Citibank 2013 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2013 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.8

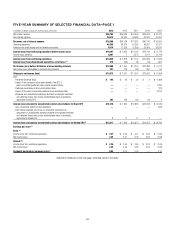

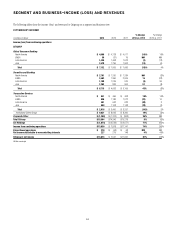

Citicorp

Citicorp net income increased 11% from the prior year to $15.6 billion. The

increase largely reflected a lower impact of CVA/DVA and lower repositioning

charges, partially offset by higher provisions for income taxes. CVA/DVA,

recorded in Securities and Banking, was a negative $345 million in

2013, compared to negative $2.5 billion in the prior year (for a summary

of CVA/DVA by business within Securities and Banking for 2013 and

comparable periods, see “Institutional Clients Group” below). Results in

the third quarter of 2013 also included the $176 million tax benefit in 2013,

compared to the $582 million tax benefit in the third quarter of 2012, and

the $189 million after-tax benefit related to the divestiture of Credicard.

Citicorp’s full year 2012 results included a pretax loss of $53 million

($34 million after-tax) related to the sale of minority investments as well as

$951 million of pretax repositioning charges in the fourth quarter of 2012

($604 million after-tax).

Excluding these items, Citicorp’s net income was $15.4 billion, down

1% from the prior year, as lower operating expenses and lower net credit

losses were largely offset by a lower net loan loss reserve release and a higher

effective tax rate in 2013.

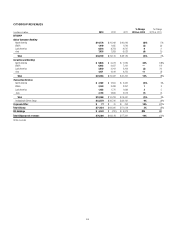

Citicorp revenues, net of interest expense, increased 3% from the prior year

to $71.8 billion. Excluding CVA/DVA and the impact of minority investments,

Citicorp revenues were $72.2 billion in 2013, relatively unchanged from

2012. GCB revenues of $38.2 billion declined 2% versus the prior year. North

America GCB revenues declined 6% to $19.8 billion, and international GCB

revenues (consisting of Asia RCB, Latin America RCB and EMEA RCB)

increased 1% year-over-year to $18.4 billion. Excluding the impact of FX

translation, international GCB revenues rose 3% year-over-year, driven by

7% revenue growth in Latin America RCB, partially offset by a 1% revenue

decline in both EMEA RCB and Asia RCB. Securities and Banking revenues

were $23.0 billion in 2013, up 15% from the prior year. Excluding CVA/DVA,

Securities and Banking revenues were $23.4 billion, or 4% higher than

the prior year. Transaction Services revenues were $10.6 billion, down

1% from the prior year, but relatively unchanged excluding the impact

of FX translation (for the impact of FX translation on 2013 results of

operations for each of EMEA RCB, Latin America RCB, Asia RCB and

Transaction Services, see the table accompanying the discussion of each

respective business’ results of operations below). Corporate/Other revenues,

excluding the impact of minority investments, increased to $77 million from

$17 million in the prior year, mainly reflecting hedging gains.

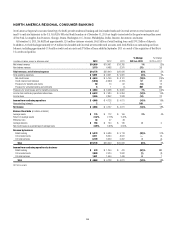

In North America RCB, the revenue decline was driven by lower mortgage

origination revenues due to the significant decline in U.S. mortgage

refinancing activity, particularly in the second half of the year, partially

offset by higher revenues in Citi retail services, mostly driven by the Best

Buy portfolio acquisition in the third quarter of 2013. North America RCB

average deposits of $166 billion grew 8% year-over-year and average retail

loans of $43 billion grew 3%. Average card loans of $107 billion declined

2%, driven by increased payment rates resulting from ongoing consumer

deleveraging, while card purchase sales of $240 billion increased 3% versus

the prior year. For additional information on the results of operations of

North America RCB for 2013, see “Global Consumer Banking—North

America Regional Consumer Banking” below.

Year-over-year, international GCB average deposits declined 2%, while

average retail loans increased 6%, investment sales increased 15%, average

card loans increased 3%, and international card purchase sales increased

7%, all excluding Credicard and the impact of FX translation. The decline

in Asia RCB revenues, excluding the impact of FX translation, reflected the

continued impact of spread compression, regulatory changes in certain

markets and the ongoing repositioning of Citi’s franchise in Korea. For

additional information on the results of operations of Asia RCB for 2013, see

“Global Consumer Banking—Asia Regional Consumer Banking” below.

In Securities and Banking, fixed income markets revenues of

$13.1 billion, excluding CVA/DVA, declined 7% from the prior year, primarily

reflecting industry-wide weakness in rates and currencies, partially offset

by strong performance in credit-related and securitized products and

commodities. Equity markets revenues of $3.0 billion in 2013, excluding

CVA/DVA, were 22% above the prior year driven primarily by market share

gains, continued improvement in cash and derivative trading performance

and a more favorable market environment. Investment banking revenues

rose 8% from the prior year to $4.0 billion, principally driven by higher

revenues in equity underwriting and advisory, partially offset by lower debt

underwriting revenues. Lending revenues of $1.2 billion increased 40% from

the prior year, driven by lower mark-to-market losses on hedges related to

accrual loans due to less significant credit spread tightening versus 2012.

Excluding the mark-to-market on hedges related to accrual loans, core

lending revenues decreased 4%, primarily due to increased hedge premium

costs and moderately lower loan balances, partially offset by higher spreads.

Private Bank revenues of $2.5 billion increased 4% from the prior year,

excluding CVA/DVA, with growth across all regions and products, particularly

in managed investments and capital markets. For additional information

on the results of operations of Securities and Banking for 2013, see

“Institutional Clients Group—Securities and Banking” below.

In Transaction Services, growth from higher deposit balances, trade

loans and fees from increased market volumes was offset by continued

spread compression. Excluding the impact of FX translation, Securities and

Fund Services revenues increased 4%, as growth in settlement volumes and

assets under custody were partially offset by spread compression related to

deposits. Treasury and Trade Solutions revenues decreased 1% excluding

the impact of FX translation, as the ongoing impact of spread compression

globally was partially offset by higher balances and fee growth. For additional

information on the results of operations of Transaction Services for 2013,

see “Institutional Clients Group—Transaction Services” below.

Citicorp end-of-period loans increased 6% year-over-year to $573 billion,

with 2% growth in Consumer loans and 11% growth in Corporate loans.