Citibank 2013 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2013 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

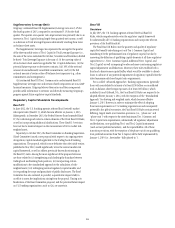

Prompt Corrective Action Framework

The Final Basel III Rules revise the Prompt Corrective Action (PCA)

regulations in certain respects. In general, the PCA regulations direct the U.S.

banking agencies to enforce increasingly strict limitations on the activities

of insured depository institutions that fail to meet certain regulatory capital

thresholds. The revised PCA framework contains five categories of capital

adequacy as measured by risk-based capital and leverage ratios: (i) “well

capitalized;” (ii) “adequately capitalized;” (iii) “undercapitalized;”

(iv) “significantly undercapitalized;” and (v) “critically undercapitalized.”

Additionally, the U.S. banking agencies revised the PCA regulations

to accommodate a new minimum Tier 1 Common ratio requirement

for substantially all categories of capital adequacy (other than critically

undercapitalized), increase the minimum Tier 1 Capital ratio requirement

at each category, and introduce for Advanced Approaches insured depository

institutions the Supplementary Leverage ratio as a metric, but only for

the “adequately capitalized” and “undercapitalized” categories. These

revisions will become effective on January 1, 2015, with the exception of the

Supplementary Leverage ratio for Advanced Approaches insured depository

institutions, for which January 1, 2018 is the effective date. Accordingly,

beginning January 1, 2015, an insured depository institution, such as

Citibank, N.A., would need minimum Tier 1 Common, Tier 1 Capital, Total

Capital, and Tier 1 Leverage ratios of 6.5% (a new requirement), 8% (a 2%

increase over the current requirement), 10%, and 5%, respectively, to be

considered “well capitalized.”

Disclosure Requirements

The Final Basel III Rules formally establish extensive qualitative and

quantitative public disclosure requirements for substantially all U.S. banking

organizations, as well as additional disclosures specifically required of

Advanced Approaches banking organizations. The required disclosures are

intended to provide transparency with respect to such regulatory capital

aspects as capital structure, capital adequacy, capital buffers, credit risk,

securitizations, operational risk, equities and interest rate risk. Qualitative

disclosures that typically remain unchanged each quarter may be disclosed

annually, however, any significant changes must be provided in the interim.

Alternatively, quantitative disclosures must be provided quarterly. An

Advanced Approaches banking organization is required to comply with the

Advanced Approaches disclosures after exiting parallel run, unless it has not

exited by the first quarter of 2015, in which case an Advanced Approaches

banking organization is required to provide the disclosures set forth under

the Standardized Approach until parallel run has been exited.

Volcker Rule

In December 2013, the U.S. banking agencies, along with the Securities and

Exchange Commission and the Commodity Futures Trading Commission,

issued final rules to implement the so-called “Volcker Rule” of the Dodd-

Frank Act (Final Volcker Rule). Aside from provisions which prohibit

“banking entities” (i.e., insured depository institutions and their affiliates)

from engaging in short-term proprietary trading, the Final Volcker Rule also

imposes limitations on the extent to which banking entities are permitted to

invest in certain “covered funds” (e.g., hedge funds and private equity funds)

and requires that such investments be fully deducted from Tier 1 Capital.

While the initial period within which banking entities have to become

compliant with the covered fund investment provisions extends to July 21,

2015, the timing as to the required Tier 1 Capital deduction, as well as the

expected incorporation of this requirement into the Final Basel III Rules, are

currently uncertain. For additional information on the Final Volcker Rule,

see “Risk Factors—Regulatory Risks” below.

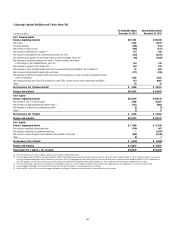

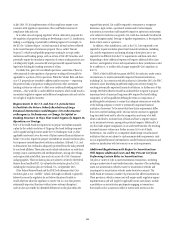

Tangible Common Equity, Tangible Book Value Per Share

and Book Value Per Share

Tangible common equity (TCE), as currently defined by Citi, represents

common equity less goodwill and other intangible assets (other than MSRs).

Other companies may calculate TCE in a different manner. TCE, tangible

book value per share and book value per share are non-GAAP financial

measures. Citi believes these capital metrics provide useful information, as

they are used by investors and industry analysts.

In millions of dollars or shares,

except per share amounts

December 31,

2013

December 31,

2012

Total Citigroup stockholders’ equity $204,339 $189,049

Less:

Preferred stock 6,738 2,562

Common equity $197,601 $186,487

Less:

Goodwill 25,009 25,673

Other intangible assets (other than MSRs) 5,056 5,697

Goodwill and other intangible assets (other

than MSRs) related to assets of discontinued

operations held for sale —32

Net deferred tax assets related to goodwill and

other intangible assets —32

Tangible common equity (TCE) $167,536 $155,053

Common shares outstanding (CSO) 3,029.2 3,028.9

Book value per share (common equity/CSO) $ 65.23 $ 61.57

Tangible book value per share (TCE/CSO) $ 55.31 $ 51.19