Citibank 2013 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2013 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.67

attacks on client systems, which attempted to allow unauthorized entrance

to Citi’s systems under the guise of a client and the extraction of client data.

For example, in 2013 Citi and other U.S. financial institutions experienced

distributed denial of service attacks which were intended to disrupt consumer

online banking services. In addition, various retail stores were the subject

of data breaches which led to access to customer account data. While Citi’s

monitoring and protection services were able to detect and respond to the

incidents targeting its systems before they became significant, they still

resulted in certain limited losses in some instances as well as increases in

expenditures to monitor against the threat of similar future cyber incidents.

There can be no assurance that such cyber incidents will not occur again,

and they could occur more frequently and on a more significant scale.

In addition, because the methods used to cause cyber attacks change

frequently or, in some cases, are not recognized until launched, Citi may be

unable to implement effective preventive measures or proactively address

these methods.

Third parties with which Citi does business may also be sources of

cybersecurity or other technological risks. Citi outsources certain functions,

such as processing customer credit card transactions, uploading content

on customer-facing websites, and developing software for new products and

services. These relationships allow for the storage and processing of customer

information, by third-party hosting of or access to Citi websites, which could

result in service disruptions or website defacements, and the potential to

introduce vulnerable code, resulting in security breaches impacting Citi

customers. While Citi engages in certain actions to reduce the exposure

resulting from outsourcing, such as performing onsite security control

assessments, limiting third-party access to the least privileged level necessary

to perform job functions, and restricting third-party processing to systems

stored within Citi’s data centers, ongoing threats may result in unauthorized

access, loss or destruction of data or other cyber incidents with increased

costs and consequences to Citi such as those discussed above. Furthermore,

because financial institutions are becoming increasingly interconnected

with central agents, exchanges and clearing houses, including through the

derivatives provisions of the Dodd-Frank Act, Citi has increased exposure to

operational failure or cyber attacks through third parties.

While Citi maintains insurance coverage that may, subject to policy terms

and conditions including significant self-insured deductibles, cover certain

aspects of cyber risks, such insurance coverage may be insufficient to cover

all losses.

Citi’s Performance and the Performance of Its Individual

Businesses Could Be Negatively Impacted If Citi Is Not Able

to Hire and Retain Qualified Employees for Any Reason.

Citi’s performance and the performance of its individual businesses is

largely dependent on the talents and efforts of highly skilled employees.

Specifically, Citi’s continued ability to compete in its businesses, to manage

its businesses effectively and to continue to execute its overall global strategy

depends on its ability to attract new employees and to retain and motivate its

existing employees. Citi’s ability to attract and retain employees depends on

numerous factors, including without limitation, its culture, compensation,

the management and leadership of the company as well as its individual

businesses, Citi’s presence in the particular market or region at issue and

the professional opportunities it offers. The banking industry has and may

continue to experience more stringent regulation of employee compensation,

including limitations relating to incentive-based compensation, clawback

requirements and special taxation. Moreover, given its continued focus

on the emerging markets, Citi is often competing for qualified employees

in these markets with entities that have a significantly greater presence in

the region or are not subject to significant regulatory restrictions on the

structure of incentive compensation. If Citi is unable to continue to attract

and retain qualified employees for any reason, Citi’s performance, including

its competitive position, the successful execution of its overall strategy and its

results of operations could be negatively impacted.

Incorrect Assumptions or Estimates in Citi’s Financial

Statements Could Cause Significant Unexpected Losses

in the Future, and Changes to Financial Accounting and

Reporting Standards Could Have a Material Impact on

How Citi Records and Reports Its Financial Condition and

Results of Operations.

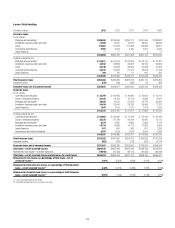

Citi is required to use certain assumptions and estimates in preparing its

financial statements under U.S. GAAP, including determining credit loss

reserves, reserves related to litigation and regulatory exposures, DTAs and

the fair values of certain assets and liabilities, among other items. If Citi’s

assumptions or estimates underlying its financial statements are incorrect,

Citi could experience unexpected losses, some of which could be significant.

Moreover, the Financial Accounting Standards Board (FASB) is currently

reviewing or proposing changes to several financial accounting and reporting

standards that govern key aspects of Citi’s financial statements, including

those areas where Citi is required to make assumptions or estimates. For

example, the FASB’s financial instruments project could, among other things,

significantly change how Citi determines the accounting classification for

financial instruments and could result in certain loans that are currently

reported at amortized cost being accounted for at fair value through Other

comprehensive income. The FASB has also proposed a new accounting

model intended to require earlier recognition of credit losses on financial

instruments. The proposed accounting model would require that life-time

“expected credit losses” on financial assets not recorded at fair value through

net income be recorded at inception of the financial asset, replacing the

multiple existing impairment models under U.S. GAAP which generally

require that a loss be “incurred” before it is recognized. In addition, the

FASB has proposed changes in the accounting for insurance contracts, which