Citibank 2013 Annual Report Download - page 195

Download and view the complete annual report

Please find page 195 of the 2013 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

177

value of which fluctuated based on the price of Citigroup common stock.

Other terms and conditions of these awards were the same as the CAP awards

granted in 2010. In 2009, some deferrals also were made in the form of a

deferred cash award subject to a four-year vesting schedule and earning a

LIBOR-based return, in addition to a CAP award.

Prior to 2009, a mandatory deferral requirement of at least 25% applied

to incentive awards valued at $20,000 or more. Deferrals were in the form of

CAP awards. In some cases, participants were entitled to elect to receive stock

options in lieu of some or all of the value that otherwise would have been

awarded as restricted or deferred stock. CAP awards granted prior to 2011

were not subject to clawback provisions or performance criteria.

Except for awards subject to variable accounting (as described below), the

total expense recognized for stock awards represents the grant date fair value

of such awards, which is generally recognized as a charge to income ratably

over the vesting period, except for awards to retirement-eligible employees

and stock payments (e.g., immediately vested awards). Whenever awards

are made or are expected to be made to retirement-eligible employees, the

charge to income is accelerated based on when the applicable conditions to

retirement eligibility are or will be met. If the employee is retirement eligible

on the grant date, the entire expense is recognized in the year prior to grant.

For immediately vested stock payments, the charge to income is recognized

in the year prior to grant. For employees who become retirement eligible

during the vesting period, expense is recognized from the grant date until

eligibility conditions are met.

Expense for immediately vested stock awards that generally are made in

lieu of cash compensation also is recognized in the year prior to grant in

accordance with U.S. GAAP.

Annual incentive awards made in January 2011 and January 2010 to

certain executive officers and other highly compensated employees were

administered in accordance with the Emergency Economic Stabilization Act

of 2008, as amended (EESA), pursuant to structures approved by the Special

Master for TARP Executive Compensation (Special Master). These structures

included stock awards subject to vesting requirements over periods of up to

three years and/or sale restrictions. Certain of these awards are subject to

discretionary performance-based vesting conditions. These awards, and CAP

awards to participants in the EU that are subject to certain discretionary

clawback provisions, are subject to variable accounting, pursuant to which

the associated charges fluctuate with changes in Citigroup’s common

stock price over the applicable vesting periods. For these awards, the total

amount that will be recognized as expense cannot be determined in full

until the awards vest. For stock awards subject to discretionary performance

conditions, compensation expense was accrued based on Citigroup’s

common stock price at the end of the reporting period and on the estimated

outcome of meeting the performance conditions.

In January 2009, certain senior executives received 30% of their annual

incentive awards as performance-vesting equity awards conditioned primarily

on stock-price performance. Because the price targets were not met, only a

fraction of the awards vested. The fraction of awarded shares that vested was

determined based on a ratio of the price of Citigroup’s common stock on

January 14, 2013 (the award termination date) to the award’s price targets of

$106.10 and $178.50. None of the shares awarded or vested were entitled to

any payment or accrual of dividend equivalents. The grant-date fair value of

the awards was recognized as compensation expense ratably over the vesting

period.

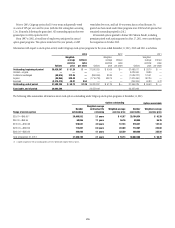

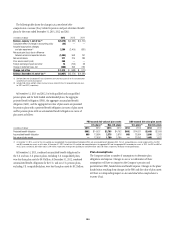

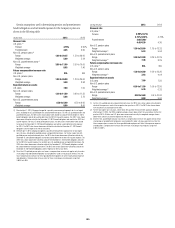

This fair value was determined using the following assumptions:

Weighted-average per-share fair value $22.97

Weighted-average expected life 3.85 years

Valuation assumptions

Expected volatility 36.07%

Risk-free interest rate 1.21%

Expected dividend yield 0.88%

Sign-on and Long-Term Awards

As referenced above, from time to time, restricted or deferred stock awards

and/or stock option grants are made outside of Citigroup’s annual incentive

programs to induce employees to join Citigroup or as special retention

awards to key employees. Vesting periods vary, but generally are two to

four years. Generally, recipients must remain employed through the

vesting dates to vest in the awards, except in cases of death, disability or

involuntary termination other than for “gross misconduct.” Unlike CAP

awards, these awards do not usually provide for post-employment vesting by

retirement-eligible participants. If these stock awards are subject to certain

clawback provisions or performance conditions, they may be subject to

variable accounting.

Deferred cash awards often are granted to induce new hires to join the

Company and usually are intended to replace deferred incentives awarded

by prior employers that were forfeited when the employees joined Citigroup.

As such, the vesting schedules and terms and conditions of these awards

generally are structured to match the vesting schedules and terms and

conditions of the forfeited awards. The expense recognized in 2013 and 2012

for these awards was $93 million and $147 million, respectively.

A retention award of deferred stock to then-CEO Vikram Pandit was made

on May 17, 2011, and was scheduled to vest in three equal installments

on December 31, 2013, 2014 and 2015. The award was cancelled in its

entirety when Mr. Pandit resigned in October 2012. Because of discretionary

performance vesting conditions, the award was subject to variable accounting

until its cancellation in the fourth quarter of 2012.