Citibank 2013 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2013 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.128

CROSS-BORDER RISK

Overview

Cross-borderriskistheriskthatactionstakenbyanon-U.S.governmentmay

prevent the conversion of local currency into non-local currency and/or the

transfer of funds outside the country, among other risks, thereby impacting

the ability of Citigroup and its customers to transact business across borders.

Examples of cross-border risk include actions taken by foreign governments

such as exchange controls and restrictions on the remittance of funds. These

actions might restrict the transfer of funds or the ability of Citigroup to obtain

payment from customers on their contractual obligations. Management of

cross-border risk at Citi is performed through a formal review process that

includes annual setting of cross-border limits and ongoing monitoring of

cross-border exposures as well as monitoring of economic conditions globally

throughCiti’sindependentriskmanagement.Seealso“RiskFactors—

Market and Economic Risks” above.

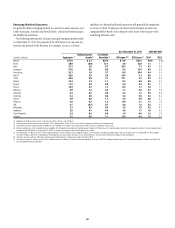

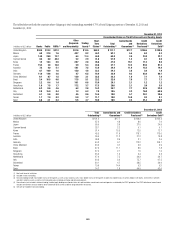

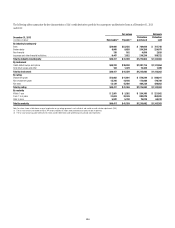

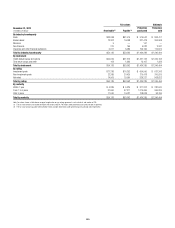

FFIEC—Cross-Border Outstandings

Citi’s cross-border disclosures are based on the country exposure bank

regulatory reporting guidelines of the Federal Financial Institutions

Examination Council (FFIEC), as revised in December 2013. The tables

below reflect these revised guidelines for both December 31, 2013 and 2012.

Reporting of cross-border exposure under FFIEC bank regulatory

guidelines differs significantly from Citi’s country risk reporting, as described

under “Country Risk” above. The more significant differences are as follows:

• FFIECamountsarebasedonthedomicileoftheultimateobligor,

counterparty, collateral, issuer or guarantor, as applicable, whereas Citi’s

country risk reporting is based on the identification of the country where

the client relationship, taken as a whole, is most directly exposed to the

economic, financial, sociopolitical or legal risks.

• FFIEC amounts do not consider the benefit of collateral received for

securities financing transactions (i.e. repurchase agreements, reverse

repurchase agreements and securities loaned and borrowed) and are

reported based on notional amounts, while country risk amounts are

reported based on the net credit exposure arising from the transaction.

• Cross-border reporting under FFIEC guidelines permits netting of

derivatives receivables and payables, reported at fair value, but only under

a legally binding netting agreement with the same specific counterparty,

and does not include the benefit of margin received or hedges, compared

to country risk reporting which recognizes the benefit of margin and

hedges and permits netting so long as under the same legally binding

netting agreement.

• ThenettingoflongandshortpositionsforAFSsecuritiesandtrading

portfolios is not permitted under FFIEC reporting, whereas such positions

are reported on a net basis under country risk reporting.

• Creditdefaultswaps(CDS)areincludedundercross-borderreporting

based on the gross notional amount sold and purchased, and do not

includeanyoffsettingCDSonthesameunderlyingentity,comparedto

countryriskwhereCDSarereportedbasedonthenetnotionalamount

ofCDSpurchasedandsold,assumingzerorecoveryfromtheunderlying

entity and adjusted for any mark-to-market receivable or payable position.

• FFIEC reporting requires loans be reported without the benefit of hedges,

compared to country risk reporting which includes loans net of hedges

and collateral.

Given the differences noted above, Citi’s cross-border exposures and total

outstandings tend to fluctuate, in some cases, significantly, from period to

period. As an example, because total outstandings under FFIEC guidelines

do not include the benefit of margin or hedges, market volatility in interest

rates, foreign exchange rates and credit spreads will cause significant

fluctuations in the level of total outstandings, all else being equal.

In addition, as noted above, FFIEC bank regulatory guidelines for

reporting of cross-border exposures were revised effective December 2013.

These revisions resulted in changes to the presentation (including increasing

the number of countries included) and calculation of Citi’s total cross-border

outstandings, as compared to those previously disclosed at December 31,

2012.Specifically,thenewguidelines(i)eliminatetheseparatereportingof

“investments in and funding of local franchises” (i.e., local country assets)

and require such assets to be included within the cross-border exposures

below, (ii) no longer permit the offsetting of local country liabilities against

local country assets, and (iii) make various changes in the categories

required to be reported.