Citibank 2013 Annual Report Download - page 235

Download and view the complete annual report

Please find page 235 of the 2013 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

217

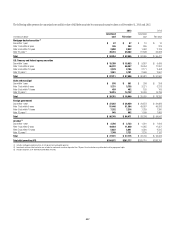

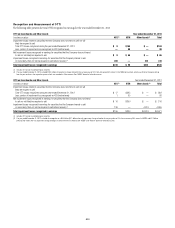

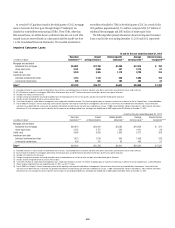

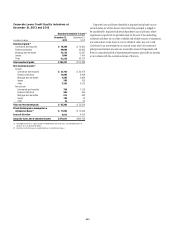

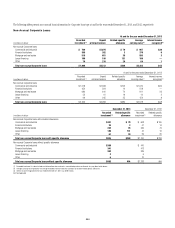

Consumer Credit Scores (FICO)

In the U.S., independent credit agencies rate an individual’s risk for

assuming debt based on the individual’s credit history and assign every

consumer a “FICO” credit score. These scores are continually updated by the

agencies based upon an individual’s credit actions (e.g., taking out a loan or

missed or late payments).

The following table provides details on the FICO scores attributable

to Citi’s U.S. Consumer loan portfolio as of December 31, 2013 and 2012

(commercial market loans are not included in the table since they are

business-based and FICO scores are not a primary driver in their credit

evaluation). FICO scores are updated monthly for substantially all of the

portfolio or, otherwise, on a quarterly basis.

FICO score distribution in U.S. portfolio (1)(2) December 31, 2013

In millions of dollars

Less than

620 ≥ 620 but less

than 660

Equal to or

greater

than 660

Residential first mortgages $11,860 $ 6,426 $ 46,207

Home equity loans 4,093 2,779 23,152

Credit cards 8,125 10,693 94,437

Installment and other 3,900 2,399 5,186

Total $27,978 $22,297 $168,982

(1) Excludes loans guaranteed by U.S. government entities, loans subject to long-term standby

commitments (LTSCs) with U.S. government-sponsored entities and loans recorded at fair value.

(2) Excludes balances where FICO was not available. Such amounts are not material.

FICO score distribution in U.S. portfolio (1)(2) December 31, 2012

In millions of dollars

Less than

620 ≥ 620 but less

than 660

Equal to or

greater

than 660

Residential first mortgages $16,754 $ 8,013 $ 50,833

Home equity loans 5,439 3,208 26,820

Credit cards 7,833 10,304 90,248

Installment and other 4,414 2,417 5,365

Total $34,440 $23,942 $173,266

(1) Excludes loans guaranteed by U.S. government entities, loans subject to LTSCs with U.S.

government-sponsored entities and loans recorded at fair value.

(2) Excludes balances where FICO was not available. Such amounts are not material.

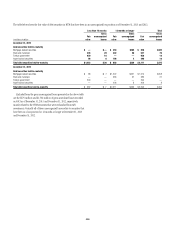

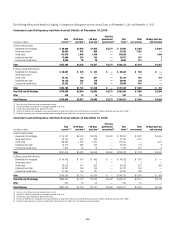

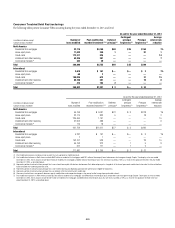

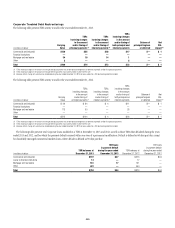

Loan to Value (LTV) Ratios

LTV ratios (loan balance divided by appraised value) are calculated at

origination and updated by applying market price data.

The following tables provide details on the LTV ratios attributable to Citi’s

U.S. Consumer mortgage portfolios as of December 31, 2013 and 2012.

LTV ratios are updated monthly using the most recent Core Logic HPI data

available for substantially all of the portfolio applied at the Metropolitan

Statistical Area level, if available, or the state level if not. The remainder

of the portfolio is updated in a similar manner using the Office of Federal

Housing Enterprise Oversight indices.

LTV distribution in U.S. portfolio (1)(2) December 31, 2013

In millions of dollars

Less than or

equal to 80%

> 80% but less

than or equal to

100%

Greater

than

100%

Residential first mortgages $45,809 $13,458 $ 5,269

Home equity loans 14,216 8,685 6,935

Total $60,025 $22,143 $12,204

(1) Excludes loans guaranteed by U.S. government entities, loans subject to LTSCs with U.S. government-

sponsored entities and loans recorded at fair value.

(2) Excludes balances where LTV was not available. Such amounts are not material.

LTV distribution in U.S. portfolio (1)(2) December 31, 2012

In millions of dollars

Less than or

equal to 80%

> 80% but less

than or equal to

100%

Greater

than

100%

Residential first mortgages $41,555 $19,070 $14,995

Home equity loans 12,611 9,529 13,153

Total $54,166 $28,599 $28,148

(1) Excludes loans guaranteed by U.S. government entities, loans subject to LTSCs with U.S. government-

sponsored entities and loans recorded at fair value.

(2) Excludes balances where LTV was not available. Such amounts are not material.

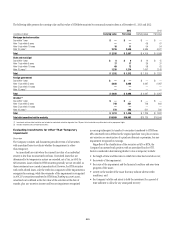

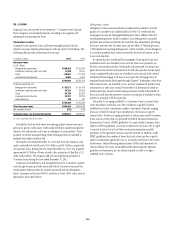

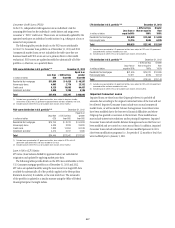

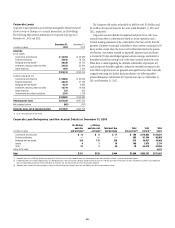

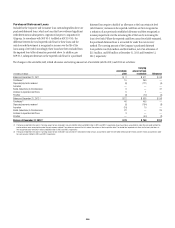

Impaired Consumer Loans

Impaired loans are those loans that Citigroup believes it is probable all

amounts due according to the original contractual terms of the loan will not

be collected. Impaired Consumer loans include non-accrual commercial

market loans, as well as smaller-balance homogeneous loans whose terms

have been modified due to the borrower’s financial difficulties and where

Citigroup has granted a concession to the borrower. These modifications

may include interest rate reductions and/or principal forgiveness. Impaired

Consumer loans exclude smaller-balance homogeneous loans that have not

been modified and are carried on a non-accrual basis. In addition, impaired

Consumer loans exclude substantially all loans modified pursuant to Citi’s

short-term modification programs (i.e., for periods of 12 months or less) that

were modified prior to January 1, 2011.