Citibank 2010 Annual Report Download - page 276

Download and view the complete annual report

Please find page 276 of the 2010 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

274

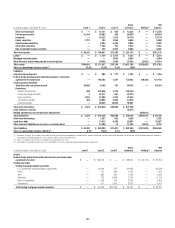

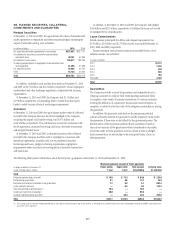

The following table provides information about certain mortgage loans HFS carried at fair value at December 31, 2010 and, 2009:

In millions of dollars December 31, 2010 December 31, 2009

Carrying amount reported on the Consolidated Balance Sheet $7,230 $3,338

Aggregate fair value in excess of unpaid principal balance 81 55

Balance of non-accrual loans or loans more than 90 days past due 14

Aggregate unpaid principal balance in excess of fair value for non-accrual loans or loans more than 90 days past due 13

The changes in fair values of these mortgage loans are reported in Other

revenue in the Company’s Consolidated Statement of Income. The changes

in fair value during the years ended December 31, 2010 and 2009 due to

instrument-specific credit risk resulted in a loss of $1 million and $4 million,

respectively. Related interest income continues to be measured based on the

contractual interest rates and reported as such in the Consolidated Statement

of Income.

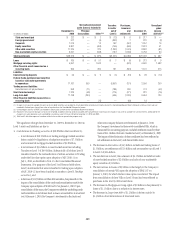

Certain consolidated VIEs

The Company has elected the fair value option for all qualified assets

and liabilities of certain VIEs that were consolidated upon the adoption

of SFAS 167 on January 1, 2010, including certain private label mortgage

securitizations, mutual fund deferred sales commissions and collateralized

loan obligation VIEs. The Company elected the fair value option for these

VIEs as the Company believes this method better reflects the economic risks,

since substantially all of the Company’s retained interests in these entities are

carried at fair value.

With respect to the consolidated mortgage VIEs, the Company determined

the fair value for the mortgage loans and long-term debt utilizing internal

valuation techniques. The fair value of the long-term debt measured using

internal valuation techniques is verified, where possible, to prices obtained

from independent vendors. Vendors compile prices from various sources and

may apply matrix pricing for similar securities when no price is observable.

Security pricing associated with long-term debt that is verified is classified

as Level 2 and non-verified debt is classified as Level 3. The fair value of

mortgage loans of each VIE is derived from the security pricing. When

substantially all of the long-term debt of a VIE is valued using Level 2 inputs,

the corresponding mortgage loans are classified as Level 2. Otherwise, the

mortgage loans of a VIE are classified as Level 3.

With respect to the consolidated mortgage VIEs for which the fair

value option was elected, the mortgage loans are classified as Loans on

Citigroup’s Consolidated Balance Sheet. The changes in fair value of

the loans are reported as Other revenue in the Company’s Consolidated

Statement of Income. Related interest revenue is measured based on the

contractual interest rates and reported as Interest revenue in the Company’s

Consolidated Statement of Income. Information about these mortgage loans

is included in the table below. The change in fair value of these loans due to

instrument-specific credit risk was a gain of $190 million for the year ended

December 31, 2010.

The debt issued by these consolidated VIEs is classified as long-term

debt on Citigroup’s Consolidated Balance Sheet. The changes in fair value

for the majority of these liabilities are reported in Other revenue in the

Company’s Consolidated Statement of Income. Related interest expense is

measured based on the contractual interest rates and reported as such in the

Consolidated Statement of Income. The aggregate unpaid principal balance

of long-term debt of these consolidated VIEs exceeded the aggregate fair

value by $857 million as of December 31, 2010.

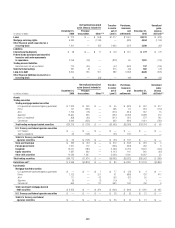

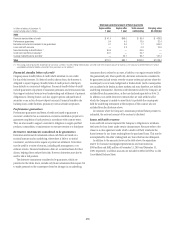

The following table provides information about Corporate and Consumer

loans of consolidated VIEs carried at fair value:

December 31, 2010

In millions of dollars

Corporate

loans

Consumer

loans

Carrying amount reported on the

Consolidated Balance Sheet $425 $1,718

Aggregate unpaid principal balance in

excess of fair value 357 527

Balance of non-accrual loans or loans more

than 90 days past due 45 133

Aggregate unpaid principal balance in excess

of fair value for non-accrual loans or loans

more than 90 days past due 43 139

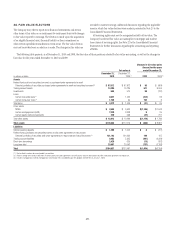

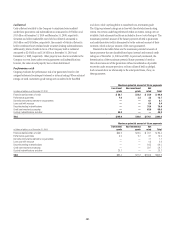

Mortgage servicing rights

The Company accounts for mortgage servicing rights (MSRs) at fair value.

Fair value for MSRs is determined using an option-adjusted spread valuation

approach. This approach consists of projecting servicing cash flows under

multiple interest-rate scenarios and discounting these cash flows using

risk-adjusted rates. The model assumptions used in the valuation of MSRs

include mortgage prepayment speeds and discount rates. The fair value of

MSRs is primarily affected by changes in prepayments that result from shifts

in mortgage interest rates. In managing this risk, the Company hedges a

significant portion of the values of its MSRs through the use of interest-rate

derivative contracts, forward-purchase commitments of mortgage-backed

securities, and purchased securities classified as trading. See Note 22 to the

Consolidated Financial Statements for further discussions regarding the

accounting and reporting of MSRs.

These MSRs, which totaled $4.554 billion and $6.530 billion as of

December 31, 2010 and 2009, respectively, are classified as Mortgage

servicing rights on Citigroup’s Consolidated Balance Sheet. Changes in fair

value of MSRs are recorded in Other revenue in the Company’s Consolidated

Statement of Income.