Citibank 2010 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2010 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

95

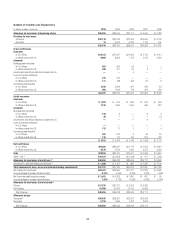

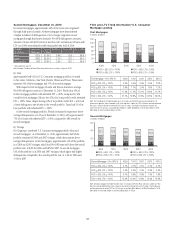

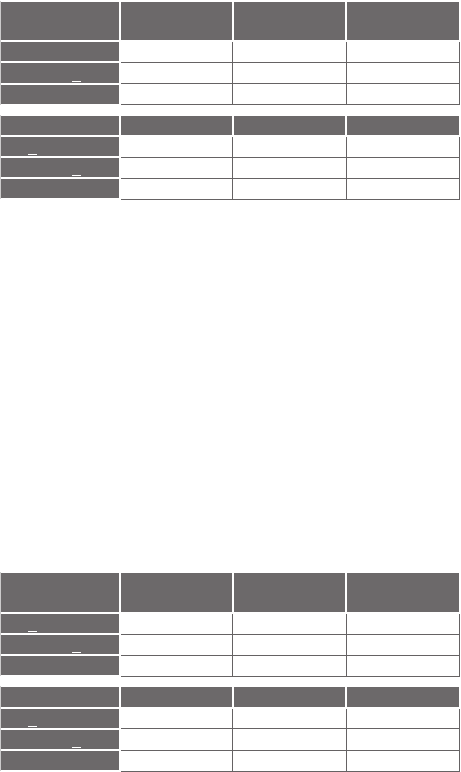

Balances: December 31, 2010—First Mortgages

AT

ORIGINATION

FICO ≥ 660 620 ≤ FICO <660 FICO < 620

LTV ≤ 80% 58% 6% 7%

80% < LTV < 100% 14% 7% 8%

LTV > 100% NM NM NM

REFRESHED FICO ≥ 660 620 ≤ FICO < 660 FICO < 620

LTV < 80% 28% 4% 9%

80% < LTV < 100% 18% 3% 8%

LTV > 100% 16% 3% 11%

Note: NM—Not meaningful. First mortgage table excludes loans in Canada and Puerto Rico. Table excludes

loans guaranteed by U.S. government agencies, loans recorded at fair value and loans subject to LTSCs.

Table also excludes $1.6 billion from At Origination balances and $0.4 billion from Refreshed balances for

which FICO or LTV data was unavailable. Balances exclude deferred fees/costs. Refreshed FICO scores

based on updated credit scores obtained from Fair Isaac Corporation. Refreshed LTV ratios are derived

from data at origination updated using mainly the Core Logic Housing Price Index (HPI) or the Federal

Housing Finance Agency Price Index.

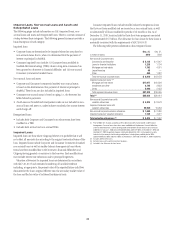

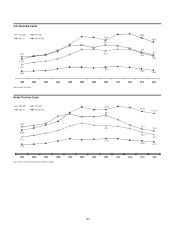

Second Mortgages—Loan Balances. In the second mortgage portfolio, the

majority of loans are in the higher FICO categories. Economic conditions

and the decrease in housing prices generally caused a migration towards

lower FICO scores and higher LTV ratios, although the negative migration

slowed during the latter half of 2010. Approximately 48% of second

mortgages had refreshed LTVs above 100%, compared to approximately 0%

at origination. Approximately 17% of second mortgages had FICO scores less

than 620 on a refreshed basis, compared to 3% at origination.

Balances: December 31, 2010—Second Mortgages

AT

ORIGINATION

FICO ≥ 660 620 ≤ FICO < 660 FICO < 620

LTV < 80% 51% 2% 2%

80% < LTV < 100% 41% 3% 1%

LTV > 100% NM NM NM

REFRESHED FICO ≥ 660 620 ≤ FICO < 660 FICO < 620

LTV < 80% 22% 1% 3%

80% < LTV < 100% 20% 2% 4%

LTV > 100% 33% 5% 10%

Note: NM—Not meaningful. Second mortgage table excludes loans in Canada and Puerto Rico. Table

excludes loans subject to LTSCs. Table also excludes $1.5 billion from At Origination balances and

$0.3 billion from Refreshed balances for which FICO or LTV data was unavailable. Balances exclude

deferred fees/costs. Refreshed FICO scores are based on updated credit scores obtained from Fair Isaac

Corporation. Refreshed LTV ratios are derived from data at origination updated using mainly the Core Logic

Housing Price Index (HPI) or the Federal Housing Finance Agency Price Index.

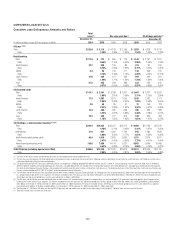

Consumer Mortgage FICO and LTV

Data appearing in the tables below have been sourced from Citigroup’s

risk systems and, as such, may not reconcile with disclosures elsewhere

generally due to differences in methodology or variations in the manner in

which information is captured. Citi has noted such variations in instances

where it believes they could be material to reconcile to the information

presented elsewhere.

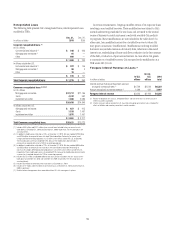

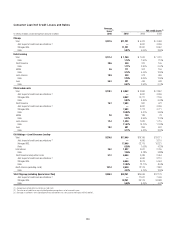

Citi’s credit risk policy is not to offer option adjustable rate mortgages

(ARMs)/negative amortizing mortgage products to its customers. As a result,

option ARMs/negative amortizing mortgages represent an insignificant

portion of total balances, since they were acquired only incidentally as part of

prior portfolio and business purchases.

A portion of loans in the U.S. Consumer mortgage portfolio currently

require a payment to satisfy only the current accrued interest for the payment

period, or an interest-only payment. Citi’s mortgage portfolio includes

approximately $27 billion of first- and second-mortgage home equity lines

of credit (HELOCs) that are still within their revolving period and have not

commenced amortization. The interest-only payment feature during the

revolving period is standard for the HELOC product across the industry. The

first mortgage portfolio contains approximately $18 billion of ARMs that

are currently required to make an interest-only payment. These loans will

be required to make a fully amortizing payment upon expiration of their

interest-only payment period, and most will do so within a few years of

origination. Borrowers that are currently required to make an interest-only

payment cannot select a lower payment that would negatively amortize the

loan. First mortgage loans with this payment feature are primarily to high-

credit-quality borrowers that have on average significantly higher origination

and refreshed FICO scores than other loans in the first mortgage portfolio.

Loan Balances

First Mortgages—Loan Balances. As a consequence of the economic

environment and the decrease in housing prices, LTV and FICO scores have

generally deteriorated since origination, although they generally stabilized

during the latter half of 2010. On a refreshed basis, approximately 30% of

first mortgages had a LTV ratio above 100%, compared to approximately 0%

at origination. Approximately 28% of first mortgages had FICO scores less

than 620 on a refreshed basis, compared to 15% at origination.