Citibank 2010 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2010 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312

|

|

9

2010 Accomplishments

• Citi helped Asia Pacific clients raise more than $160 billion

from international capital markets, including sovereign debt

issues for Indonesia and Vietnam.

• Citi was involved in several landmark equity offerings,

including the largest single-tranche initial public offering

ever priced (for wealth management and insurance giant

AIA), the largest Singapore IPO (for Global Logistic

Properties), the largest India IPO (for Coal India) and the

largest Philippine IPO in dollar terms (for Cebu Pacific Air).

• Thailand awarded us the mandate to provide payment

services to its Government Pension Fund, which manages the

retirement savings of more than one million members.

• Retail deposits in Asia hit $100 billion for the first time, and

institutional deposits reached an all-time high of more than

$120 billion.

• Our GTS business provides the widest range of cash

management, trade and securities, and fund services in the

region, processing more than $6 trillion of cross-border funds

in 2010, with assets under custody of more than $1.3 trillion.

• We grew our footprint significantly, opening 45 new branches

during the year. Our network now totals more than 700 retail

branches across the region, compared with fewer than

100 in 2000.

• In Australia, China, Hong Kong and Thailand, we launched the

next generation of Internet banking service, which provides a

vastly superior customer experience, global view of accounts,

improved security, customized alerts and financial advice.

• We launched Powered by Citi, a region-wide campaign

with leading retailers and corporate clients across Asia

that promotes specific value propositions based on credit

card spending.

• We continued to expand our equity presence with the launch

of local brokerages in Indonesia and Malaysia and the

establishment of a research team in the Philippines.

• We launched Citigold Private Client, a new wealth

management program for individuals with assets between

$1 million and $10 million. Currently available in China,

Singapore and Hong Kong, the program provides an exclusive

and individual level of service to manage both personal and

business wealth. Clients enjoy unrivaled access to Citi’s

global banking network and all of the products and services

offered across our entire franchise, including transactional

banking, capital markets and advisory services and business

banking solutions.

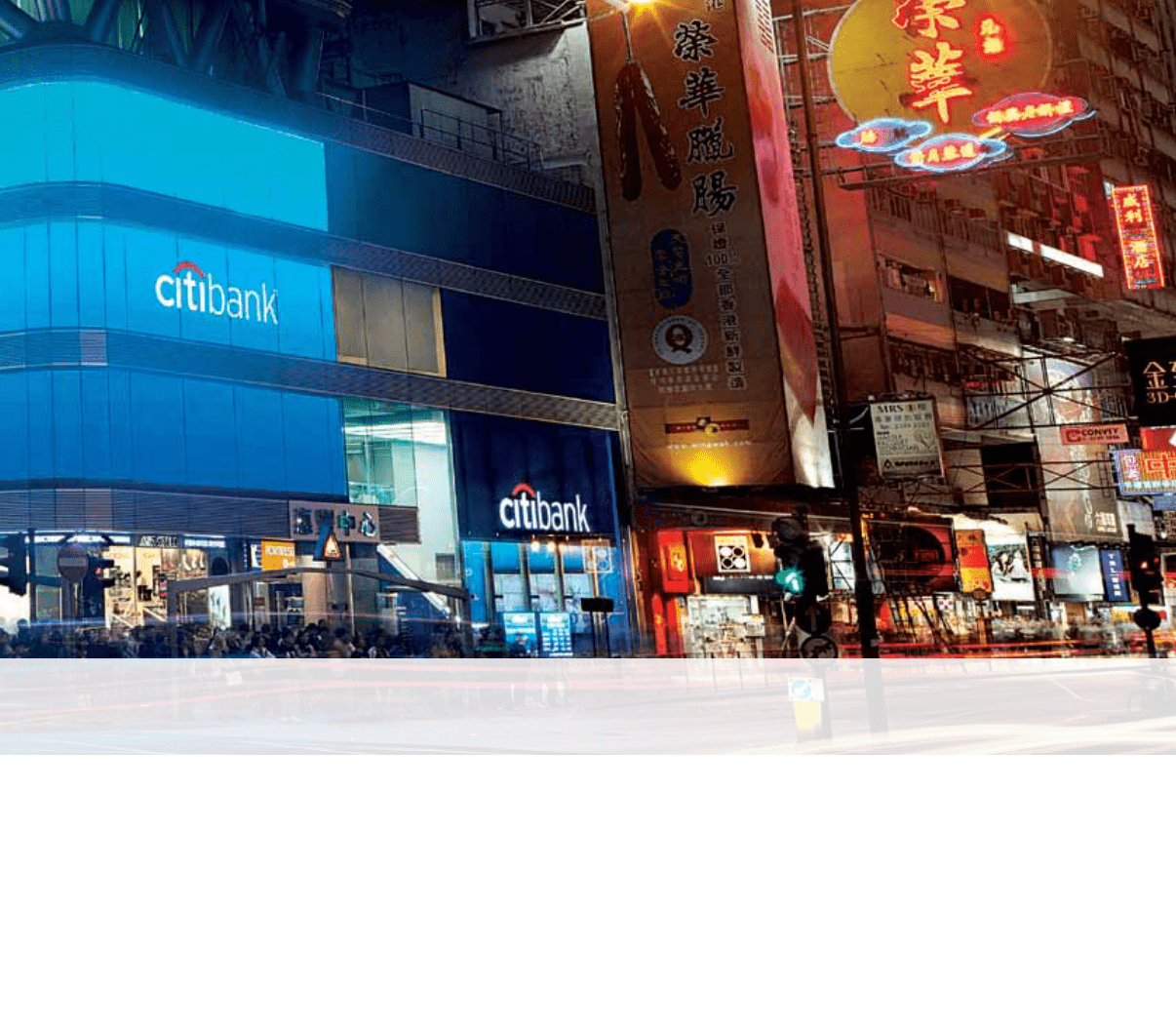

Hong Kong In 2010, Citibank opened its largest branch in Asia Pacific. Situated in Mong Kok at the heart of Hong Kong’s Kowloon Peninsula, this

multistory location offers a full range of banking services, covering general banking, loans and mortgages and credit cards. The branch also houses

banking centers for Citigold, Citigold Private Client and Commercial Banking, all in one building that strategically serves the large population of

Kowloon. The Mong Kok branch is our 43rd retail branch in Hong Kong.