Citibank 2013 Annual Report Download - page 154

Download and view the complete annual report

Please find page 154 of the 2013 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.136

SIGNIFICANT ACCOUNTING POLICIES AND SIGNIFICANT ESTIMATES

Note 1 to the Consolidated Financial Statements contains a summary of

Citigroup’s significant accounting policies, including a discussion of recently

issued accounting pronouncements. These policies, as well as estimates made

by management, are integral to the presentation of Citi’s results of operations

and financial condition. While all of these policies require a certain level of

management judgment and estimates, this section highlights and discusses

the significant accounting policies that require management to make highly

difficult, complex or subjective judgments and estimates at times regarding

matters that are inherently uncertain and susceptible to change (see also

“Risk Factors—Business and Operational Risks”). Management has

discussed each of these significant accounting policies, the related estimates,

and its judgments with the Audit Committee of the Board of Directors.

Additional information about these policies can be found in Note 1 to the

Consolidated Financial Statements.

Valuations of Financial Instruments

Citigroup holds debt and equity securities, derivatives, retained interests

in securitizations, investments in private equity and other financial

instruments. In addition, Citi purchases securities under agreements to

resell (reverse repos) and sells securities under agreements to repurchase

(repos). Citigroup holds its investments, trading assets and liabilities, and

resale and repurchase agreements on the Consolidated Balance Sheet to meet

customer needs and to manage liquidity needs, interest rate risks and private

equity investing.

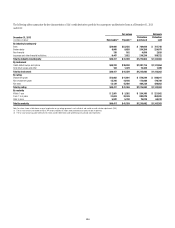

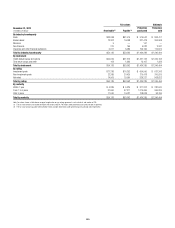

Substantially all of the assets and liabilities described in the preceding

paragraph are reflected at fair value on Citi’s Consolidated Balance Sheet.

In addition, certain loans, short-term borrowings, long-term debt and

deposits, as well as certain securities borrowed and loaned positions that are

collateralized with cash, are carried at fair value. Approximately 39.0% and

42.7% of total assets, and 11.6% and 16.0% of total liabilities, were accounted

for at fair value as of December 31, 2013 and 2012, respectively.

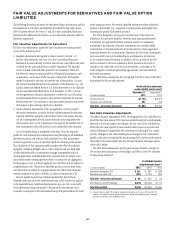

When available, Citi generally uses quoted market prices to determine

fair value and classifies such items within Level 1 of the fair value hierarchy

established under ASC 820-10, Fair Value Measurement (see Note 25 to

the Consolidated Financial Statements). If quoted market prices are not

available, fair value is based upon internally developed valuation models that

use, where possible, current market-based or independently sourced market

parameters, such as interest rates, currency rates and option volatilities.

Where a model is internally developed and used to price a significant

product, it is subject to validation and testing by Citi’s separate model

verification group. Such models are often based on a discounted cash flow

analysis. In addition, items valued using such internally generated valuation

techniques are classified according to the lowest level input or value driver

that is significant to the valuation. Thus, an item may be classified under the

fair value hierarchy as Level 3 even though there may be some significant

inputs that are readily observable.

The credit crisis caused some markets to become illiquid, thus reducing

the availability of certain observable data used by Citi’s valuation techniques.

This illiquidity, in at least certain markets, continued through 2013. When

or if liquidity returns to these markets, the valuations will revert to using

the related observable inputs in verifying internally calculated values. For

additional information on Citigroup’s fair value analysis, see Notes 25 and 26

to the Consolidated Financial Statements.

Recognition of Changes in Fair Value

Changes in the valuation of the trading assets and liabilities, as well as all

other assets (excluding available-for-sale securities (AFS) and derivatives

in qualifying cash flow hedging relationships) and liabilities carried at fair

value, are recorded in the Consolidated Statement of Income. Changes in

the valuation of AFS, other than write-offs and credit impairments, and the

effective portion of changes in the valuation of derivatives in qualifying

cash flow hedging relationships generally are recorded in Accumulated

other comprehensive income (loss) (AOCI), which is a component of

Stockholders’ equity on the Consolidated Balance Sheet. A full description of

Citi’s policies and procedures relating to recognition of changes in fair value

can be found in Notes 1, 25 and 26 to the Consolidated Financial Statements.

Evaluation of Other-than-Temporary Impairment

Citi conducts and documents periodic reviews of all securities with unrealized

losses to evaluate whether the impairment is other-than-temporary. Under

the guidance for debt securities, other-than-temporary impairment (OTTI)

is recognized in earnings in the Consolidated Statement of Income for debt

securities that Citi has an intent to sell or that Citi believes it is more likely

than not that it will be required to sell prior to recovery of the amortized cost

basis. For those securities that Citi does not intend to sell nor expect to be

required to sell, credit-related impairment is recognized in earnings, with the

non-credit-related impairment recorded in AOCI.

An unrealized loss exists when the current fair value of an individual

security is less than its amortized cost basis. Unrealized losses that are

determined to be temporary in nature are recorded, net of tax, in AOCI for

AFS securities, while such losses related to held-to-maturity (HTM) securities

are not recorded, as these investments are carried at their amortized cost (less

any OTTI). For securities transferred to HTM from Trading account assets,

amortized cost is defined as the fair value amount of the securities at the date

of transfer plus any accretion income and less any impairments recognized

in earnings subsequent to transfer. For securities transferred to HTM from

AFS, amortized cost is defined as the original purchase cost, plus or minus

any accretion or amortization of a purchase discount or premium, less any

impairment recognized in earnings.

Regardless of the classification of the securities as AFS or HTM, Citi

assesses each position with an unrealized loss for OTTI.

Management assesses equity method investments with fair value less

than carrying value for OTTI, as discussed in Note 14 to the Consolidated

Financial Statements. For investments that management does not plan to sell

prior to recovery of value, or Citi is not likely to be required to sell, various

factors are considered in assessing OTTI. For investments that Citi plans to

sell prior to recovery of value, or would likely be required to sell and there

is no expectation that the fair value will recover prior to the expected sale

date, the full impairment would be recognized in the Consolidated Statement

of Income.