Citibank 2013 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2013 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

85

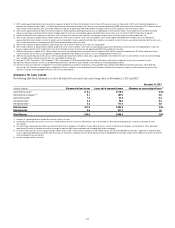

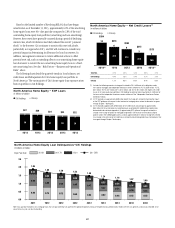

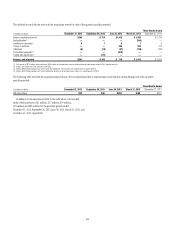

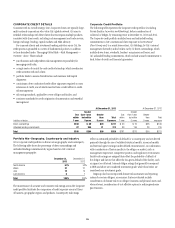

North America Residential First Mortgages—State Delinquency Trends

The following tables set forth, for total Citigroup, the six states and/or regions with the highest concentration of Citi’s residential first mortgages as of

December 31, 2013 and December 31, 2012.

In billions of dollars December 31, 2013 December 31, 2012

State (1) ENR (2)

ENR

Distribution

90+DPD

%

%

LTV >

100%

Refreshed

FICO ENR (2)

ENR

Distribution

90+DPD

%

%

LTV >

100%

Refreshed

FICO

CA $19.2 30% 1.0% 4% 738 $21.1 28% 2.1% 23% 730

NY/NJ/CT (3) 11.7 18 2.6 3 733 11.8 16 4.0 8 723

IN/OH/MI (3) 3.1 5 3.9 21 659 4.0 5 5.5 31 655

FL (3) 3.1 5 4.4 25 688 3.8 5 8.1 43 676

IL (3) 2.7 4 3.8 16 703 3.1 4 5.8 34 694

AZ/NV 1.5 2 2.7 25 710 1.9 3 4.8 50 702

Other 23.1 36 4.1 8 671 29.7 39 5.4 15 667

Total $64.4 100% 2.9% 8% 705 $75.4 100% 4.4% 20% 692

Note: Totals may not sum due to rounding.

(1) Certain of the states are included as part of a region based on Citi’s view of similar HPI within the region.

(2) Ending net receivables. Excludes loans in Canada and Puerto Rico, loans guaranteed by U.S. government agencies, loans recorded at fair value and loans subject to LTSCs. Excludes balances for which FICO or LTV data

are unavailable.

(3) New York, New Jersey, Connecticut, Indiana, Ohio, Florida and Illinois are judicial states.

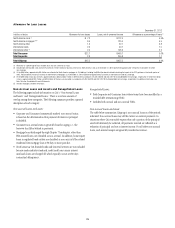

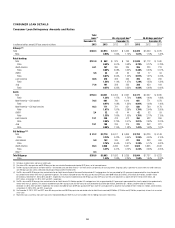

Citi’s residential first mortgages portfolio is primarily concentrated in

California and the New York/New Jersey/Connecticut region (with New York

the largest of the three states). The significant improvement in refreshed

LTV percentages at December 31, 2013 was primarily the result of HPI

improvements across substantially all metropolitan statistical areas, thereby

increasing values used in the determination of LTV, although the HPI

improvement varies from market to market. Additionally, delinquent and

re-performing asset sales of high LTV loans during 2013 further reduced the

amount of loans with greater than 100% LTV. To a lesser extent, modification

programs involving principal forgiveness further reduced the loans in this

category. While 90+ days past due delinquency rates have improved for the

states or regions above, the continued lengthening of the foreclosure process

(see discussion under “Foreclosures” below) could result in less improvement

in these rates in the future, especially in judicial states.

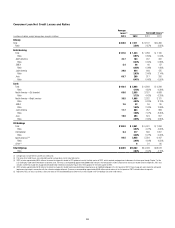

Foreclosures

The substantial majority of Citi’s foreclosure inventory consists of residential

first mortgages. At December 31, 2013, Citi’s foreclosure inventory included

approximately $0.8 billion, or 1.2%, of Citi’s residential first mortgages,

compared to approximately $1.2 billion, or 1.5%, at December 31, 2012

(based on the dollar amount of ending net receivables of loans in foreclosure

inventory, excluding loans that are guaranteed by U.S. government agencies

and loans subject to LTSCs).

While Citi’s foreclosure inventory declined year-over-year, due largely to

portfolio delinquency trends, asset sales and loan modifications, extensive

state requirements and other regulatory requirements for the foreclosure

process continue to impact foreclosure timelines. Citi’s average timeframes to

move a loan out of foreclosure are two to three times longer than historical

norms. Extended foreclosure timelines continue to be even more pronounced

in judicial states (i.e., states that require foreclosures to be processed via

court approval), where Citi has a higher concentration of residential first

mortgages in foreclosure. Active foreclosure units in process for over two years

as a percentage of Citi’s total foreclosure inventory was approximately 29%,

unchanged from December 31, 2012.

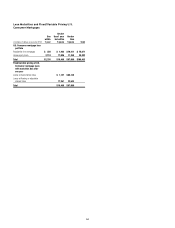

Citi’s servicing agreements for mortgage loans sold to the U.S. government

sponsored enterprises (GSEs) generally provide the GSEs with significant

mortgage servicing oversight, including, among other things, foreclosures

or modification completion timelines. The agreements allow for the GSEs

to take action against a servicer for violation of the timelines, including

imposing compensatory fees. While the GSEs have not historically exercised

their rights to impose compensatory fees, they have begun to regularly

impose such fees.

In connection with Citi’s sale of mortgage servicing rights (MSRs)

announced in January 2014, Citi and Fannie Mae substantially resolved

pending and future compensatory fee claims related to Citi’s servicing of the

loans sold in the transaction (for additional information, see “Mortgage

Servicing Rights” below). To date, the GSEs’ imposition of compensatory

fees, as a result of the extended foreclosure timelines or in connection with

the announced sale of MSRs or otherwise, has not been material.