Citibank 2013 Annual Report Download - page 230

Download and view the complete annual report

Please find page 230 of the 2013 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.212

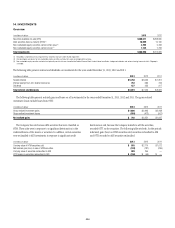

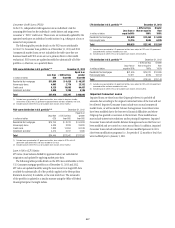

after-tax) recorded in Other revenue. As of December 31, 2013, the

remaining 9.9% stake in Akbank is recorded within marketable equity

securities available-for-sale. The revaluation of the Turkish Lira was

hedged, so the change in the value of the currency related to Akbank

investment did not have a significant impact on earnings during

the year.

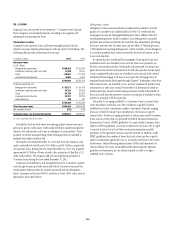

MSSB

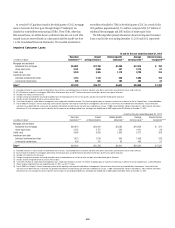

On September 17, 2012, Citi sold to Morgan Stanley a 14% interest (the 14%

Interest) in the MSSB joint venture, pursuant to the exercise of the purchase

option by Morgan Stanley on June 1, 2012. Morgan Stanley paid Citi

$1.89 billion in cash as the purchase price of the 14% Interest. The purchase

price was based on an implied 100% valuation of the MSSB joint venture

of $13.5 billion, as agreed between Morgan Stanley and Citi pursuant to an

agreement dated September 11, 2012. The related approximately $4.5 billion

in deposits were transferred to Morgan Stanley at no premium, as agreed

between the parties.

Prior to the September 2012 sale, Citi’s carrying value of its 49% interest

in the MSSB joint venture was approximately $11.3 billion. As a result

of the agreement entered into with Morgan Stanley on September 11,

2012, Citi recorded a charge to net income in the third quarter of 2012 of

approximately $2.9 billion after-tax ($4.7 billion pretax), consisting of

(i) a charge recorded in Other revenue of approximately $800 million

after-tax ($1.3 billion pretax), representing a loss on sale of the 14%

Interest, and (ii) an OTTI of the carrying value of its then-remaining 35%

interest in the MSSB joint venture of approximately $2.1 billion after-tax

($3.4 billion pretax).

On June 21, 2013, Morgan Stanley notified Citi of its intent to exercise

its call option with respect to Citi’s remaining 35% investment in the MSSB

joint venture, composed of an approximate $4.725 billion equity investment

and $3 billion of other MSSB financing (consisting of approximately

$2.028 billion of preferred stock and a $0.880 billion loan). At the closing

of the transaction on June 28, 2013, the loan to MSSB was repaid and the

MSSB interests and preferred stock were settled, with no significant gains or

losses recorded at the time of settlement. In addition, MSSB made a dividend

payment to Citi on June 28, 2013 in the amount of $37.5 million.

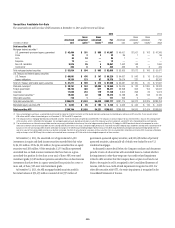

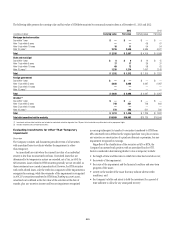

Mortgage-backed securities

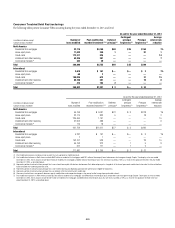

For U.S. mortgage-backed securities (and in particular for Alt-A and other

mortgage-backed securities that have significant unrealized losses as a

percentage of amortized cost), credit impairment is assessed using a cash

flow model that estimates the cash flows on the underlying mortgages, using

the security-specific collateral and transaction structure. The model estimates

cash flows from the underlying mortgage loans and distributes those cash

flows to various tranches of securities, considering the transaction structure

and any subordination and credit enhancements that exist in that structure.

The cash flow model incorporates actual cash flows on the mortgage-backed

securities through the current period and then projects the remaining cash

flows using a number of assumptions, including default rates, prepayment

rates, recovery rates (on foreclosed properties) and loss severity rates

(on non-agency mortgage-backed securities).

Management develops specific assumptions using as much market data

as possible and includes internal estimates, as well as estimates published

by rating agencies and other third-party sources. Default rates are projected

by considering current underlying mortgage loan performance, generally

assuming the default of (i) 10% of current loans, (ii) 25% of 30-59 day

delinquent loans, (iii) 70% of 60-90 day delinquent loans and (iv) 100%

of 91+ day delinquent loans. These estimates are extrapolated along a

default timing curve to estimate the total lifetime pool default rate. Other

assumptions contemplate the actual collateral attributes, including

geographic concentrations, rating actions and current market prices.

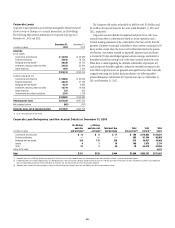

Cash flow projections are developed using different stress test scenarios.

Management evaluates the results of those stress tests (including the

severity of any cash shortfall indicated and the likelihood of the stress

scenarios actually occurring based on the underlying pool’s characteristics

and performance) to assess whether management expects to recover the

amortized cost basis of the security. If cash flow projections indicate that the

Company does not expect to recover its amortized cost basis, the Company

recognizes the estimated credit loss in earnings.

State and municipal securities

The process for identifying credit impairments in Citigroup’s AFS state and

municipal bonds is primarily based on a credit analysis that incorporates

third-party credit ratings. Citigroup monitors the bond issuers and any

insurers providing default protection in the form of financial guarantee

insurance. The average external credit rating, ignoring any insurance, is

Aa3/AA-. In the event of an external rating downgrade or other indicator of

credit impairment (i.e., based on instrument-specific estimates of cash flows

or probability of issuer default), the subject bond is specifically reviewed for

adverse changes in the amount or timing of expected contractual principal

and interest.

For AFS state and municipal bonds with unrealized losses that Citigroup

plans to sell, would likely be required to sell or will be subject to an issuer call

deemed probable of exercise prior to the expected recovery of its amortized

cost basis, the full impairment is recognized in earnings.