Citibank 2013 Annual Report Download - page 221

Download and view the complete annual report

Please find page 221 of the 2013 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327 -

328

328 -

329

329 -

330

330 -

331

331 -

332

332 -

333

333 -

334

334 -

335

335 -

336

336 -

337

337 -

338

338 -

339

339 -

340

340 -

341

341 -

342

342

|

|

203

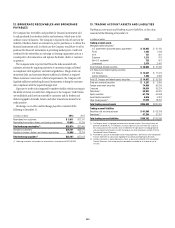

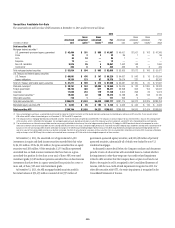

12. BROKERAGE RECEIVABLES AND BROKERAGE

PAYABLES

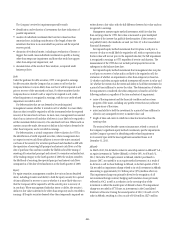

The Company has receivables and payables for financial instruments sold

to and purchased from brokers, dealers and customers, which arise in the

ordinary course of business. The Company is exposed to risk of loss from the

inability of brokers, dealers or customers to pay for purchases or to deliver the

financial instruments sold, in which case the Company would have to sell or

purchase the financial instruments at prevailing market prices. Credit risk

is reduced to the extent that an exchange or clearing organization acts as a

counterparty to the transaction and replaces the broker, dealer or customer

in question.

The Company seeks to protect itself from the risks associated with

customer activities by requiring customers to maintain margin collateral

in compliance with regulatory and internal guidelines. Margin levels are

monitored daily, and customers deposit additional collateral as required.

Where customers cannot meet collateral requirements, the Company will

liquidate sufficient underlying financial instruments to bring the customer

into compliance with the required margin level.

Exposure to credit risk is impacted by market volatility, which may impair

the ability of clients to satisfy their obligations to the Company. Credit limits

are established and closely monitored for customers and for brokers and

dealers engaged in forwards, futures and other transactions deemed to be

credit sensitive.

Brokerage receivables and Brokerage payables consisted of the

following at December 31:

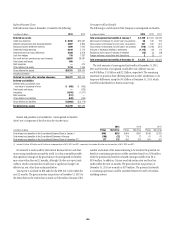

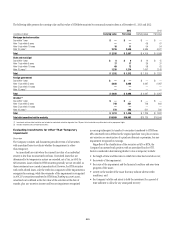

In millions of dollars 2013 2012

Receivables from customers $ 5,811 $12,191

Receivables from brokers, dealers, and clearing organizations 19,863 10,299

Total brokerage receivables (1) $25,674 $22,490

Payables to customers $34,751 $38,279

Payables to brokers, dealers, and clearing organizations 18,956 18,734

Total brokerage payables (1) $53,707 $57,013

(1) Brokerage receivables and payables are accounted for in accordance with ASC 940-320.

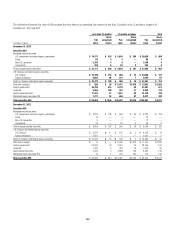

13. TRADING ACCOUNT ASSETS AND LIABILITIES

Trading account assets and Trading account liabilities, at fair value,

consisted of the following at December 31:

In millions of dollars 2013 2012

Trading account assets

Mortgage-backed securities (1)

U.S. government-sponsored agency guaranteed $ 23,955 $ 31,160

Prime 1,422 1,248

Alt-A 721 801

Subprime 1,211 812

Non-U.S. residential 723 607

Commercial 2,574 2,441

Total mortgage-backed securities $ 30,606 $ 37,069

U.S. Treasury and federal agency securities

U.S. Treasury $ 13,537 $ 17,472

Agency obligations 1,300 2,884

Total U.S. Treasury and federal agency securities $ 14,837 $ 20,356

State and municipal securities $ 3,207 $ 3,806

Foreign government securities 74,856 89,239

Corporate 30,534 35,224

Derivatives (2) 52,821 54,620

Equity securities 61,776 56,998

Asset-backed securities (1) 5,616 5,352

Other trading assets (3) 11,675 18,265

Total trading account assets $285,928 $320,929

Trading account liabilities

Securities sold, not yet purchased $ 61,508 $ 63,798

Derivatives (2) 47,254 51,751

Total trading account liabilities $108,762 $115,549

(1) The Company invests in mortgage-backed and asset-backed securities. These securitizations are

generally considered VIEs. The Company’s maximum exposure to loss from these VIEs is equal to

the carrying amount of the securities, which is reflected in the table above. For mortgage-backed

and asset-backed securitizations in which the Company has other involvement, see Note 22 to the

Consolidated Financial Statements.

(2) Presented net, pursuant to enforceable master netting agreements. See Note 23 to the Consolidated

Financial Statements for a discussion regarding the accounting and reporting for derivatives.

(3) Includes investments in unallocated precious metals, as discussed in Note 26 to the Consolidated

Financial Statements. Also includes physical commodities accounted for at the lower of cost or

fair value.