Citibank 2010 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2010 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68

Liquidity Risk Management

Citigroup runs a centralized treasury model where the overall balance sheet

is managed by Citigroup Treasury through Global Franchise Treasurers

and Regional Treasurers. Day-to-day liquidity and funding are managed by

treasurers at the country and business level and are monitored by Corporate

Treasury and Citi risk management.

Liquidity management is the responsibility of senior management

through Citigroup’s Finance and Asset and Liability Committee (FinALCO)

and is overseen by the Board of Directors through its Risk Management

and Finance Committee. Asset and liability committees are also established

globally and for each region, country and/or major line of business.

Liquidity Measures and Stress Testing

Citi uses multiple measures in monitoring its liquidity, including liquidity

ratios, stress testing and liquidity limits, each as described below.

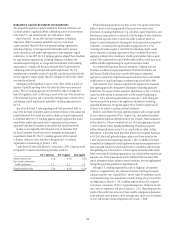

In broad terms, the structural liquidity ratio, defined as the sum of

deposits, long-term debt and stockholders’ equity as a percentage of total

assets, measures whether the asset base is funded by sufficiently long-dated

liabilities. Citi’s structural liquidity ratio was 73% at December 31, 2010, 71%

at September 30, 2010, and 73% at December 31, 2009.

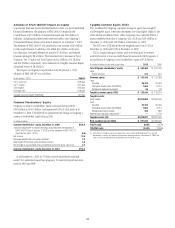

Another measure of Citi’s structural liquidity is cash capital. Cash capital

is a more detailed measure of the ability to fund the structurally illiquid

portion of Citigroup’s balance sheet. Cash capital measures the amount of

long-term funding—or core customer deposits, long-term debt (over one

year) and equity—available to fund illiquid assets. Illiquid assets generally

include loans (net of securitization adjustments), securities haircuts and

other assets (i.e., goodwill, intangibles, fixed assets). At December 31, 2010,

both the non-bank and the aggregate bank subsidiaries had a significant

excess of cash capital. In addition, as of December 31, 2010, the non-bank

maintained liquidity to meet all maturing obligations significantly in excess

of a one-year period without access to the unsecured wholesale markets.

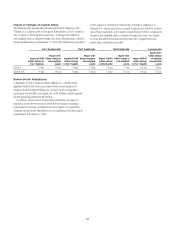

Liquidity stress testing is performed for each major entity, operating

subsidiary and/or country. Stress testing and scenario analyses are intended

to quantify the potential impact of a liquidity event on the balance sheet

and liquidity position, and to identify viable funding alternatives that can

be utilized. These scenarios include assumptions about significant changes

in key funding sources, market triggers (such as credit ratings), potential

uses of funding and political and economic conditions in certain countries.

These conditions include standard and stressed market conditions as well as

firm-specific events.

A wide range of liquidity stress tests are important for monitoring

purposes. Some span liquidity events over a full year, some may cover an

intense stress period of one month, and still other time frames may be

appropriate. These potential liquidity events are useful to ascertain potential

mis-matches between liquidity sources and uses over a variety of horizons

(overnight, one week, two week, one month, three month, one year), and

liquidity limits are set accordingly. To monitor the liquidity of a unit,

those stress tests and potential mismatches may be calculated with varying

frequencies, with several important tests performed daily.

Given the range of potential stresses, Citi maintains a series of

Contingency Funding Plans on a consolidated basis as well as for individual

entities. These plans specify a wide range of readily available actions that

are available in a variety of adverse market conditions, or idiosyncratic

disruptions.

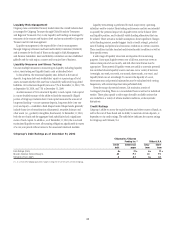

Credit Ratings

Citigroup’s ability to access the capital markets and other sources of funds, as

well as the cost of these funds and its ability to maintain certain deposits, is

dependent on its credit ratings. The table below indicates the current ratings

for Citigroup and Citibank, N.A.

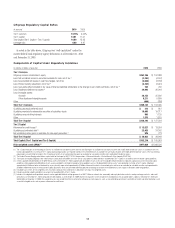

Citigroup’s Debt Ratings as of December 31, 2010

Citigroup Inc./Citigroup

Funding Inc. (1) Citibank, N.A.

Senior

debt

Commercial

paper

Long-

term

Short-

term

Fitch Ratings (Fitch) A+ F1+ A+ F1+

Moody’s Investors Service (Moody’s) A3 P-1 A1 P-1

Standard & Poor’s (S&P) A A-1 A+ A-1

(1) As a result of the Citigroup guarantee, changes in ratings for CFI are the same as those of Citigroup.