Citibank 2013 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2013 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

116

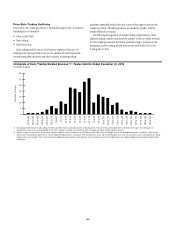

Value at Risk

Value at risk (VAR) estimates, at a 99% confidence level, the potential decline

in the value of a position or a portfolio under normal market conditions

assuming a one-day holding period. VAR statistics, which are based on

historical data, can be materially different across firms due to differences in

portfolio composition, differences in VAR methodologies, and differences in

model parameters. As a result, Citi believes VAR statistics can be used more

effectively as indicators of trends in risk taking within a firm, rather than as a

basis for inferring differences in risk-taking across firms.

Citi uses a single, independently approved Monte Carlo simulation VAR

model (see “VAR Model Review and Validation” below), which has been

designed to capture material risk sensitivities (such as first- and second-order

sensitivities of positions to changes in market prices) of various asset classes/

risk types (such as interest rate, foreign exchange, equity and commodity

risks). Citi’s VAR includes all positions, which are measured at fair value;

it does not include investment securities classified as available-for-sale or

held-to-maturity. For information on these securities, see Note 14 to the

ConsolidatedFinancialStatements.

Citi believes its VAR model is conservatively calibrated to incorporate the

greater of short-term (most recent month) and long-term (three years)

market volatility. The Monte Carlo simulation involves approximately

300,000 market factors, making use of approximately 200,000 time series,

with sensitivities updated daily and model parameters updated weekly.

The conservative features of the VAR calibration contribute approximately

a 16% add-on to what would be a VAR estimated under the assumption of

stable and perfectly normally distributed markets.

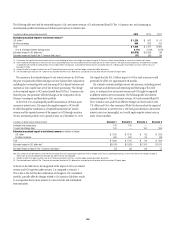

As set forth in the table below, Citi’s total Trading and Credit Portfolios VAR

was $144 million at December 31, 2013 and $118 million at December 31,

2012. Daily total Trading and Credit Portfolios VAR averaged $121 million

in 2013 and ranged from $93 million to $175 million. The change in

total Trading and Credit Portfolios VAR was primarily driven by a loss of

diversificationbenefitduetoashiftinassetclasscomposition.Specifically,

there was an increase in risk to G10 interest rate exposures and a reduction in

commercial real estate exposures.

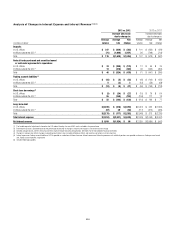

In millions of dollars

Dec. 31,

2013

2013

Average

Dec. 31,

2012

2012

Average

Interest rate $115 $114 $116 $122

Foreign exchange 34 35 33 38

Equity 26 27 32 29

Commodity 13 12 11 15

Covariance adjustment (1) (63) (75) (76) (82)

Total Trading VAR—all

market risk factors,

including general and

specific risk (excluding

credit portfolios) (2) $125 $113 $116 $122

Specific risk-only

component (3) $ 15 $ 14 $ 31 $ 24

Total Trading VAR—general

market risk factors only

(excluding credit portfolios) (2) $110 $ 99 $ 85 $ 98

Incremental Impact of the

Credit Portfolio (4) 19 8 $ 2 $ 26

Total Trading and

Credit Portfolios VAR $144 $121 $118 $148

(1) Covariance adjustment (also known as diversification benefit) equals the difference between the

total VAR and the sum of the VARs tied to each individual risk type. The benefit reflects the fact that

the risks within each and across risk types are not perfectly correlated and, consequently, the total

VAR on a given day will be lower than the sum of the VARs relating to each individual risk type.

The determination of the primary drivers of changes to the covariance adjustment is made by an

examination of the impact of both model parameter and position changes.

(2) The total Trading VAR includes mark-to-market and certain fair value option trading positions from

S&B and Citi Holdings, with the exception of hedges to the loan portfolio, fair value option loans, and

all CVA exposures. Available-for-sale and accrual exposures are not included.

(3) The specific risk-only component represents the level of equity and fixed income issuer-specific risk

embedded in VAR.

(4) The credit portfolio is composed of mark-to-market positions associated with non-trading business

units including Citi Treasury, the CVA relating to derivative counterparties and all associated CVA

hedges. DVA is not included. It also includes hedges to the loan portfolio, fair value option loans, and

tail hedges that are not explicitly hedging the trading book.

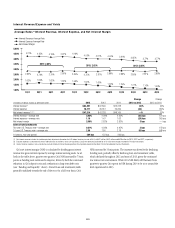

The table below provides the range of market factor VARs inclusive of

specific risk that was experienced during 2013 and 2012.

2013 2012

In millions of dollars Low High Low High

Interest rate $92 $142 $101 $149

Foreign exchange 21 66 25 53

Equity 18 60 17 59

Commodity 8 24 9 21