Citibank 2013 Annual Report Download - page 324

Download and view the complete annual report

Please find page 324 of the 2013 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.306

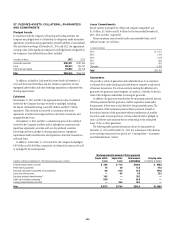

Counterparty and Investor Actions

In 2010, Abu Dhabi Investment Authority (ADIA) commenced an arbitration

(ADIA I) against Citigroup and Related Parties before the International

Center for Dispute Resolution (ICDR), alleging statutory and common

law claims in connection with its $7.5 billion investment in Citigroup in

December 2007. ADIA sought rescission of the investment agreement or, in

the alternative, more than $4 billion in damages. Following a hearing in

May 2011 and post-hearing proceedings, on October 14, 2011, the arbitration

panel issued a final award and statement of reasons finding in favor of

Citigroup on all claims asserted by ADIA. On March 4, 2013, the United States

District Court for the Southern District of New York denied ADIA’s petition

to vacate the arbitration award and granted Citigroup’s cross-petition to

confirm. ADIA appealed, and on February 19, 2014, the United States Court of

Appeals for the Second Circuit affirmed the judgment. Additional information

concerning this action is publicly available in court filings under the docket

numbers 12 Civ. 283 (S.D.N.Y.) (Daniels, J.) and 13-1068-cv (2d Cir.).

On August 20, 2013, ADIA commenced a second arbitration (ADIA II)

against Citigroup before the ICDR, alleging common law claims arising out

of the same investment at issue in ADIA I. On August 28, 2013, Citigroup

filed a complaint against ADIA in the United States District Court for the

Southern District of New York seeking to enjoin ADIA II on the ground that it

is barred by the court’s judgment confirming the arbitral award in ADIA I. On

September 23, 2013, ADIA filed motions to dismiss Citigroup’s complaint and

to compel arbitration. On November 25, 2013, the court denied Citigroup’s

motion for a preliminary injunction and granted ADIA’s motions to dismiss

and to compel arbitration. On December 23, 2013, Citigroup appealed that

ruling to the United States Court of Appeals for the Second Circuit. Additional

information concerning this action is publicly available in court filings

under the docket numbers 13 Civ. 6073 (S.D.N.Y.) (Castel, J.) and 13-4825

(2d Cir.).

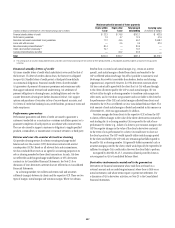

Alternative Investment Fund-Related Litigation and

Other Matters

Since mid-2008, the SEC has been investigating the management and

marketing of the ASTA/MAT and Falcon funds, alternative investment

funds managed and marketed by certain Citigroup affiliates that suffered

substantial losses during the credit crisis. In addition to the SEC inquiry,

on June 11, 2012, the New York Attorney General served a subpoena on a

Citigroup affiliate seeking documents and information concerning certain

of these funds; on August 1, 2012, the Massachusetts Attorney General

served a Civil Investigative Demand on a Citigroup affiliate seeking similar

documents and information. Citigroup is cooperating fully with these

inquiries. Citigroup has entered into tolling agreements with the New York

Attorney General concerning certain claims related to the investigations.

Citigroup and Related Parties have been named as defendants in a

putative class action lawsuit filed in October 2012 on behalf of investors

in CSO Ltd., CSO US Ltd., and Corporate Special Opportunities Ltd., whose

investments were managed indirectly by a Citigroup affiliate. Plaintiffs

assert a variety of state common law claims, alleging that they and other

investors were misled into investing in the funds and, later, not redeeming

their investments. The complaint seeks to recover more than $400 million

on behalf of a putative class of investors. Additional information concerning

this action is publicly available in court filings under the docket number

12-cv-7717 (S.D.N.Y.) (Castel, J.).

In addition, numerous investors in the ASTA/MAT funds have filed

lawsuits or arbitrations against Citigroup and Related Parties seeking

damages and related relief. Although most of these investor disputes have

been resolved, some remain pending.

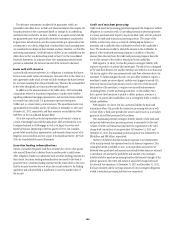

Auction Rate Securities-Related Litigation and

Other Matters

Citigroup and Related Parties have been named as defendants in numerous

actions and proceedings brought by Citigroup shareholders and purchasers

or issuers of ARS, asserting federal and state law claims arising from the

collapse of the ARS market in early 2008, which plaintiffs contend Citigroup

and other ARS underwriters and broker-dealers foresaw or should have

foreseen, but failed adequately to disclose. Many of these matters have

been dismissed or settled. Most of the remaining matters are in arbitrations

pending before FINRA.

KIKOs

Prior to the devaluation of the Korean won in 2008, several local banks in

Korea, including Citibank Korea Inc. (CKI), entered into foreign exchange

derivative transactions with small and medium-size export businesses

(SMEs) to enable the SMEs to hedge their currency risk. The derivatives had

“knock-in, knock-out” features. Following the devaluation of the won, many

of these SMEs incurred significant losses on the derivative transactions and

filed civil lawsuits against the banks, including CKI. The claims generally

allege that the products were not suitable and that the risk disclosure was

inadequate.

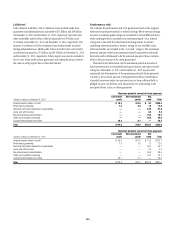

As of December 31, 2013, there were 102 civil lawsuits filed by SMEs

against CKI. To date, 84 decisions have been rendered at the district court

level, and CKI has prevailed in 64 of those decisions. In the other 20

decisions, plaintiffs were awarded only a portion of the damages sought.

The damage awards total in the aggregate approximately $37.2 million.

CKI is appealing the 20 adverse decisions. A significant number of plaintiffs

that had decisions rendered against them are also filing appeals, including

plaintiffs that were awarded less than all of the damages they sought.

Of the 84 cases decided at the district court level, 62 have been appealed to

the high court, including the 20 in which an adverse decision was rendered

against CKI in the district court. Of the 27 appeals decided or settled at high

court level, CKI prevailed in 17 cases, and in the other 10 cases plaintiffs

were awarded partial damages, which increased the aggregate damages

awarded against CKI by a further $10.1 million. CKI is appealing nine of the

adverse decisions to the Korean Supreme Court and many plaintiffs have filed

appeals to the Supreme Court as well.

As of December 31, 2013, the Supreme Court has rendered five judgments

relating to CKI, and CKI has prevailed in all five cases.