Citibank 2013 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2013 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.28

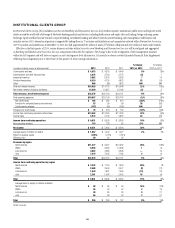

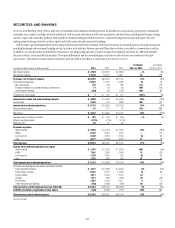

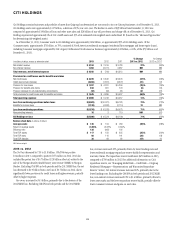

2013 vs. 2012

Net income increased 45%. Excluding negative $345 million of CVA/DVA

(see table below), net income increased 12%, primarily driven by higher

revenues and lower expenses, partially offset by a higher effective tax rate

(see Note 9 to the Consolidated Financial Statements).

Revenues increased 15%. Excluding CVA/DVA:

• Revenues increased 4%, reflecting higher revenues in equity markets,

investment banking and the Private Bank, partially offset by lower

revenues in fixed income markets. Overall, Citi’s wallet share continued

to improve in most major products, while maintaining what Citi believes

to be a disciplined risk appetite for the changing market environment

during 2013.

• Fixed income markets revenues decreased 7%, primarily reflecting

industry-wide weakness in rates and currencies, partially offset by strong

performance in credit-related and securitized products and commodities.

Rates and currencies performance was lower compared to a strong 2012

that benefited from increased client revenues and a more liquid market

environment, particularly in EMEA. 2013 results also reflected a general

slowdown in client activity exacerbated by uncertainty, particularly in the

latter part of 2013, around the tapering of quantitative easing as well as

geopolitical issues. Credit-related and securitized products results reflected

increased client activity driven by improved market conditions and

demand for spread products. In addition, while not generally material to

overall fixed income markets revenues, lower revenues from Citi Capital

Advisors (CCA) during 2013 also contributed to the decline in fixed

income markets revenue year-over-year, as Citi continued to wind down

this business.

• Equity markets revenues increased 22%, primarily due to market

share gains, continued improvement in cash and derivative trading

performance and a more favorable market environment.

• Investment banking revenues increased 8%, reflecting gains in overall

investment banking wallet share. Advisory revenues increased 19%,

reflecting an improvement in wallet share, despite a contraction in the

overall M&A market wallet. Equity underwriting revenues increased

51%, driven by improved wallet share and increased market activity,

particularly initial public offerings. Debt underwriting revenues decreased

6%, primarily due to lower bond underwriting fees and a decline in wallet

share during the year.

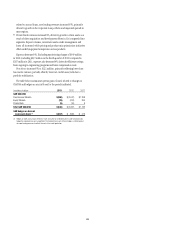

• Lending revenues increased 40%, driven by lower mark-to-market losses

on hedges related to accrual loans (see table below) due to less significant

credit spread tightening versus 2012. Excluding the mark-to-market losses

on hedges related to accrual loans, core lending revenues decreased 4%,

primarily due to increased hedge premium costs and moderately lower

loan balances, partially offset by higher spreads. Citi expects demand for

Corporate loans to remain muted in the current market environment.

• Private Bank revenues increased 4%, with growth across all regions and

products, particularly in managed investments, where growth reflected

both higher client assets under management and increased placement

fees, as well as in capital markets. Revenue growth in lending and

deposits, primarily driven by growth in client volumes, was partially offset

by continued spread compression.

Expenses decreased 4%, primarily reflecting repositioning savings, the

impact of lower performance-based compensation, lower repositioning

charges and the impact of FX translation, partially offset by higher legal and

related costs and volume-related expenses.

Provisions decreased $115 million, primarily reflecting higher loan loss

reserve releases, partially offset by an increase in the provision for unfunded

lending commitments in the Corporate loan portfolio.

2012 vs. 2011

Net income decreased 10%. Excluding negative $2.5 billion CVA/DVA

(see table below), net income increased 56%, primarily driven by an increase

in revenues and decrease in expenses.

Revenues decreased 8%. Excluding CVA/DVA:

• Revenues increased 13%, reflecting higher revenues in most major

S&B businesses. Overall, Citi gained wallet share during 2012 in most

major products and regions, while maintaining what it believed to be a

disciplined risk appetite for the market environment.

• Fixed income markets revenues increased 28%, reflecting strong

performance in rates and currencies and higher revenues in credit-related

and securitized products. These results reflected an improved market

environment and more balanced trading flows, particularly in the

second half of 2012. Rates and currencies performance reflected strong

client and trading results in G-10 FX, G-10 rates and Citi’s local markets

franchise. Credit products, securitized markets and municipals products

experienced improved trading results, particularly in the second half of

2012, compared to the prior-year period. Citi’s position serving corporate

clients for markets products also contributed to the strength and diversity

of client flows.

• Equity markets revenues increased 1%, due to improved derivatives

performance as well as the absence of proprietary trading losses in

2011, partially offset by lower cash equity volumes that impacted the

industry as a whole. Citi’s improved performance in derivatives reflected

improved trading and continued progress in capturing additional client

wallet share.

• Investment banking revenues increased 10%, reflecting increases in

debt underwriting and advisory revenues, partially offset by lower equity

underwriting revenues. Debt underwriting revenues rose 18%, driven by

increases in investment grade and high yield bond issuances. Advisory

revenues increased 4%, despite the overall reduction in market activity

during the year. Equity underwriting revenues declined 7%, driven by

lower levels of market and client activity.

• Lending revenues decreased 48%, driven by the mark-to-market losses

on hedges related to accrual loans (see table below). The loss on lending

hedges, compared to a gain in the prior year, resulted from credit spreads

narrowing during 2012. Excluding the mark-to-market losses on hedges