Citibank 2013 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2013 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327 -

328

328 -

329

329 -

330

330 -

331

331 -

332

332 -

333

333 -

334

334 -

335

335 -

336

336 -

337

337 -

338

338 -

339

339 -

340

340 -

341

341 -

342

342

|

|

We grew our overall loan portfolio in Citicorp by 6%. In

particular, we met — and exceeded — a commitment made in

2011 to lend $24 billion to U.S. small businesses over three

years. With $9.1 billion lent in 2013 — more than double the

2009 level — that brings the total to $26.6 billion to enable

small businesses to start and expand operations, add jobs

and turn their passions into progress.

We also made good progress on several legacy issues.

We resolved some significant mortgage litigation, utilized

$2.5 billion of our deferred tax assets, reduced Citi Holdings

assets by a further 25% and cut Holdings’ annual loss in half.

These numbers helped show the capability of this franchise

to generate capital. During 2013, we generated more than

$20 billion in regulatory capital, ending the year with our

Tier I Common ratio at an estimated 10.6% on a Basel III

basis — 60 basis points above the goal we set for ourselves

at the beginning of the year. At the end of the year, our

Supplementary Leverage Ratio stood at 5.4%. And, crucially,

we achieved no objection from the Federal Reserve to our

2013 capital plan.

I told you last year that execution of our strategy would be

my primary focus. In 2013, we put in place key tools to help

us achieve the most from our franchise. We created detailed,

tough but realistic scorecards to judge the performance of

more than 500 of the top leaders of our firm. We sorted

our 101 countries into four categories — or “buckets” — to

help us prioritize the commitment of our resources to those

sectors and regions most important to our clients. And we

announced three targets for 2015 to which we are holding

ourselves accountable — return on assets, return on tangible

common equity and operating efficiency — and improved our

performance across all of them in 2013.

We’ve shown that we can generate quality earnings. But

our 2013 results also surprised us with a damaging example

of how ethical failures can jeopardize everything we work

for. We discovered that invoices that were paid through

an accounts receivable financing program in Mexico were

falsified, resulting in a $235 million reduction to our 2013 net

income. While we have completed a rapid review of similar

lending programs, we continue to investigate what took place

in Mexico and are working to identify any areas where we

need to strengthen our controls through stronger oversight or

improved processes. We are pursuing every possible avenue

to recover these funds and to punish the guilty — inside and

outside the firm.

The financial impact of fraud can be calculated. The harm to

our credibility is harder to gauge. Credibility is the currency

that allows us to meet our goals. That’s true of clients, the

core constituency we aim to serve every day; it’s true of

regulators, who grant us our license to do business; it’s true

of employees, whom we need to attract by making Citi the

best possible place to work; and it’s true of our shareholders,

whose trust we require to succeed and which we will continue

to strive to earn.

I want you to know that I’ve made crystal clear to all our

employees that I expect the very highest standards from each

and every one of them. We are launching a comprehensive

program — including improved training and a continued

focus on responsible finance — to support and enhance the

institutional values that have served this company so well for

more than 200 years.

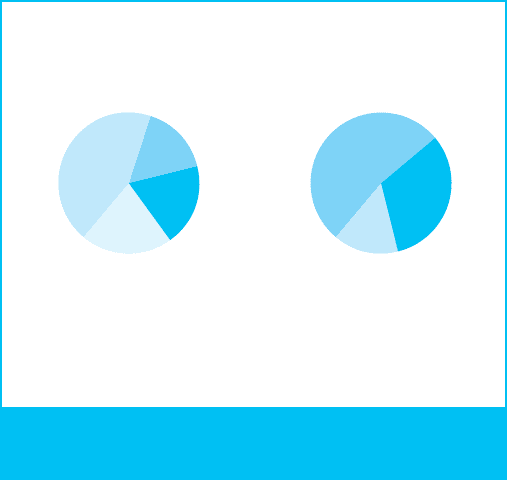

2013 Revenues: $72 billion

By Region By Business

GCB

53%

CTS

15%

S&B

32%

NA

44%

ASIA

21%

LATAM

19%

EMEA

16%

GCB — Global Consumer Banking

S&B — Securities and Banking

CTS — Citi Transaction Services

NA — North America

EMEA — Europe, Middle East and Africa

LATAM — Latin America

2013 Citicorp Revenues

Regional results exclude Corporate/Other.

3