Citibank 2013 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2013 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

90

Citigroup Residential Mortgages—Representations and

Warranties Repurchase Reserve

Overview

In connection with Citi’s sales of residential mortgage loans to the U.S.

government-sponsored entities (GSEs) and private investors, as well as

through private-label residential mortgage securitizations, Citi typically

makes representations and warranties that the loans sold meet certain

requirements, such as the loan’s compliance with any applicable loan

criteria established by the buyer and the validity of the lien securing the loan.

The specific representations and warranties made by Citi in any particular

transaction depend on, among other things, the nature of the transaction

and the requirements of the investor (e.g., whole loan sale to the GSEs versus

loans sold through securitization transactions), as well as the credit quality

of the loan (e.g., prime, Alt-A or subprime).

These sales expose Citi to potential claims for alleged breaches of its

representations and warranties. In the event of a breach of its representations

and warranties, Citi could be required either to repurchase the mortgage

loans with the identified defects (generally at unpaid principal balance plus

accrued interest) or to indemnify (“make whole”) the investors for their

losses on these loans.

Citi has recorded a repurchase reserve for its potential repurchase or

make-whole liability regarding residential mortgage representation and

warranty claims. During the period 2005-2008, Citi sold approximately

$91 billion of mortgage loans through private-label securitizations,

$66.4 billion of which was sold through its legacy Securities and Banking

business and $24.6 billion of which was sold through CitiMortgage.

Beginning in the first quarter of 2013, Citi considers private-label residential

mortgage securitization representation and warranty claims as part of its

litigation accrual analysis and not as part of its repurchase reserve. See

Note 28 to the Consolidated Financial Statements for additional information

Citi’s potential private-label residential mortgage securitization exposure.

Accordingly, Citi’s repurchase reserve has been recorded for purposes of its

potential representation and warranty repurchase liability resulting from its

whole loan sales to the GSEs and, to a lesser extent private investors, which

are made through Citi’s Consumer business in CitiMortgage.

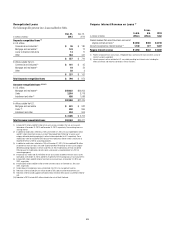

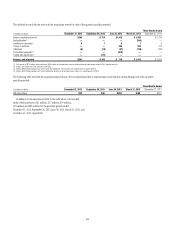

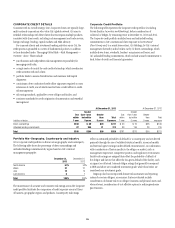

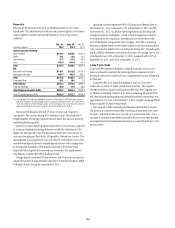

Representation and Warranty Claims by Claimant

The following table sets forth the original principal balance of representation and warranty claims received, as well as the original principal balance of

unresolved claims by claimant, for each of the periods presented

GSEs and others (1)

In millions of dollars December 31, 2013 September 30, 2013 June 30, 2013 March 31, 2013 December 31, 2012

Claims during the three months ended $ 80 $152 $647 $1,126 $ 787

Unresolved claims at 169 153 264 1,252 1,229

(1) The decreases in claims during the three months ended and unresolved claims at September 30, 2013 and June 30, 2013 primarily reflect the agreements with Fannie Mae and Freddie Mac during the second quarter

of 2013 and the third quarter of 2013, respectively. See “Repurchase Reserve” below.

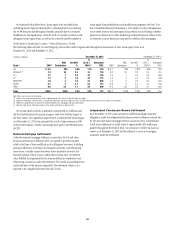

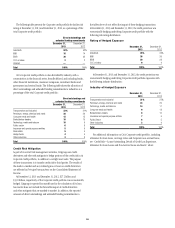

Repurchase Reserve

The repurchase reserve is based on various assumptions which are

primarily based on Citi’s historical repurchase activity with the GSEs. As of

December 31, 2013, the most significant assumptions used to calculate the

reserve levels are the: (i) probability of a claim based on correlation between

loan characteristics and repurchase claims; (ii) claims appeal success rates;

and (iii) estimated loss per repurchase or make-whole payment. In addition,

as part of its repurchase reserve analysis, Citi considers reimbursements

estimated to be received from third-party sellers, which are generally based

on Citi’s analysis of its most recent collection trends and the financial

viability of the third-party sellers (i.e., to the extent Citi made representation

and warranties on loans it purchased from third-party sellers that remain

financially viable, Citi may have the right to seek recovery from the third

party based on representations and warranties made by the third party to Citi

(a “back-to-back” claim)).

During 2013, Citi recorded an additional reserve of $470 million relating

to its loan sale repurchase exposure, all of which was recorded in the first

half of 2013. During the second and third quarters of 2013, Citi entered

into previously-disclosed agreements with Fannie Mae and Freddie Mac,

respectively, to resolve potential future origination-related representation

and warranty repurchase claims on a pool of residential first mortgage loans

that were, in each case, originated between 2000 and 2012. The change in

estimate in the repurchase reserve during 2013 primarily resulted from GSE

loan documentation requests received prior to the respective agreements

referred to above. As a result of these agreements, and based on currently

available information, Citi believes that changes in estimates in the

repurchase reserve should generally be consistent with its levels of loan sales

going forward.