Citibank 2013 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2013 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.31

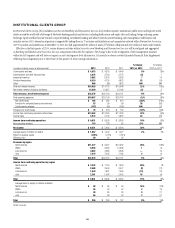

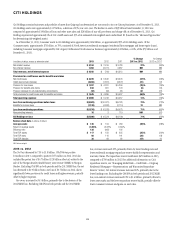

The discussion of the results of operations for Transaction Services below excludes the impact of FX translation for all periods presented. Presentation

of the results of operations, excluding the impact of FX translation, are non-GAAP financial measures. Citi believes the presentation of Transaction

Services’ results excluding the impact of FX translation is a more meaningful depiction of the underlying fundamentals of the business. For a

reconciliation of certain of these metrics to the reported results, see the table above.

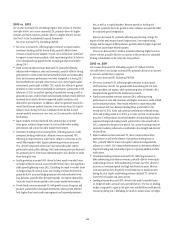

2013 vs. 2012

Net income decreased 12%, primarily due to higher expenses and a higher

effective tax rate (see Note 9 to the Consolidated Financial Statements),

partially offset by lower credit costs.

Revenues were unchanged as growth from higher deposit balances, trade

loans and fees from higher market volumes was offset by continued spread

compression. Treasury and Trade Solutions revenues decreased 1%, as the

ongoing impact of spread compression globally was partially offset by higher

balances and fee growth. Treasury and Trade Solutions average deposits

increased 7% and average trade loans increased 22%, including the impact

of the consolidation of approximately $7 billion of trade loans during the

second quarter of 2013. Securities and Fund Services revenues increased 4%,

as settlement volumes increased 15% and assets under custody increased

10%, partially offset by spread compression related to deposits. Despite the

overall underlying volume growth, Citi expects spread compression will

continue to negatively impact Transaction Services net interest revenues in

the near term.

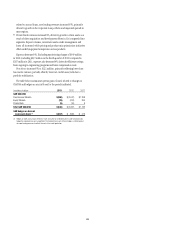

Expenses increased $311 million. The increase was due to an estimated

$360 million charge in the fourth quarter of 2013 related to a fraud

discovered in Banamex in February 2014. Specifically, as more fully described

in Citi’s Form 8-K filed with the Securities and Exchange Commission on

February 28, 2014, as of December 31, 2013, Citi, through Banamex, had

extended approximately $585 million of short-term credit to Oceanografia

S.A. de C.V. (OSA), a Mexican oil services company, through an accounts

receivable financing program. OSA had been a key supplier to Petróleos

Mexicanos (Pemex), the Mexican state-owned oil company, although,

in February 2014, OSA was suspended from being awarded new Mexican

government contracts. Pursuant to the program, Banamex extended credit

to OSA to finance accounts receivables due from Pemex. In February 2014,

Citi discovered that credit had been extended to OSA based on fraudulent

accounts receivable documentation. The estimated $360 million charge

in the fourth quarter of 2013 resulted from the difference between the

$585 million Citi had recorded as owed by Pemex to Citi as of December 31,

2013, and an estimated $185 million that Citi currently believes is owed by

Pemex, with an offset to compensation expense of approximately $40 million

associated with the Banamex variable compensation plan. Excluding the

charge related to the fraud in the fourth quarter of 2013, expenses were

unchanged as volume-related growth and increased financial transaction

taxes in EMEA, which are expected to continue in future periods, were

offset by efficiency savings, lower repositioning charges and lower legal and

related costs.

Provisions decreased by 54% due to lower credit costs. As discussed above,

Citi currently believes it is owed approximately $185 million by Pemex

pursuant to the Banamex accounts receivable financing program with

OSA. In addition, as of December 31, 2013, Citi, through Banamex, had

approximately $33 million in either direct obligations of OSA or standby

letters of credit issued on OSA’s behalf. Citi continues to review the events

arising from or relating to the fraud and their potential impacts. Based on

its continued review, Citi will determine whether all or any portion of the

$33 million of direct loans made to OSA and the remaining approximately

$185 million of accounts receivable due from Pemex may be impaired.

Any such impairment would negatively impact provisions in Transaction

Services in future periods.

Average deposits and other customer liabilities increased 8%, primarily as

a result of client activity in Latin America, EMEA and North America (for

additional information on Citi’s deposits, see “Managing Global Risk—

Market Risk—Funding and Liquidity” below).

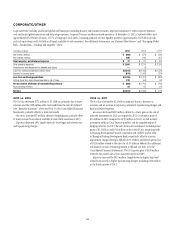

2012 vs. 2011

Net income increased 9%, reflecting growth in revenues, partially offset by

higher expenses and credit costs.

Revenues increased 5% as higher trade loan and deposit balances were

partially offset by continued spread compression and lower market volumes.

Treasury and Trade Solutions revenues were up 8%, driven by growth in

trade as end-of-period trade loans grew 24%. Cash management revenues

also grew, reflecting growth in deposit balances and fees, partially offset

by continued spread compression due to the continued low interest rate

environment. Securities and Fund Services revenues decreased 2%, primarily

driven by lower market volumes as well as spread compression on deposits.

Expenses increased 2%. Excluding repositioning charges of $134 million

in 2012 (including $95 million in the fourth quarter of 2012) compared

to $60 million in 2011, expenses were unchanged, primarily driven by

incremental investment spending and higher legal and related costs, offset by

efficiency savings.

Average deposits and other customer liabilities grew 14%, driven by

focused deposit building activities as well as continued market demand for

U.S. dollar deposits.