Citibank 2013 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2013 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.131

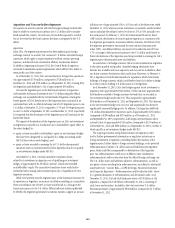

Venezuela

Since2003,theVenezuelangovernmenthasenactedforeignexchange

controls. Under these controls, the Venezuelan government’s Foreign

Currency Administration Commission (CADIVI) purchases and sells foreign

currency at an official foreign exchange rate fixed by the government (as of

December 31, 2013, the official exchange rate was fixed at 6.3 bolivars to one

U.S.dollar).The exchange controlshavelimitedCiti’sabilitytoobtainU.S.

dollars in Venezuela at the official foreign currency rate. Citi has not been

abletoacquireU.S.dollarsfromCADIVIsince2008.

In2013,theVenezuelangovernmentcreatedtheComplimentarySystem

ofForeignCurrencyAcquirement(SICAD),analternateforeignexchange

mechanism in Venezuela established to settle certain import transactions.

SincetheSICADcommencedoperations,ithasconducted15auctionsfor

approximately $1.7 billion. As of December 31, 2013, the rate published by

SICADforitsrecentauctionswas11.3bolivarsperU.S.dollar.

As of December 31, 2013, Citi used the official CADIVI exchange rate of

6.3bolivarsperU.S.dollartore-measureforeigncurrencytransactionsin

thefinancialstatementsofitsVenezuelanoperations(whichusetheU.S.

dollarasthefunctionalcurrency)intoU.S.dollars,astheofficialexchange

rate was the only rate legally available to Citi at December 31, 2013 in the

country,despitethelimitedavailabilityofU.S.dollarsfromCADIVIand

although the official rate may not necessarily be reflective of economic

reality. Re-measurement of Citi’s bolivar-denominated assets and liabilities

due to changes in the exchange rate is recorded in earnings.

At December 31, 2013, Citi’s net investment in its Venezuelan operations

was approximately $240 million (compared to $340 million at December 31,

2012and$230millionatSeptember30,2013),whichincludednetmonetary

assets denominated in Venezuelan bolivars of approximately $220 million

(compared to $290 million at December 31, 2012 and $220 million

atSeptember30,2013).Totalthird-partyassetsofCitiVenezuelawere

approximately $1.2 billion at December 31, 2013, composed primarily of

cash, loans and debt securities.

In January 2014, the Venezuelan government announced that the

exchange rate to be applied to foreign currency transactions related to

foreigninvestmentandvariousotheroperationswillbetheSICADrate

going forward. Accordingly, beginning in the first quarter of 2014, Citi

willbeginusingtheSICADratetoremeasureitsnetbolivar-denominated

monetaryassetsasthisistherateatwhichCitiwillbeabletoacquireU.S.

dollars.However,althoughtheSICADratewillbeapplicabletoU.S.dollar

purchases,CitidoesnotexpecttobeabletobuyU.S.dollarsinVenezuelain

theforeseeablefuture.BasedontheFebruary21,2014SICADauctionrateof

11.8bolivarsperU.S.dollar,Citiestimatesthatitwillincuranapproximate

$110 million foreign currency loss in the first quarter of 2014, which could

increaseifthebolivarcontinuestodevalueintheSICADmarket.Additionally,

beginning in the first quarter of 2014, Citi’s revenues and expenses will be

translatedattheSICADrate,andanyfurtherdevaluationsofthebolivarin

theSICADmarketwillresultinforeignexchangelossesinthefuture.

More recently, the Venezuelan government has also announced the

creationofanewforeignexchangemarket(SICADII).Oncethedetailsof

this new foreign exchange market have been announced, Citi will determine

whether further changes to the foreign exchange rate used to translate Citi’s

results in Venezuela are necessary. Any further changes could negatively

affect Citi’s financial results in the future.

Egypt

There has been ongoing political transition and sporadic civil unrest in

Egypt, contributing to significant economic uncertainty and volatility. Citi

operates in Egypt through a branch of Citibank N.A., and uses the Egyptian

pound as the functional currency to translate its financial statements into

U.S.dollarsusingquotedexchangerates.AsofDecember31,2013,Citi’s

net investment in Egypt was approximately $250 million, unchanged

fromSeptember30,2013,andCitihadcumulativetranslationlosses

related to its investment in Egypt, net of qualifying net investment hedges,

of approximately $123 million (pretax), compared to approximately

$116million(pretax)asofSeptember30,2013.Substantiallyallofthe

net investment is hedged with forward foreign-exchange derivatives. Total

third-party assets of the Egypt Citibank, N.A. branch were approximately

$1.6billion(largelyunchangedfromSeptember30,2013),composed

primarily of cash on deposit with the Central Bank of Egypt, loans and short-

term local government debt securities. A significant majority of these third-

party assets were funded with local deposit liabilities. Citi continues to closely

monitor the political and economic situation in Egypt, and will continue to

take actions to mitigate its exposures to potential risk events.

Ukraine

There have been political changes, civil unrest and military action in

Ukraine, contributing to significant economic uncertainty and volatility.

Citi operates in Ukraine through a subsidiary of Citibank, N.A., and uses

theU.S.dollarasthefunctionalcurrency.AsofDecember31,2013,Citi’s

netinvestmentinUkrainewasapproximately$130million.Substantially

all of the net investment is hedged with a Ukraine sovereign bond indexed

to foreign exchange rates which is subject to sovereign political risk. Total

third-party assets of the Ukraine Citibank subsidiary were approximately

$0.6 billion, as of December 31, 2013, composed primarily of cash on

deposit with the Central Bank of Ukraine, short-term local government debt

securities and corporate loans. A significant majority of these third-party

assets were funded with local deposit liabilities. Citi continues to closely

monitor the political, economic and military situation in Ukraine, and will

continue to take actions to mitigate its exposures to potential risk events.