Citibank 2013 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2013 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.107

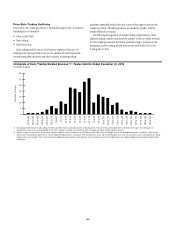

Price Risk

Price risk losses arise from fluctuations in the market value of trading

and non-trading positions resulting from changes in interest rates, credit

spreads, foreign exchange rates, equity and commodity prices, and in their

implied volatilities.

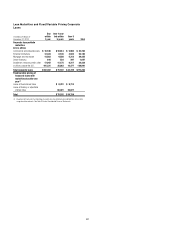

Price Risk Measurement and Stress Testing

Price risks are measured in accordance with established standards to

ensure consistency across businesses and the ability to aggregate risk.

The measurement used for non-trading and trading portfolios, as well as

associated stress testing processes, are described below.

Price Risk—Non-Trading Portfolios

Net Interest Revenue and Interest Rate Risk

Net interest revenue (NIR), for interest rate exposure purposes, is the

difference between the yield earned on the non-trading portfolio assets

(including customer loans) and the rate paid on the liabilities (including

customer deposits or company borrowings). NIR is affected by changes in the

level of interest rates, as well as the amounts of assets and liabilities, and the

timing of repricing of assets and liabilities to reflect market rates.

Interest Rate Risk Measurement

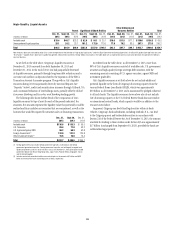

Citi’s principal measure of risk to NIR is interest rate exposure (IRE). IRE

measures the change in expected NIR in each currency resulting solely from

unanticipated changes in forward interest rates. Factors such as changes

in volumes, credit spreads, margins and the impact of prior-period pricing

decisions are not captured by IRE. IRE also assumes that businesses make no

additional changes in pricing or balances in response to the unanticipated

rate changes.

For example, if the current 90-day LIBOR rate is 3% and the one-

year-forward rate (i.e., the estimated 90-day LIBOR rate in one year) is

5%, the +100 bps IRE scenario measures the impact on NIR of a 100 bps

instantaneous change in the 90-day LIBOR to 6% in one year.

The impact of changing prepayment rates on loan portfolios is

incorporated into the results. For example, in the declining interest rate

scenarios, it is assumed that mortgage portfolios prepay faster and that

income is reduced. In addition, in a rising interest rate scenario, portions of

the deposit portfolio are assumed to experience rate increases that may be less

than the change in market interest rates.

Mitigation and Hedging of Interest Rate Risk

In order to manage changes in interest rates effectively, Citi may modify

pricing on new customer loans and deposits, enter into transactions with

other institutions or enter into derivative transactions that have the opposite

risk exposures. Citi regularly assesses the viability of these and other strategies

to reduce its interest rate risks and implements such strategies when it

believes those actions are prudent. Such strategies are not included in the

estimation of IRE.

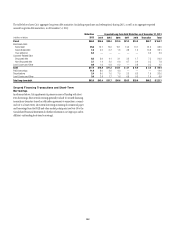

Stress Testing

Citigroup employs additional measurements, including stress testing the

impact of non-linear interest rate movements on the value of the balance

sheet; the analysis of portfolio duration and volatility, particularly as they

relate to mortgage loans and mortgage-backed securities; and the potential

impact of the change in the spread between different market indices.

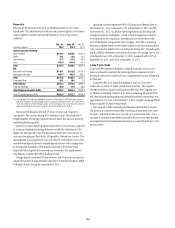

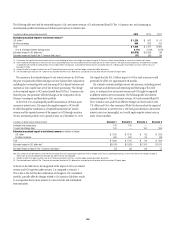

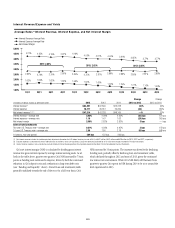

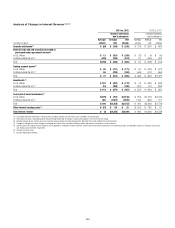

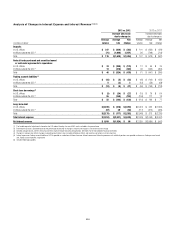

Changes in Interest Rates—Impacts on Net Interest Revenue, Other

Comprehensive Income and Capital

Citi measures the potential impacts of changes in interest rates on Citi’s net

interest revenue and value of its other comprehensive income (OCI), which

can in turn impact Citi’s estimated Basel III Tier 1 Common ratio. Citi’s

goal is to benefit from an increase in the market level of interest rates, while

limiting the impact of changes in OCI on its regulatory capital position.

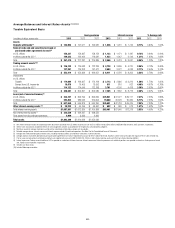

Citi manages interest rate risk as a consolidated net position. Citi’s client-

facing businesses create interest rate sensitive-positions, including loans and

deposits, as part of their ongoing activities. Citi Treasury accumulates these

risk positions and manages them centrally. Operating within established

limits, Citi Treasury makes positioning decisions and uses tools, such as Citi’s

investment securities portfolio, firm-issued debt, and interest rate derivatives,

to target the desired risk profile. Changes in Citi’s interest rate risk position

reflect the accumulated changes in all non-trading assets and liabilities,

with potentially large and offsetting impacts, as well as Citi Treasury’s

positioning decisions.

OCI at risk is managed as part of the firm-wide interest rate risk position.

OCI at risk considers potential changes in OCI (and the corresponding

impact on the estimated Basel III Tier 1 Common ratio) relative to Citi’s

capital generation capacity.