Citibank 2013 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2013 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

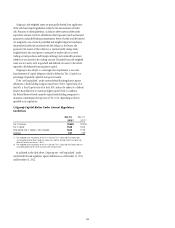

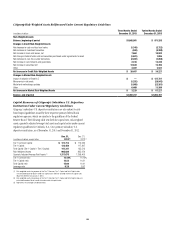

Components of Citigroup Capital Under Current Regulatory Guidelines

In millions of dollars

December 31,

2013

December 31,

2012

Tier 1 Common Capital

Citigroup common stockholders’ equity (1) $ 197,694 $186,487

Regulatory Capital Adjustments and Deductions:

Less: Net unrealized gains (losses) on securities AFS, net of tax (2)(3) (1,724) 597

Less: Accumulated net unrealized losses on cash flow hedges, net of tax (4) (1,245) (2,293)

Less: Defined benefit plans liability adjustment, net of tax (5) (3,989) (5,270)

Less: Cumulative effect included in fair value of financial liabilities attributable to the change in

own creditworthiness, net of tax (6) (224) 18

Less: Disallowed deferred tax assets (7) 39,384 41,800

Less: Intangible assets:

Goodwill, net of related deferred tax liability (DTL) 23,362 24,170

Other disallowed intangible assets, net of related DTL 3,625 3,868

Less: Net unrealized losses on AFS equity securities, net of tax (2) 66 —

Other (369) (502)

Total Tier 1 Common Capital $ 138,070 $123,095

Tier 1 Capital

Qualifying perpetual preferred stock (1) $ 6,645 $ 2,562

Qualifying trust preferred securities 3,858 9,983

Qualifying noncontrolling interests 871 892

Total Tier 1 Capital $ 149,444 $136,532

Tier 2 Capital

Allowance for credit losses (8) $ 13,756 $ 12,330

Qualifying subordinated debt (9) 18,758 18,689

Net unrealized pretax gains on AFS equity securities (2) —135

Total Tier 2 Capital $ 32,514 $ 31,154

Total Capital (Tier 1 Capital + Tier 2 Capital) $ 181,958 $167,686

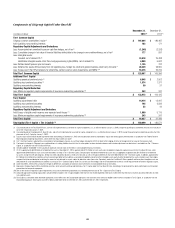

Citigroup Risk-Weighted Assets

In millions of dollars

December 31,

2013 (11)

December 31,

2012 (12)

Credit Risk-Weighted Assets (10) $ 963,949 $929,722

Market Risk-Weighted Assets 128,758 41,531

Total Risk-Weighted Assets $1,092,707 $971,253

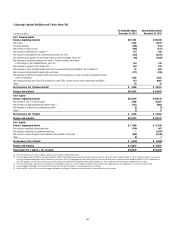

(1) Issuance costs of $93 million related to preferred stock outstanding at December 31, 2013 are excluded from common stockholders’ equity and netted against preferred stock in accordance with Federal Reserve

Board regulatory reporting requirements, which differ from those under U.S. GAAP.

(2) Tier 1 Capital excludes net unrealized gains (losses) on available-for-sale (AFS) debt securities and net unrealized gains on AFS equity securities with readily determinable fair values, in accordance with current

risk-based capital guidelines. Further, in arriving at Tier 1 Capital, banking organizations are required to deduct net unrealized losses on AFS equity securities with readily determinable fair values, net of tax. Banking

organizations are permitted to include in Tier 2 Capital up to 45% of net unrealized pretax gains on AFS equity securities with readily determinable fair values.

(3) In addition, includes the net amount of unamortized loss on held-to-maturity (HTM) securities. This amount relates to securities that were previously transferred from AFS to HTM, and non-credit-related factors such as

changes in interest rates and liquidity spreads for HTM securities with other-than-temporary impairment.

(4) Accumulated net unrealized gains (losses) on cash flow hedges recorded in Accumulated other comprehensive income (AOCI) as a result of the adoption and application of ASC 815, Derivatives and Hedging (formerly

FAS 133), are excluded from Tier 1 Capital, in accordance with current risk-based capital guidelines.

(5) The Federal Reserve Board granted interim capital relief, allowing banking organizations to exclude from regulatory capital any amounts recorded in AOCI resulting from the adoption and application of ASC 715-20,

Compensation—Retirement Benefits—Defined Benefits Plans (formerly SFAS 158).

(6) The impact of changes in Citi’s own creditworthiness in valuing liabilities for which the fair value option has been elected is excluded from Tier 1 Capital, in accordance with current risk-based capital guidelines.

(7) Of Citi’s approximately $52.8 billion of net deferred tax assets at December 31, 2013, approximately $10.9 billion of such assets were includable in regulatory capital pursuant to current risk-based capital guidelines,

while approximately $39.4 billion of such assets exceeded the limitation imposed by these guidelines and were deducted in arriving at Tier 1 Capital. Citi’s approximately $2.5 billion of other net deferred tax assets

primarily represented deferred tax assets related to the regulatory capital adjustments for defined benefit plans liability, unrealized gains (losses) on AFS securities and cash flow hedges, partially offset by deferred tax

liabilities related to the deductions for goodwill and certain other intangible assets, which are permitted to be excluded prior to deriving the amount of net deferred tax assets subject to limitation under the guidelines.

(8) Includable up to 1.25% of risk-weighted assets. Any excess allowance for credit losses is deducted in arriving at risk-weighted assets.

(9) Includes qualifying subordinated debt in an amount not exceeding 50% of Tier 1 Capital.

(10) Includes risk-weighted credit equivalent amounts, net of applicable bilateral netting agreements, of approximately $61 billion for interest rate, commodity, equity, foreign exchange and credit derivative contracts as

of December 31, 2013, compared with approximately $62 billion as of December 31, 2012. Credit risk-weighted assets also include those deriving from certain other off-balance-sheet exposures, such as financial

guarantees, unfunded lending commitments and letters of credit, and reflect deductions such as for certain intangible assets and any excess allowance for credit losses.

(11) Risk-weighted assets as computed under Basel I credit risk capital rules and final (revised) market risk capital rules (Basel II.5) effective on January 1, 2013.

(12) Risk-weighted assets as computed under Basel I credit risk and market risk capital rules. Total risk-weighted assets at December 31, 2012, including estimated market risk-weighted assets of approximately

$169.3 billion assuming application of the Basel II.5 rules, would have been approximately $1.11 trillion.