Citibank 2010 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2010 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.69

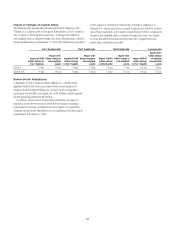

Each of the credit rating agencies is evaluating the impact of the Dodd-

Frank Wall Street Reform and Consumer Protection Act of 2010 (Financial

Reform Act) on the rating support assumptions currently included in their

methodologies, as related to large U.S. bank holdings companies (see

also “Risk Factors” below). It is their belief that the Financial Reform Act

increases the uncertainty regarding the U.S. government’s willingness to

provide support to large bank holding companies in the future. Consistent

with this belief, and their actions with respect to other large U.S. banks, both

S&P and Moody’s revised their outlooks on Citigroup’s supported ratings from

stable to negative, and Fitch placed Citigroup’s supported ratings on rating

watch negative, during 2010. The ultimate timing of the completion of the

credit rating agencies’ evaluations of the impact of the Financial Reform Act,

as well as the outcomes, is uncertain.

Also in 2010, however, Citi’s unsupported ratings were improved at two of

the three agencies listed above. In both the first quarter and fourth quarter of

2010, S&P upgraded Citi’s stand alone credit profile, or unsupported rating,

by one notch, for a total two-notch upgrade during 2010. In the fourth

quarter of 2010, Fitch upgraded Citi’s unsupported rating by a notch. Further,

Fitch stated that as long as Citi’s intrinsic performance and fundamental

credit profile remain stable or improve, any future lowering or elimination

of government support from its ratings would still result in a long-term

unsupported rating in the “A” category, and short-term unsupported rating

of at least “F1.” Citi believes these upgrades were based on its progress to

date, and such upgrades have narrowed the gap between Citi’s supported and

unsupported ratings.

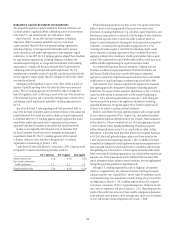

Ratings downgrades by Fitch, Moody’s or S&P could have material

impacts on funding and liquidity through cash obligations, reduced funding

capacity, and due to collateral triggers. Because of the current credit ratings

of Citigroup, a one-notch downgrade of its senior debt/long-term rating

may or may not impact Citigroup’s commercial paper/short-term rating by

one notch.

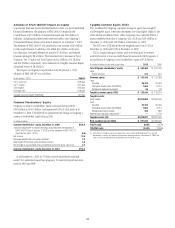

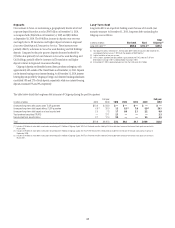

As of December 31, 2010, Citi currently believes that a one-notch

downgrade of both the senior debt/long-term rating of Citigroup and a one-

notch downgrade of Citigroup’s commercial paper/short-term rating could

result in the assumed loss of unsecured commercial paper ($8.9 billion) and

tender option bonds funding ($0.3 billion), as well as derivative triggers and

additional margin requirements ($1.0 billion). Other funding sources, such

as secured financing and other margin requirements for which there are no

explicit triggers, could also be adversely affected.

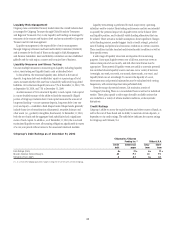

The aggregate liquidity resources of Citigroup’s non-bank stood at

$95 billion as of December 31, 2010, in part as a contingency for such an

event, and a broad range of mitigating actions are currently included in

Citigroup’s Contingency Funding Plans (as described under “Liquidity

Measures and Stress Testing” above). These mitigating factors include, but

are not limited to, accessing surplus funding capacity from existing clients,

tailoring levels of secured lending, adjusting the size of select trading books,

and collateralized borrowings from significant bank subsidiaries.

Citi currently believes that a more severe ratings downgrade scenario, such

as a two-notch downgrade of the senior debt/long-term rating of Citigroup,

accompanied by a one-notch downgrade of Citigroup’s commercial paper/

short-term rating, could result in an additional $1.2 billion in funding

requirement in the form of cash obligations and collateral.

Further, as of December 31, 2010, a one-notch downgrade of the senior

debt/long-term ratings of Citibank, N.A. could result in an approximate

$4.6 billion funding requirement in the form of collateral and cash

obligations. Because of the current credit ratings of Citibank, N.A., a one-

notch downgrade of its senior debt/long-term rating is unlikely to have any

impact on its commercial paper/short-term rating. The significant bank

entities, Citibank, N.A., and other bank vehicles have aggregate liquidity

resources of $227 billion, and have detailed contingency funding plans that

encompass a broad range of mitigating actions.