Citibank 2013 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2013 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48

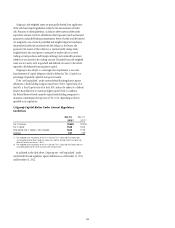

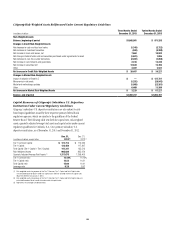

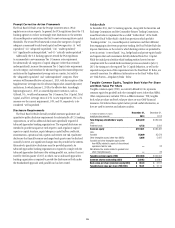

Components of Citigroup Capital Under Basel III

In millions of dollars

December 31,

2013 (1)

December 31,

2012 (2)

Tier 1 Common Capital

Citigroup common stockholders’ equity (3) $ 197,694 $ 186,487

Add: Qualifying noncontrolling interests 182 171

Regulatory Capital Adjustments and Deductions:

Less: Accumulated net unrealized losses on cash flow hedges, net of tax (4) (1,245) (2,293)

Less: Cumulative change in fair value of financial liabilities attributable to the change in own creditworthiness, net of tax (5) 177 587

Less: Intangible assets:

Goodwill, net of related DTL (6) 24,518 25,488

Identifiable intangible assets other than mortgage servicing rights (MSRs), net of related DTL 4,950 5,632

Less: Defined benefit pension plan net assets 1,125 732

Less: Deferred tax assets (DTAs) arising from net operating loss, foreign tax credit and general business credit carry-forwards (7) 26,439 28,800

Less: Excess over 10%/15% limitations for other DTAs, certain common stock investments, and MSRs (7)(8) 16,315 22,316

Total Tier 1 Common Capital $ 125,597 $ 105,396

Additional Tier 1 Capital

Qualifying perpetual preferred stock (3) 6,645 $ 2,562

Qualifying trust preferred securities (9) 1,374 1,377

Qualifying noncontrolling interests 39 37

Regulatory Capital Deduction:

Less: Minimum regulatory capital requirements of insurance underwriting subsidiaries (10) 243 247

Total Tier 1 Capital $ 133,412 $ 109,125

Tier 2 Capital

Qualifying subordinated debt 14,414 $ 13,947

Qualifying trust preferred securities 745 2,582

Qualifying noncontrolling interests 52 49

Regulatory Capital Adjustment and Deduction:

Add: Excess of eligible credit reserves over expected credit losses (11) 1,669 5,115

Less: Minimum regulatory capital requirements of insurance underwriting subsidiaries (10) 243 247

Total Tier 2 Capital $ 16,637 $ 21,446

Total Capital (Tier 1 Capital + Tier 2 Capital) (12) $ 150,049 $ 130,571

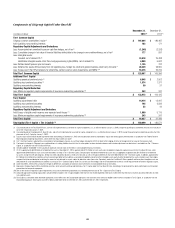

(1) Calculated based on the Final Basel III Rules, and with full implementation assumed for all capital components (i.e., an effective date of January 1, 2019), except for qualifying trust preferred securities that fully phase-

out of Tier 2 Capital by January 1, 2022.

(2) Calculated based on the proposed U.S. Basel III rules, and with full implementation assumed for capital components (i.e., an effective date of January 1, 2019), except for qualifying trust preferred securities that fully

phase-out of Tier 2 Capital by January 1, 2022.

(3) Issuance costs of $93 million related to preferred stock outstanding at December 31, 2013 are excluded from common stockholders’ equity and netted against preferred stock in accordance with Federal Reserve

Board regulatory reporting requirements, which differ from those under U.S. GAAP.

(4) Tier 1 Common Capital is adjusted for accumulated net unrealized gains (losses) on cash flow hedges included in AOCI that relate to the hedging of items not recognized at fair value on the balance sheet.

(5) The impact of changes in Citigroup’s own creditworthiness in valuing liabilities for which the fair value option has been elected and own-credit valuation adjustments on derivatives is excluded from Tier 1 Common

Capital, in accordance with the Final Basel III Rules.

(6) Includes goodwill “embedded” in the valuation of significant common stock investments in unconsolidated financial institutions.

(7) Of Citi’s approximately $52.8 billion of net deferred tax assets at December 31, 2013, approximately $12.2 billion of such assets were includable in regulatory capital pursuant to the Final Basel III Rules, while

approximately $40.6 billion of such assets were excluded in arriving at Tier 1 Common Capital. Comprising the excluded net deferred tax assets was an aggregate of approximately $41.8 billion of net deferred

tax assets arising from net operating loss, foreign tax credit and general business credit carry-forwards as well as temporary differences that were deducted from Tier 1 Common Capital. In addition, approximately

$1.2 billion of net deferred tax liabilities, primarily consisting of deferred tax liabilities associated with goodwill and certain other intangible assets, partially offset by deferred tax assets related to cash flow hedges,

are permitted to be excluded prior to deriving the amount of net deferred tax assets subject to deduction under these rules. Separately, under the Final Basel III Rules, goodwill and these other intangible assets are

deducted net of associated deferred tax liabilities in arriving at Tier 1 Common Capital, while Citi’s current cash flow hedges and the related deferred tax effects are not required to be reflected in regulatory capital.

(8) Aside from MSRs, reflects DTAs arising from temporary differences and significant common stock investments in unconsolidated financial institutions.

(9) Represents Citigroup Capital XIII trust preferred securities, which are permanently grandfathered as Tier 1 Capital under the Final Basel III Rules. Accordingly, the prior period has been conformed to current period

presentation for comparative purposes.

(10) 50% of the minimum regulatory capital requirements of insurance underwriting subsidiaries must be deducted from each of Tier 1 Capital and Tier 2 Capital.

(11) Advanced Approaches banking organizations are permitted to include in Tier 2 Capital eligible credit reserves that exceed expected credit losses to the extent that the excess reserves do not exceed 0.6% of credit

risk-weighted assets.

(12) Total Capital as calculated under Advanced Approaches, which differs from the Standardized Approach in the treatment of the amount of eligible credit reserves includable in Tier 2 Capital. In accordance with the

Standardized Approach, Total Capital was $161.8 billion and $138.5 billion at December 31, 2013 and December 31, 2012, respectively.