Citibank 2013 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2013 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.137

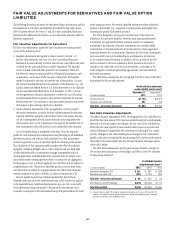

CVA/DVA Methodology

ASC 820-10 requires that Citi’s own credit risk be considered in determining

the market value of any Citi liability carried at fair value. These liabilities

include derivative instruments as well as debt and other liabilities for which

the fair value option has been elected. The credit valuation adjustment

(CVA) also incorporates the market view of the counterparty credit risk in

the valuation of derivative assets. The CVA is recognized on the Consolidated

Balance Sheet as a reduction or increase in the associated derivative asset or

liability to arrive at the fair value (carrying value) of the derivative asset or

liability. The debt valuation adjustment (DVA) is recognized on the balance

sheet as a reduction or increase in the associated fair value option debt

liability to arrive at the fair value of the liability. For additional information,

see “Fair Value Adjustments for Derivatives and FVO Liabilities” above.

Allowance for Credit Losses

Allowance for Funded Lending Commitments

Management provides reserves for an estimate of probable losses inherent

in the funded loan portfolio on the Consolidated Balance Sheet in the

form of an allowance for loan losses. These reserves are established in

accordance with Citigroup’s credit reserve policies, as approved by the

Audit Committee of the Board of Directors. Citi’s Chief Risk Officer and

Chief Financial Officer review the adequacy of the credit loss reserves each

quarter with representatives from the risk management and finance staffs

for each applicable business area. Applicable business areas include those

having classifiably managed portfolios, where internal credit-risk ratings

are assigned (primarily Institutional Clients Group and Global Consumer

Banking), or modified Consumer loans, where concessions were granted due

to the borrowers’ financial difficulties.

The above-mentioned representatives covering these respective business

areas present recommended reserve balances for their funded and unfunded

lending portfolios along with supporting quantitative and qualitative data.

The quantitative data include:

Estimated Probable Losses for Non-Performing, Non-Homogeneous

Exposures Within a Business Line’s Classifiably Managed Portfolio and

Impaired Smaller-Balance Homogeneous Loans Whose Terms Have

Been Modified Due to the Borrowers’ Financial Difficulties, Where It Was

Determined That a Concession Was Granted to the Borrower.

Consideration may be given to the following, as appropriate, when

determining this estimate: (i) the present value of expected future cash flows

discounted at the loan’s original effective rate; (ii) the borrower’s overall

financial condition, resources and payment record; and (iii) the prospects

for support from financially responsible guarantors or the realizable value of

any collateral. When impairment is measured based on the present value of

expected future cash flows, the entire change in present value is recorded in

the Provision for loan losses.

Statistically Calculated Losses Inherent in the Classifiably Managed

Portfolio for Performing and De Minimus Non-Performing Exposures.

The calculation is based upon: (i) Citigroup’s internal system of credit-

risk ratings, which are analogous to the risk ratings of the major credit

rating agencies; and (ii) historical default and loss data, including rating

agency information regarding default rates from 1983 to 2012, and

internal data dating to the early 1970s on severity of losses in the event of

default. Adjustments may be made to this data. Such adjustments include:

(i) statistically calculated estimates to cover the historical fluctuation

of the default rates over the credit cycle, the historical variability of loss

severity among defaulted loans, and the degree to which there are large

obligor concentrations in the global portfolio; and (ii) adjustments made

for specifically known items, such as current environmental factors and

credit trends.

In addition, representatives from both the risk management and finance

staffs that cover business areas with delinquency-managed portfolios

containing smaller homogeneous loans present their recommended reserve

balances based upon leading credit indicators, including loan delinquencies

and changes in portfolio size, as well as economic trends, including housing

prices, unemployment and GDP. This methodology is applied separately for

each individual product within each different geographic region in which

these portfolios exist.

This evaluation process is subject to numerous estimates and judgments.

The frequency of default, risk ratings, loss recovery rates, the size and

diversity of individual large credits, and the ability of borrowers with foreign

currency obligations to obtain the foreign currency necessary for orderly debt

servicing, among other things, are all taken into account during this review.

Changes in these estimates could have a direct impact on Citi’s credit costs

in any period and could result in a change in the allowance. Changes to the

allowance are recorded in the Provision for loan losses.

Allowance for Unfunded Lending Commitments

A similar approach to the allowance for loan losses is used for calculating

a reserve for the expected losses related to unfunded loan commitments

and standby letters of credit. This reserve is classified on the Consolidated

Balance Sheet in Other liabilities. Changes to the allowance for unfunded

lending commitments are recorded in the Provision for unfunded

lending commitments.

For a further description of the loan loss reserve and related accounts, see

Notes 1 and 16 to the Consolidated Financial Statements.