Citibank 2013 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2013 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327 -

328

328 -

329

329 -

330

330 -

331

331 -

332

332 -

333

333 -

334

334 -

335

335 -

336

336 -

337

337 -

338

338 -

339

339 -

340

340 -

341

341 -

342

342

|

|

I know that Citi’s culture is robust and that the overwhelming

majority of our people know right from wrong and strive to do

the right thing every day, in all aspects of our work. But I also

know that it takes only one person to jeopardize our credibility.

Looking ahead, we’ve set clear goals for 2014. We must

continue on a path to meet our 2015 financial targets. We also

hope to resolve more legacy issues this year, with the aim

of putting the bulk of our financial crisis-era legal overhang

behind us.

With Citi Holdings now comprising only 6% of our balance

sheet, our focus has shifted from selling assets to reducing

the drag that the remaining portfolio causes on our earnings.

We expect to reduce the loss incurred in Holdings further

this year, putting us closer to breakeven. Every dollar saved,

of course, falls directly to the bottom line. And we expect to

continue to utilize our deferred tax assets by generating

U.S. earnings.

In our core businesses, work proceeds to integrate and

streamline our products and services to ensure that we

provide a seamless experience across our offerings and

regions. A monumental effort is under way to transform

our Consumer business from what is, today, too much of an

amalgamation of 36 local banks into one truly global bank.

We’re consolidating platforms, processes and products, all with

the goal of giving our customers a consistently remarkable

experience wherever they live, work or travel and across all

our product lines.

Letter to Shareholders

In the Institutional Clients Group, aligning and integrating

our legacy Markets businesses and our Investor Services and

Direct Custody and Clearing activities will allow us to deliver

a more comprehensive set of capabilities, as well as enable

us to prioritize our resources more efficiently, particularly

around operations and technology. Citi is uniquely positioned

to become the industry-leading integrated services platform

as the business moves to adjust to more demanding capital,

leverage and counterparty risk requirements.

We will continue to invest in our Treasury and Trade Solutions

business, the backbone of our global network, while we

capitalize on our focus on the payments side. This business is

capital friendly and not easily replicable. It took us decades to

build and remains the clear global industry leader.

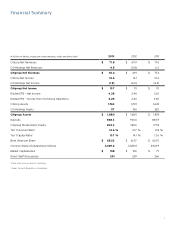

Citigroup Key Capital Metrics

$50.90 $51.81 $52.69 $51.19 $52.35 $53.10 $54.52 $55.31

1Q’12

7.2%

8.6%

7.9 %

2Q’12 3Q’12 4Q’12 1Q’13 2Q’13 3Q’13 4Q’13

$1,272 $1,250 $1,237 $1,206 $1,192 $1,168 $1,159 $1,186

1

8.7% 9.3% 10.0% 10.5% 10.6%

4.9% 5.1% 5.4%

TBV/Share

3

1 Citi Holdings comprised approximately 19% of estimated Basel III risk-weighted

assets as of 4Q’13.

2 Citigroup’s estimated Basel III Tier 1 Common ratio and estimated Supplementary

Leverage Ratio are non-GAAP financial measures. For additional information, see the

“Capital Resources” section of Citi’s 2013 Annual Report on Form 10-K.

3 Tangible Book Value Per Share is a non-GAAP financial measure. For a reconciliation

of this metric to the most direct comparable GAAP measure, see the “Capital

Resources” section of Citi’s 2013 Annual Report on Form 10-K.

