Citibank 2013 Annual Report Download - page 312

Download and view the complete annual report

Please find page 312 of the 2013 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

294

has elected the fair value option for certain of these ventures, because such

investments are considered similar to many private equity or hedge fund

activities in Citi’s investment companies, which are reported at fair value.

The fair value option brings consistency in the accounting and evaluation of

these investments. All investments (debt and equity) in such private equity

and real estate entities are accounted for at fair value. These investments are

classified as Investments on Citigroup’s Consolidated Balance Sheet.

Citigroup also holds various non-strategic investments in leveraged

buyout funds and other hedge funds for which the Company elected fair

value accounting to reduce operational and accounting complexity. Since

the funds account for all of their underlying assets at fair value, the impact

of applying the equity method to Citigroup’s investment in these funds was

equivalent to fair value accounting. These investments are classified as Other

assets on Citigroup’s Consolidated Balance Sheet.

Changes in the fair values of these investments are classified in Other

revenue in the Company’s Consolidated Statement of Income.

Citigroup also elects the fair value option for certain non-marketable

equity securities whose risk is managed with derivative instruments that are

accounted for at fair value through earnings. These securities are classified as

Trading Assets on Citigroup’s Consolidated Balance Sheet. Changes in the fair

value of these securities and the related derivative instruments are recorded

in Principal transactions.

Certain mortgage loans (HFS)

Citigroup has elected the fair value option for certain purchased and

originated prime fixed-rate and conforming adjustable-rate first mortgage

loans HFS. These loans are intended for sale or securitization and are hedged

with derivative instruments. The Company has elected the fair value option

to mitigate accounting mismatches in cases where hedge accounting is

complex and to achieve operational simplifications.

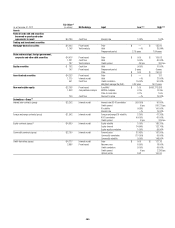

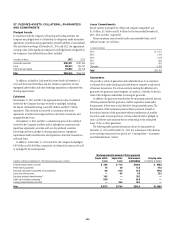

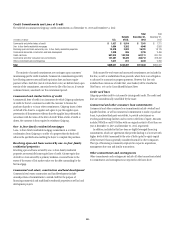

The following table provides information about certain mortgage loans HFS carried at fair value at December 31, 2013 and 2012:

In millions of dollars December 31, 2013 December 31, 2012

Carrying amount reported on the Consolidated Balance Sheet $2,089 $6,879

Aggregate fair value in excess of unpaid principal balance 48 390

Balance of non-accrual loans or loans more than 90 days past due ——

Aggregate unpaid principal balance in excess of fair value for non-accrual loans or loans more than 90 days past due ——

The changes in fair values of these mortgage loans are reported in Other

revenue in the Company’s Consolidated Statement of Income. There was no

net change in fair value during the years ended December 31, 2013 and 2012

due to instrument-specific credit risk. Related interest income continues to

be measured based on the contractual interest rates and reported as Interest

revenue in the Consolidated Statement of Income.

Certain consolidated VIEs

The Company has elected the fair value option for all qualified assets

and liabilities of certain VIEs that were consolidated upon the adoption

of SFAS 167 on January 1, 2010, including certain private label mortgage

securitizations, mutual fund deferred sales commissions and collateralized

loan obligation VIEs. The Company elected the fair value option for these

VIEs, as the Company believes this method better reflects the economic risks,

since substantially all of the Company’s retained interests in these entities are

carried at fair value.

With respect to the consolidated mortgage VIEs, the Company determined

the fair value for the mortgage loans and long-term debt utilizing internal

valuation techniques. The fair value of the long-term debt measured using

internal valuation techniques is verified, where possible, to prices obtained

from independent vendors. Vendors compile prices from various sources and

may apply matrix pricing for similar securities when no price is observable.

Security pricing associated with long-term debt that is valued using

observable inputs is classified as Level 2, and debt that is valued using one or

more significant unobservable inputs is classified as Level 3. The fair value

of mortgage loans in each VIE is derived from the security pricing. When

substantially all of the long-term debt of a VIE is valued using Level 2 inputs,

the corresponding mortgage loans are classified as Level 2. Otherwise, the

mortgage loans of a VIE are classified as Level 3.

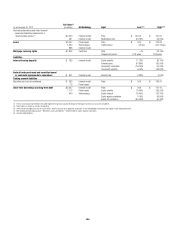

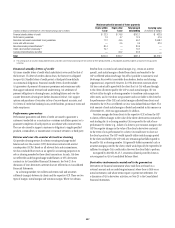

With respect to the consolidated mortgage VIEs for which the fair

value option was elected, the mortgage loans are classified as Loans on

Citigroup’s Consolidated Balance Sheet. The changes in fair value of

the loans are reported as Other revenue in the Company’s Consolidated

Statement of Income. Related interest revenue is measured based on the

contractual interest rates and reported as Interest revenue in the Company’s

Consolidated Statement of Income. Information about these mortgage loans

is included in the table below. The change in fair value of these loans due to

instrument-specific credit risk was a loss of $156 and $107 million for the

years ended December 31, 2013 and 2012, respectively.

The debt issued by these consolidated VIEs is classified as long-term debt

on Citigroup’s Consolidated Balance Sheet. The changes in fair value for the

majority of these liabilities are reported in Other revenue in the Company’s

Consolidated Statement of Income. Related interest expense is measured