Citibank 2010 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2010 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312

|

|

112

for the near term, although the actual number of claims may differ and is

subject to uncertainty. Furthermore, in Citi’s experience to date, approximately

half of the repurchase claims have been successfully appealed and have resulted

in no loss to Citi. The activity in the repurchase reserve for the years ended

December 31, 2010 and 2009 was as follows:

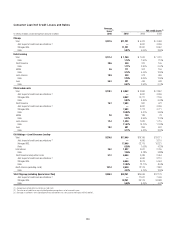

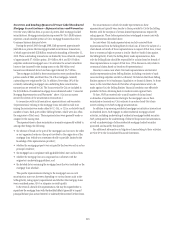

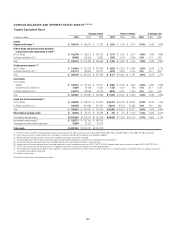

Year ended December 31,

In millions of dollars 2010 2009

Balance, beginning of period $ 482 $ 75

Additions for new sales 16 34

Change in estimate 917 492

Utilizations (446) (119)

Balance, end of period $ 969 $ 482

As referenced above, the repurchase reserve is calculated by sales vintage.

The majority of the repurchases in 2010 were from the 2006 through 2008

sales vintages, which also represent the vintages with the largest loss severity.

An insignificant percentage of 2010 repurchases were from vintages prior to

2006, and Citi anticipates that this percentage will continue to decrease, as

those vintages are later in the credit cycle. Although still early in the credit

cycle, Citi has to date experienced lower repurchases and loss severity from

the 2009 and 2010 vintages.

Sensitivity of Repurchase Reserve

As discussed above, the repurchase reserve estimation process is subject to

numerous estimates and judgments. The assumptions used to calculate the

repurchase reserve contain a level of uncertainty and risk that, if different

from actual results, could have a material impact on the reserve amounts.

For example, Citi estimates that if there were a simultaneous 10% adverse

change in each of the significant assumptions noted above, the repurchase

reserve would increase by approximately $342 million as of December 31,

2010. This potential change is hypothetical and intended to indicate the

sensitivity of the repurchase reserve to changes in the key assumptions. Actual

changes in the key assumptions may not occur at the same time or to the

same degree (i.e., an adverse change in one assumption may be offset by an

improvement in another). Citi does not believe it has sufficient information

to estimate a range of reasonably possible loss (as defined under ASC 450)

relating to its Consumer representations and warranties.

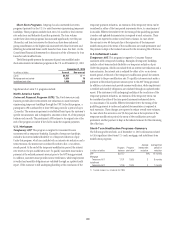

Representation and Warranty Claims—By Claimant

The representation and warranty claims by claimant for the years ended

December 31, 2010 and 2009, respectively, were as follows:

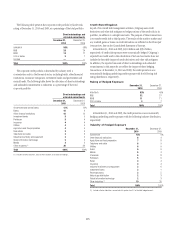

Year ended December 31,

2010 2009

Dollars in millions

Number

of claims

Original

principal

balance

Number

of claims

Original

principal

balance

GSEs 9,512 $2,063 5,835 $1,218

Private investors 321 73 409 69

Mortgage insurers (1) 268 58 316 65

Total 10,101 $2,194 6,560 $1,352

(1) Represents the insurer’s rejection of a claim for loss reimbursement that has yet to be resolved. To the

extent that mortgage insurance will not cover the claim on a loan, Citi may have to make the GSE or

private investor whole.

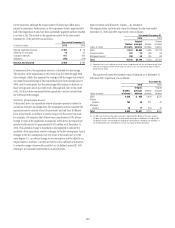

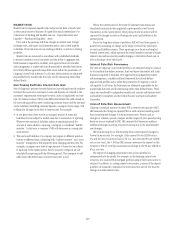

The number of unresolved claims by type of claimant as of December 31,

2010 and 2009, respectively, was as follows:

December 31,

2010 2009

Dollars in millions

Number

of claims (1)

Original

principal

balance

Number

of claims

Original

principal

balance

GSEs 4,344 $ 954 2,600 $572

Private

investors 163 30 311 40

Mortgage

insurers 76 17 204 42

Total 4,583 $1,001 3,115 $654

(1) For GSEs, the response to the repurchase claim is required within 90 days of the claim receipt. If

Citi does not respond within 90 days, the claim would then be discussed between Citi and the GSE.

For private investors, the time period for responding is governed by the individual sale agreement. If

the specified timeframe is exceeded, the investor may choose to initiate legal action.