Citibank 2013 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2013 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

122

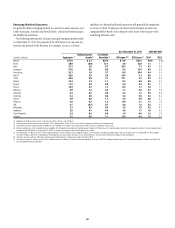

Emerging Markets Trading Account Assets and Investment Securities

In the ordinary course of business, Citi holds securities in its trading accounts

and investment accounts, including those above. Trading account assets are

marked to market daily, with asset levels varying as Citi maintains inventory

consistent with customer needs. Investment securities are recorded at either

fair value or historical cost, based on the underlying accounting treatment,

and are predominantly held as part of the local entity asset and liability

management program, or to comply with local regulatory requirements.

In the markets in the table above, 98% of Citi’s investment securities were

related to sovereign issuers.

Emerging Markets Consumer Lending

GCB’s strategy within the emerging markets is consistent with GCB’s

overall strategy, which is to leverage its global footprint and seek to be the

preeminent bank for the emerging affluent and affluent consumers in

large urban centers. In credit cards and in certain retail markets, Citi serves

customers in a somewhat broader set of segments and geographies. Overall,

Citi believes that its customers are more resilient than the overall market

under a wide range of economic conditions. Citi’s Consumer business has

a well-established risk appetite framework across geographies and products

that reflects the business strategy and activities and establishes boundaries

around the key risks that arise from the strategy and activities.

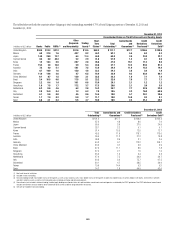

As of December 31, 2013, GCB had approximately $127 billion of

Consumer loans outstanding to borrowers in the emerging markets, or

approximately 42% of GCB’s total loans, compared to approximately

$118 billion or 41% of total GCB loans as of December 31, 2012. Of the

approximately $127 billion as of December 31, 2013, the five largest

emergingmarkets—Mexico,Korea,Singapore,HongKongandIndia—

comprised approximately 28% of GCB’s total loans.

Within the emerging markets, 28% of Citi’s GCB loans were mortgages,

27% were commercial markets loans, 23% were personal loans, and 22% were

credit cards loans, each as of year-end 2013.

Overall consumer credit quality in the emerging markets remained

generally stable in 2013, as net credit losses were 1.9% of average loans in

2013, compared to 1.8% in 2012, consistent with Citi’s target market strategy

and risk appetite framework.

Emerging Markets Corporate Lending

Consistent with its overall strategy, Citi’s Corporate clients in the emerging

markets are typically large, multi-national corporations who value Citi’s

global network. Citi aims to establish relationships with these clients that

encompass multiple products, consistent with client needs, including

cash management and trade services, foreign exchange, lending,

capital markets and M&A advisory. Citi believes that its target corporate

segment is more resilient under a wide range of economic conditions,

and that its relationship-based approach to client service enables it to

effectively manage the risks inherent in such relationships. Citi has a

well-established risk appetite framework around its corporate lending

activities, including risk-based limits and approval authorities and portfolio

concentration boundaries.

As of December 31, 2013, ICG had approximately $126 billion of

loans outstanding to borrowers in the emerging markets, representing

approximately 47% of ICG’s total loans outstanding, as compared to

approximately $117 billion or 48% of ICG loans outstanding at December 31,

2012. No single emerging market country accounted for more than 6% of

Citi’s ICG loans as of December 31, 2013.

As of December 31, 2013, approximately two-thirds of Citi’s emerging

markets Corporate loans (excluding Private Bank in Securities and

Banking) are to borrowers whose ultimate parent is rated investment grade,

which Citi considers to be ratings of BBB or better according to Citi’s internal

risk measurement system and methodology (for additional information on

Citi’s internal risk measurement system for Corporate loans, see “Corporate

Credit Details” above). The vast majority of the remainder are rated BB or B

according to Citi’s internal risk measurement system and methodology.

Overall ICG net credit losses in the emerging markets were 0.04% of

average loans in 2013, as compared to 0.2% in 2012. The ratio of non-

accrual ICG loans to total loans in the emerging markets remained stable at

0.5% as of December 31, 2013, as compared with December 31, 2012.

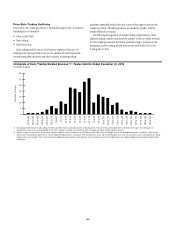

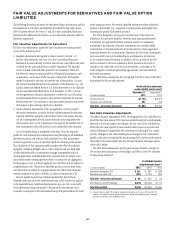

The following chart shows the composition of emerging markets ICG

loans overall and for Citi’s three largest ICG lending markets—Brazil, China

and India—by type of loan.

IndiaChinaBrazilTotal Emerging

Markets

43%

39%

18%

59%

29%

13%

47%

39%

13%

60%

37%

3%

$125.8 $14.4 $10.3

$12.1

Funded Emerging Markets ICG Loans by Loan Type

In billions of dollars

Transaction Services Corporate Lending in S&B Private Bank and Other