Citibank 2013 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2013 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

89

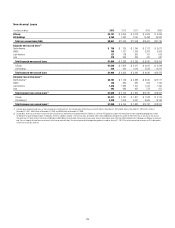

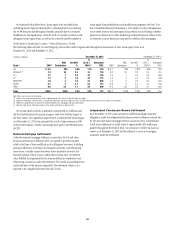

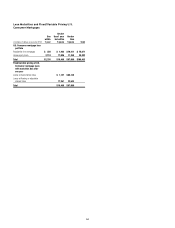

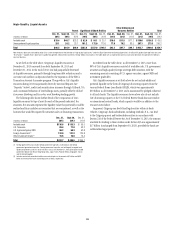

Citi Holdings Consumer Mortgage FICO and LTV

The following charts detail the quarterly trends for the residential first

mortgage and home equity loan portfolios within Citi Holdings by risk

segment (FICO and LTV/CLTV).

Residential First Mortgages - Citi Holdings (EOP Loans)

In billions of dollars

FICO

≥ 660 660-620 <620

4Q’11 4Q’12 4Q’13 4Q’11 4Q’12 4Q’13 4Q’11 4Q’12 4Q’13

LTV

< 80% $ 7.8 $ 8.0 $ 9.9 $ 2.6 $ 2.7 $ 3.0 $ 6.3 $ 6.1 $ 5.6

80-100% 8.0 8.4 6.6 2.3 2.3 1.8 5.6 5.1 3.4

> 100% 12.5 7. 2.2 3.2 2.2 0.9 8.0 5.0 2.2

Total(1) $ 28.3 $ 24.1 $ 18.6 $ 8.2 $ 7.3 $ 5.7 $ 19.9 $ 16.2 $ 11.3

Home Equity Loans - Citi Holdings (EOP Loans)

In billions of dollars

FICO

≥ 660 660-620 <620

4Q’11 4Q’12 4Q’13 4Q’11 4Q’12 4Q’13 4Q’11 4Q’12 4Q’13

CLTV

< 80% $ 8.9 $ 8.6 $ 9.8 $ 0.7 $ 0.7 $ 0.9 $ 1.2 $ 1.2 $ 1.3

80-100% 6.8 6.0 5.8 0.8 0.9 0.9 1.6 1.7 1.4

> 100% 12.5 9.3 5.0 1.9 1.4 0.8 3.5 2.4 1.2

Total(1) $ 28.3 $ 23.9 $ 20.6 $ 3.5 $ 3.1 $ 2.6 $ 6.2 $ 5.3 $ 4.0

Notes: Tables may not sum due to rounding. Data appearing in the tables above have been sourced from

Citi’s risk systems and, as such, may not reconcile with disclosures elsewhere generally due to differences

in methodology or variations in the manner in which information is captured. Citi has noted such variations

in instances where it believes they could be material to reconcile to the information presented elsewhere.

(1) Excludes loans in Canada and Puerto Rico, loans guaranteed by U.S. government agencies (residential

first mortgages table only), loans recorded at fair value (residential first mortgages table only) and

loans subject to LTSCs.

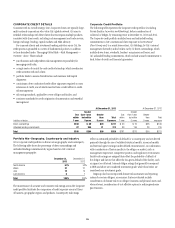

During 2013, Citi Holdings residential first mortgages with an LTV above

100% declined by 65%, and with an LTV above 100% with FICO scores of

less than 620 by 56%. The residential first mortgage portfolio has migrated

to a higher FICO and lower LTV distribution primarily due to home price

appreciation, asset sales of delinquent first mortgages and principal

forgiveness. Loans 90+ days past due in the residential first mortgage

portfolio with refreshed FICO scores of less than 620 as well as LTVs above

100% declined 64% year-over-year to $0.4 billion primarily due to home price

appreciation, liquidations and asset sales of delinquent first mortgages.

In addition, during 2013, Citi Holdings home equity loans with a CLTV

above 100% declined by 47%, and with a CLTV above 100% and FICO scores of

less than 620 by 50%, primarily due to home price appreciation, repayments

and charge-offs. Loans 90+ days past due in the home equity portfolio with

refreshed FICO scores of less than 620 as well as CLTVs above 100% declined

60% year-over-year to $130 million primarily due to charge-offs, home price

appreciation and modifications.

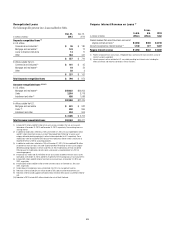

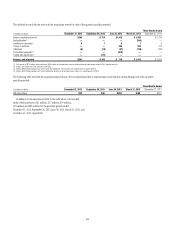

Mortgage Servicing Rights

To minimize credit and liquidity risk, Citi sells most of the conforming

mortgage loans it originates but retains the servicing rights. These sale

transactions create an intangible asset referred to as mortgage servicing

rights (MSRs), which are recorded at fair value on Citi’s Consolidated

Balance Sheet. The fair value of MSRs is primarily affected by changes in

prepayments of mortgages that result from shifts in mortgage interest rates.

Specifically, higher interest rates tend to lead to declining prepayments

which causes the fair value of the MSRs to increase. In managing this risk,

Citi economically hedges a significant portion of the value of its MSRs

through the use of interest rate derivative contracts, forward purchase and

sale commitments of mortgage-backed securities and purchased securities

classified as trading account assets.

Citi’s MSRs totaled $2.7 billion as of December 31, 2013, compared to

$2.6 billion and $1.9 billion at September 30, 2013 and December 31, 2012,

respectively. The increase year-over-year primarily reflected the impact

of higher interest rates and newly capitalized MSRs, partially offset by

amortization. At December 31, 2013, approximately $2.1 billion of

MSRs were specific to Citicorp, with the remainder to Citi Holdings. For

additional information on Citi’s MSRs, see Note 22 to the Consolidated

Financial Statements.

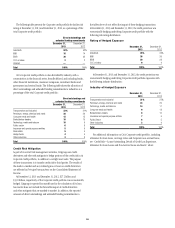

As announced in January 2014, Citi signed an agreement for the sale

of Citi’s MSRs portfolio representing approximately 64,000 loans with

outstanding unpaid principal balances of $10.3 billion (approximately

10% of Citi Holdings third-party servicing portfolio). The sale resulted in

no adjustment to the value of Citi’s MSRs. The MSRs portfolio being sold

includes the majority of delinquent loans serviced by CitiMortgage for Fannie

Mae and represents almost 20% of the total loans serviced by CitiMortgage

that are 60 days or more past due. Citi and Fannie Mae have substantially

resolved pending and future compensatory fee claims related to Citi’s

servicing on those loans. Transfer of the MSRs portfolio is expected to occur

in tranches during 2014.

8