Citibank 2013 Annual Report Download - page 282

Download and view the complete annual report

Please find page 282 of the 2013 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

264

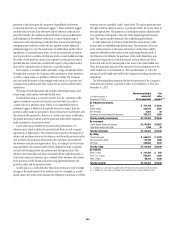

The amounts recognized in Principal transactions in the Consolidated

Statement of Income for the years ended December 31, 2013, 2012 and 2011

related to derivatives not designated in a qualifying hedging relationship as

well as the underlying non-derivative instruments are presented in Note 6

to the Consolidated Financial Statements. Citigroup presents this disclosure

by business classification, showing derivative gains and losses related to its

trading activities together with gains and losses related to non-derivative

instruments within the same trading portfolios, as this represents the way

these portfolios are risk managed.

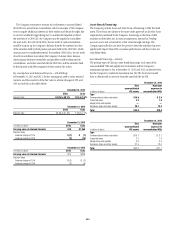

The amounts recognized in Other revenue in the Consolidated Statement

of Income for the years ended December 31, 2013, 2012 and 2011 related to

derivatives not designated in a qualifying hedging relationship are shown

below. The table below does not include the offsetting gains/losses on the

hedged items, which amounts are also recorded in Other revenue.

Gains (losses) included in Other revenue

Year ended December 31,

In millions of dollars 2013 2012 2011

Interest rate contracts $(376) $ (427) $1,192

Foreign exchange 221 182 224

Credit derivatives (595) (1,022) 115

Total Citigroup $(750) $(1,267) $1,531

Accounting for Derivative Hedging

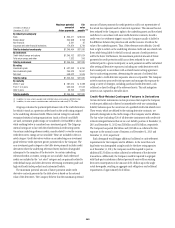

Citigroup accounts for its hedging activities in accordance with ASC 815,

Derivatives and Hedging (formerly SFAS 133). As a general rule, hedge

accounting is permitted where the Company is exposed to a particular risk,

such as interest-rate or foreign-exchange risk, that causes changes in the

fair value of an asset or liability or variability in the expected future cash

flows of an existing asset, liability or a forecasted transaction that may

affect earnings.

Derivative contracts hedging the risks associated with the changes in fair

value are referred to as fair value hedges, while contracts hedging the risks

affecting the expected future cash flows are called cash flow hedges. Hedges

that utilize derivatives or debt instruments to manage the foreign exchange

risk associated with equity investments in non-U.S.-dollar-functional-

currency foreign subsidiaries (net investment in a foreign operation) are

called net investment hedges.

If certain hedging criteria specified in ASC 815 are met, including testing

for hedge effectiveness, special hedge accounting may be applied. The hedge

effectiveness assessment methodologies for similar hedges are performed

in a similar manner and are used consistently throughout the hedging

relationships. For fair value hedges, the changes in value of the hedging

derivative, as well as the changes in value of the related hedged item due to

the risk being hedged, are reflected in current earnings. For cash flow hedges

and net investment hedges, the changes in value of the hedging derivative are

reflected in Accumulated other comprehensive income (loss) in Citigroup’s

stockholders’ equity, to the extent the hedge is effective. Hedge ineffectiveness,

in either case, is reflected in current earnings.

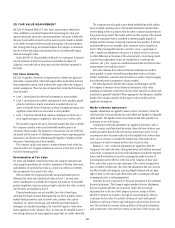

For asset/liability management hedging, the fixed-rate long-term debt

would be recorded at amortized cost under current GAAP. However, by electing

to use ASC 815 (SFAS 133) fair value hedge accounting, the carrying value

of the debt is adjusted for changes in the benchmark interest rate, with any

such changes in value recorded in current earnings. The related interest-rate

swap also is recorded on the balance sheet at fair value, with any changes

in fair value reflected in earnings. Thus, any ineffectiveness resulting from

the hedging relationship is recorded in current earnings. Alternatively, a

management hedge, which does not meet the ASC 815 hedging criteria,

would involve recording only the derivative at fair value on the balance sheet,

with its associated changes in fair value recorded in earnings. The debt would

continue to be carried at amortized cost and, therefore, current earnings

would be impacted only by the interest rate shifts and other factors that cause

the change in the swap’s value and may change the underlying yield of the

debt. This type of hedge is undertaken when hedging requirements cannot

be achieved or management decides not to apply ASC 815 hedge accounting.

Another alternative for the Company is to elect to carry the debt at fair

value under the fair value option. Once the irrevocable election is made

upon issuance of the debt, the full change in fair value of the debt would

be reported in earnings. The related interest rate swap, with changes in fair

value, would also be reflected in earnings, and provides a natural offset to the

debt’s fair value change. To the extent the two offsets are not exactly equal,

the difference is reflected in current earnings.