Basel III Risk-Weighted Assets ($B)

Tier 1 Common (Basel III)

2

Supplementary Leverage Ratio (Basel III)

2

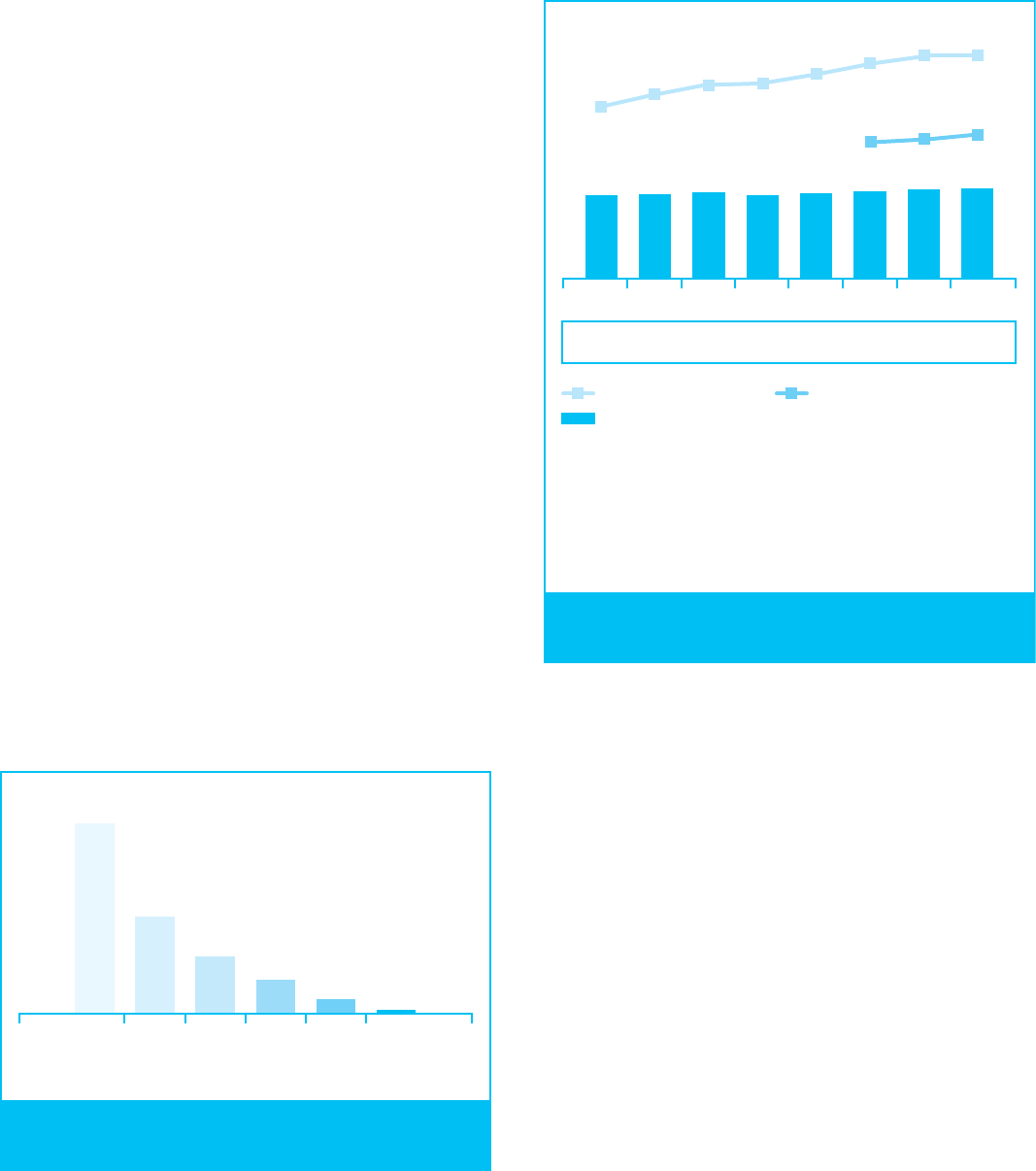

1Q’08 4Q’10 4Q’12 4Q’134Q’114Q’09

$156 $117

$458

$313

$225

$797

1

1 Non-GAAP financial measure.

Citi Holdings EOP Assets (in billions of dollars)

4