Citibank 2013 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2013 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.51

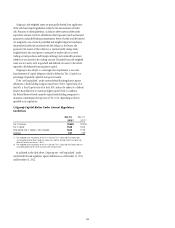

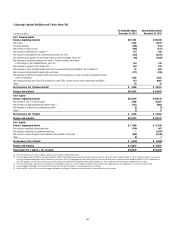

Supplementary Leverage Ratio

Citigroup’s estimated Basel III Supplementary Leverage ratio was 5.4% for

the fourth quarter of 2013, compared to an estimated 5.1% for the third

quarter. The quarter-over-quarter ratio improvement was primarily due to an

increase in Tier 1 Capital arising largely from quarterly net income, as well

as a decrease in Total Leverage Exposure substantially resulting from lower

on-balance-sheet assets.

The Supplementary Leverage ratio represents the average for the quarter

of the three monthly ratios of Tier 1 Capital to Total Leverage Exposure (i.e.,

the sum of the ratios calculated for October, November and December, divided

by three). Total Leverage Exposure is the sum of: (i) the carrying value of

all on-balance-sheet assets less applicable Tier 1 Capital deductions; (ii) the

potential future exposure on derivative contracts; (iii) 10% of the notional

amount of unconditionally cancellable commitments; and (iv) the full

notional amount of certain other off-balance sheet exposures (e.g., other

commitments and contingencies).

Citi’s estimated Basel III Tier 1 Common ratio and estimated Basel III

Supplementary Leverage ratio and certain related components are non-GAAP

financial measures. Citigroup believes these ratios and their components

provide useful information to investors and others by measuring Citigroup’s

progress against future regulatory capital standards.

Regulatory Capital Standards Developments

Basel II.5

In June 2012, the U.S. banking agencies released final (revised) market

risk capital rules (Basel II.5), which became effective on January 1, 2013.

Subsequently, in December 2013, the Federal Reserve Board amended Basel

II.5 by conforming such rules to certain elements of the Final Basel III Rules,

as well as incorporating additional clarifications. These Basel II.5 revisions

have not had a material impact on the measurement of Citi’s market risk-

weighted assets.

Separately, in October 2013, the Basel Committee on Banking Supervision

(Basel Committee) issued a new proposal with respect to its ongoing review

of regulatory capital standards applicable to the trading book of banking

organizations. The proposal, which is more definitive than the initial version

published in May 2012, would significantly revise the current market risk

capital framework, as well as address previously known shortcomings in

the Basel II.5 rules. Among the more significant of the proposed revisions

are those related to (i) strengthening and clarifying the boundary between

trading book and banking book positions; (ii) incorporating certain

modifications to the standardized approach to the calculation of risk-

weighted assets; (iii) redesigning internal regulatory capital models; and

(iv) expanding the scope and granularity of public disclosures. The Basel

Committee has also initiated, in parallel, a quantitative impact study in

an effort to assess the implications arising from the proposal. Timing as to

finalization of the Basel Committee proposal, and the potential future impact

on U.S. banking organizations, such as Citi, are uncertain.

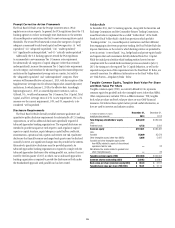

Basel III

Overview

In July 2013, the U.S. banking agencies released the Final Basel III

Rules, which comprehensively revise the regulatory capital framework

for substantially all U.S. banking organizations and incorporate relevant

provisions of the Dodd-Frank Act.

The Final Basel III Rules raise the quantity and quality of regulatory

capital by formally introducing not only Tier 1 Common Capital and

mandating it be the predominant form of regulatory capital, but also by

narrowing the definition of qualifying capital elements at all three regulatory

capital tiers (i.e., Tier 1 Common Capital, Additional Tier 1 Capital, and

Tier 2 Capital) as well as imposing broader and more constraining regulatory

capital adjustments and deductions. Moreover, these rules establish both a

fixed and a discretionary capital buffer, which would be available to absorb

losses in advance of any potential impairment of regulatory capital below the

stated minimum risk-based capital ratio requirements.

For so-called “Advanced Approaches” banking organizations (generally

those with consolidated total assets of at least $250 billion or consolidated

total on-balance-sheet foreign exposures of at least $10 billion), which

includes Citi and Citibank, N.A., the Final Basel III Rules are required to be

adopted effective January 1, 2014, with the exception of the “Standardized

Approach” for deriving risk-weighted assets, which becomes effective

January 1, 2015. However, in order to minimize the effect of adopting

these new requirements on U.S. banking organizations and consequently

potentially also global economies, the Final Basel III Rules contain several

differing, largely multi-year transition provisions (i.e., “phase-ins” and

“phase-outs”) with respect to the stated minimum Tier 1 Common and

Tier 1 Capital ratio requirements, substantially all regulatory adjustments

and deductions, non-qualifying Tier 1 and Tier 2 Capital instruments

(such as trust preferred securities), and the capital buffers. All of these

transition provisions, with the exception of the phase-out of non-qualifying

trust preferred securities from Tier 2 Capital, will be fully implemented by

January 1, 2019 (i.e., hereinafter “fully phased-in”).