Citibank 2013 Annual Report Download - page 305

Download and view the complete annual report

Please find page 305 of the 2013 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.287

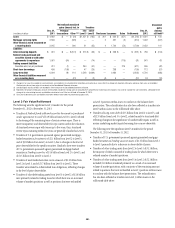

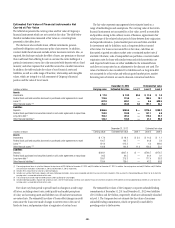

Sensitivity to Unobservable Inputs and Interrelationships

between Unobservable Inputs

The impact of key unobservable inputs on the Level 3 fair value

measurements may not be independent of one another. In addition, the

amount and direction of the impact on a fair value measurement for a given

change in an unobservable input depends on the nature of the instrument as

well as whether the Company holds the instrument as an asset or a liability.

For certain instruments, the pricing hedging and risk management are

sensitive to the correlation between various inputs rather than on the analysis

and aggregation of the individual inputs.

The following section describes the sensitivities and interrelationships of

the most significant unobservable inputs used by the Company in Level 3 fair

value measurements.

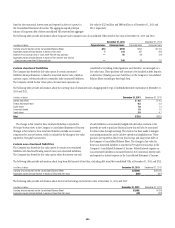

Correlation

Correlation is a measure of the co-movement between two or more variables.

A variety of correlation-related assumptions are required for a wide range of

instruments, including equity and credit baskets, foreign-exchange options,

CDOs backed by loans or bonds, mortgages, subprime mortgages and many

other instruments. For almost all of these instruments, correlations are not

observable in the market and must be estimated using historical information.

Estimating correlation can be especially difficult where it may vary over time.

Extracting correlation information from market data requires significant

assumptions regarding the informational efficiency of the market (for

example, swaption markets). Changes in correlation levels can have a major

impact, favorable or unfavorable, on the value of an instrument, depending

on its nature. A change in the default correlation of the fair value of the

underlying bonds comprising a CDO structure would affect the fair value of

the senior tranche. For example, an increase in the default correlation of the

underlying bonds would reduce the fair value of the senior tranche, because

highly correlated instruments produce larger losses in the event of default

and a part of these losses would become attributable to the senior tranche.

That same change in default correlation would have a different impact on

junior tranches of the same structure.

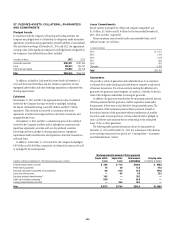

Volatility

Volatility represents the speed and severity of market price changes and is

a key factor in pricing options. Typically, instruments can become more

expensive if volatility increases. For example, as an index becomes more

volatile, the cost to Citi of maintaining a given level of exposure increases

because more frequent rebalancing of the portfolio is required. Volatility

generally depends on the tenor of the underlying instrument and the strike

price or level defined in the contract. Volatilities for certain combinations

of tenor and strike are not observable. The general relationship between

changes in the value of a portfolio to changes in volatility also depends on

changes in interest rates and the level of the underlying index. Generally,

long option positions (assets) benefit from increases in volatility, whereas

short option positions (liabilities) will suffer losses. Some instruments are

more sensitive to changes in volatility than others. For example, an at-the-

money option would experience a larger percentage change in its fair value

than a deep-in-the-money option. In addition, the fair value of an option

with more than one underlying security (for example, an option on a basket

of bonds) depends on the volatility of the individual underlying securities as

well as their correlations.

Yield

Adjusted yield is generally used to discount the projected future principal and

interest cash flows on instruments, such as asset-backed securities. Adjusted

yield is impacted by changes in the interest rate environment and relevant

credit spreads.

In some circumstances, the yield of an instrument is not observable in

the market and must be estimated from historical data or from yields of

similar securities. This estimated yield may need to be adjusted to capture the

characteristics of the security being valued. In other situations, the estimated

yield may not represent sufficient market liquidity and must be adjusted as

well. Whenever the amount of the adjustment is significant to the value of

the security, the fair value measurement is classified as Level 3.

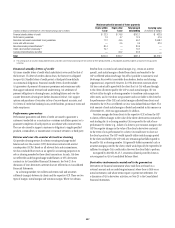

Prepayment

Voluntary unscheduled payments (prepayments) change the future cash

flows for the investor and thereby change the fair value of the security. The

effect of prepayments is more pronounced for residential mortgage-backed

securities. An increase in prepayments—in speed or magnitude—generally

creates losses for the holder of these securities. Prepayment is generally

negatively correlated with delinquency and interest rate. A combination

of low prepayment and high delinquencies amplify each input’s negative

impact on mortgage securities’ valuation. As prepayment speeds change, the

weighted average life of the security changes, which impacts the valuation

either positively or negatively, depending upon the nature of the security and

the direction of the change in the weighted average life.

Recovery

Recovery is the proportion of the total outstanding balance of a bond or loan

that is expected to be collected in a liquidation scenario. For many credit

securities (such as asset-backed securities), there is no directly observable

market input for recovery, but indications of recovery levels are available

from pricing services. The assumed recovery of a security may differ from

its actual recovery that will be observable in the future. The recovery rate

impacts the valuation of credit securities. Generally, an increase in the

recovery rate assumption increases the fair value of the security. An increase

in loss severity, the inverse of the recovery rate, reduces the amount of

principal available for distribution and, as a result, decreases the fair value of

the security.