Citibank 2013 Annual Report Download - page 289

Download and view the complete annual report

Please find page 289 of the 2013 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.271

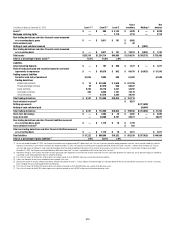

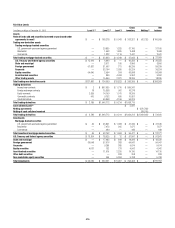

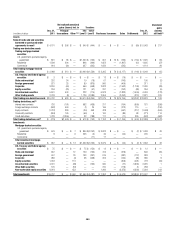

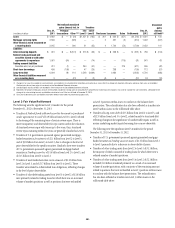

25. FAIR VALUE MEASUREMENT

ASC 820-10 (formerly SFAS 157) Fair Value Measurement, defines fair

value, establishes a consistent framework for measuring fair value and

requires disclosures about fair value measurements. Fair value is defined as

the price that would be received to sell an asset or paid to transfer a liability

in an orderly transaction between market participants at the measurement

date. Among other things, the standard requires the Company to maximize

the use of observable inputs and minimize the use of unobservable inputs

when measuring fair value.

Under ASC 820-10, the probability of default of a counterparty is factored

into the valuation of derivative positions and includes the impact of

Citigroup’s own credit risk on derivatives and other liabilities measured at

fair value.

Fair Value Hierarchy

ASC 820-10 specifies a hierarchy of inputs based on whether the inputs are

observable or unobservable. Observable inputs reflect market data obtained

from independent sources, while unobservable inputs reflect the Company’s

market assumptions. These two types of inputs have created the following fair

value hierarchy:

• Level1:Quotedpricesforidentical instruments in active markets.

• Level2:Quotedpricesforsimilar instruments in active markets; quoted

prices for identical or similar instruments in markets that are not

active; and model-derived valuations in which all significant inputs and

significant value drivers are observable in active markets.

• Level3:Valuationsderivedfromvaluationtechniquesinwhichoneor

more significant inputs or significant value drivers are unobservable.

This hierarchy requires the use of observable market data when available.

The Company considers relevant and observable market prices in its

valuations where possible. The frequency of transactions, the size of the bid-

ask spread and the amount of adjustment necessary when comparing similar

transactions are all factors in determining the liquidity of markets and the

relevance of observed prices in those markets.

The Company’s policy with respect to transfers between levels of the fair

value hierarchy is to recognize transfers into and out of each level as of the

end of the reporting period.

Determination of Fair Value

For assets and liabilities carried at fair value, the Company measures such

value using the procedures set out below, irrespective of whether these assets

and liabilities are carried at fair value as a result of an election or whether

they are required to be carried at fair value.

When available, the Company generally uses quoted market prices to

determinefairvalueandclassifiessuchitemsasLevel1.Insomecases

where a market price is available, the Company will make use of acceptable

practical expedients (such as matrix pricing) to calculate fair value, in which

casetheitemsareclassifiedasLevel2.

If quoted market prices are not available, fair value is based upon

internally developed valuation techniques that use, where possible, current

market-based parameters, such as interest rates, currency rates, option

volatilities, etc. Items valued using such internally generated valuation

techniques are classified according to the lowest level input or value driver

thatissignificanttothevaluation.Thus,anitemmaybeclassifiedasLevel3

even though there may be some significant inputs that are readily observable.

The Company may also apply a price-based methodology, which utilizes,

where available, quoted prices or other market information obtained from

recent trading activity in positions with the same or similar characteristics to

the position being valued. The market activity and the amount of the bid-ask

spread are among the factors considered in determining the liquidity of

markets and the relevance of observed prices from those markets. If relevant

and observable prices are available, those valuations may be classified as

Level2.Whenlessliquidityexistsforasecurityorloan,aquotedpriceis

stale, a significant adjustment to the price of a similar security is necessary

to reflect differences in the terms of the actual security or loan being valued,

or prices from independent sources are insufficient to corroborate the

valuation, the “price” inputs are considered unobservable and the fair value

measurementsareclassifiedasLevel3.

Fair value estimates from internal valuation techniques are verified,

where possible, to prices obtained from independent vendors or brokers.

Vendorsandbrokers’valuationsmaybebasedonavarietyofinputsranging

from observed prices to proprietary valuation models.

The following section describes the valuation methodologies used by

the Company to measure various financial instruments at fair value,

including an indication of the level in the fair value hierarchy in which each

instrument is generally classified. Where appropriate, the description includes

details of the valuation models, the key inputs to those models and any

significant assumptions.

Market valuation adjustments

LiquidityadjustmentsareappliedtoitemsinLevel2andLevel3ofthefair

value hierarchy to ensure that the fair value reflects the liquidity or illiquidity

of the market. The liquidity reserve may utilize the bid-offer spread for an

instrument as one of the factors.

Counterparty credit-risk adjustments are applied to derivatives, such as

over-the-counter uncollateralized derivatives, where the base valuation uses

market parameters based on the relevant base interest rate curves. Not all

counterparties have the same credit risk as that implied by the relevant base

curve, so it is necessary to consider the market view of the credit risk of a

counterparty in order to estimate the fair value of such an item.

Bilateral or “own” credit-risk adjustments are applied to reflect the

Company’s own credit risk when valuing derivatives and liabilities measured

at fair value. Counterparty and own credit adjustments consider the expected

future cash flows between Citi and its counterparties under the terms of

the instrument and the effect of credit risk on the valuation of those cash

flows, rather than a point-in-time assessment of the current recognized net

asset or liability. Furthermore, the credit-risk adjustments take into account

the effect of credit-risk mitigants, such as pledged collateral and any legal

right of offset (to the extent such offset exists) with a counterparty through

arrangements such as netting agreements.

Generally, the unit of account for a financial instrument is the individual

financial instrument. The Company applies market valuation adjustments

that are consistent with the unit of account, which does not include

adjustment due to the size of the Company’s position, except as follows.

ASC 820-10 permits an exception, through an accounting policy election,

to measure the fair value of a portfolio of financial assets and financial

liabilities on the basis of the net open risk position when certain criteria are

met. Citi has elected to measure certain portfolios of financial instruments,

such as derivatives, that meet those criteria on the basis of the net open risk