venture as well as approximately $2.5 billion utilization

of DTAs, which was partially offset by additional net losses in AOCI and, to a

lesser extent, share repurchases and dividends.

On February 21, 2014, the Federal Reserve Board announced that Citi

was approved to exit the “parallel run” period regarding the application of

the Basel III Advanced Approaches in the calculation of risk-weighted assets,

effective for the second quarter of 2014. One of the stipulations for such

approval is that Citi further increase its estimated operational risk-weighted

assets to $288 billion from $232 billion as of December 31, 2013, reflecting

ongoing developments regarding the overall banking industry operating

environment. The pro forma impact of the required higher operational risk-

weighted assets would have been a decrease of approximately 50 basis points

in Citi’s estimated Basel III Tier 1 Common ratio at December 31, 2013 to

approximately 10.1%. For additional information regarding the parallel

run period applicable to the Advanced Approaches under the Final Basel III

Rules, see “Regulatory Capital Standards Developments—Risk-Based Capital

Ratios” below.