Citibank 2010 Annual Report Download - page 254

Download and view the complete annual report

Please find page 254 of the 2010 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

252

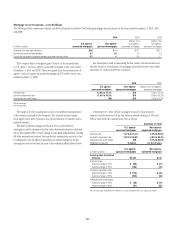

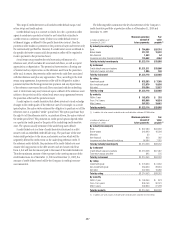

Derivative Mark-to-Market (MTM) Receivables/Payables

Derivatives classified in trading

account assets/liabilities

(1)

Derivatives classified in other

assets/liabilities

In millions of dollars at December 31, 2010 Assets Liabilities Assets Liabilities

Derivative instruments designated as ASC 815 (SFAS 133) hedges

Interest rate contracts $ 867 $ 72 $ 6,342 $ 2,437

Foreign exchange contracts 357 762 1,656 2,603

Total derivative instruments designated as ASC 815 (SFAS 133) hedges $ 1,224 $ 834 $ 7,998 $ 5,040

Other derivative instruments

Interest rate contracts $ 475,805 $ 476,667 $ 2,756 $ 2,474

Foreign exchange contracts 84,144 87,512 1,401 1,433

Equity contracts 16,146 33,434 — —

Commodity and other contracts 12,608 13,518 — —

Credit derivatives (2) 65,041 59,461 88 337

Total other derivative instruments $ 653,744 $ 670,592 $ 4,245 $ 4,244

Total derivatives $ 654,968 $ 671,426 $12,243 $ 9,284

Cash collateral paid/received 50,302 38,319 211 3,040

Less: Netting agreements and market value adjustments (655,057) (650,015) (2,615) (2,615)

Net receivables/payables $ 50,213 $ 59,730 $ 9,839 $ 9,709

(1) The trading derivatives fair values are presented in Note 14 to the Consolidated Financial Statements.

(2) The credit derivatives trading assets are composed of $42,403 million related to protection purchased and $22,638 million related to protection sold as of December 31, 2010. The credit derivatives trading liabilities

are composed of $23,503 million related to protection purchased and $35,958 million related to protection sold as of December 31, 2010.

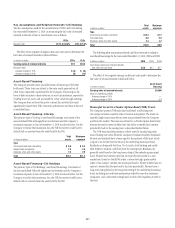

Derivatives classified in trading

account assets/liabilities

(1)

Derivatives classified in other

assets/liabilities

In millions of dollars at December 31, 2009 Assets Liabilities Assets Liabilities

Derivative instruments designated as ASC 815 (SFAS 133) hedges

Interest rate contracts $ 304 $ 87 $ 4,267 $ 2,898

Foreign exchange contracts 753 1,580 3,599 1,416

Total derivative instruments designated as ASC 815 (SFAS 133) hedges $ 1,057 $ 1,667 $ 7,866 $ 4,314

Other derivative instruments

Interest rate contracts $ 454,974 $ 449,551 $ 2,882 $ 3,022

Foreign exchange contracts 71,005 70,584 1,498 2,381

Equity contracts 18,132 40,612 6 5

Commodity and other contracts 16,698 15,492 — —

Credit derivatives (2) 92,792 82,424 — —

Total other derivative instruments $ 653,601 $ 658,663 $ 4,386 $ 5,408

Total derivatives $ 654,658 $ 660,330 $12,252 $ 9,722

Cash collateral paid/received 48,561 38,611 263 4,950

Less: Netting agreements and market value adjustments (644,340) (634,835) (4,224) (4,224)

Net receivables/payables $ 58,879 $ 64,106 $ 8,291 $10,448

(1) The trading derivatives fair values are presented in Note 14 to the Consolidated Financial Statements.

(2) The credit derivatives trading assets are composed of $68,558 million related to protection purchased and $24,234 million related to protection sold as of December 31, 2009. The credit derivatives trading liabilities

are composed of $24,162 million related to protection purchased and $58,262 million related to protection sold as of December 31, 2009.

All derivatives are reported on the balance sheet at fair value. In addition,

where applicable, all such contracts covered by master netting agreements

are reported net. Gross positive fair values are netted with gross negative fair

values by counterparty pursuant to a valid master netting agreement. In

addition, payables and receivables in respect of cash collateral received from

or paid to a given counterparty are included in this netting. However, non-

cash collateral is not included.

The amount of payables in respect of cash collateral received that was

netted with unrealized gains from derivatives was $31 billion and $30 billion

as of December 31, 2010 and December 31, 2009, respectively. The amount of

receivables in respect of cash collateral paid that was netted with unrealized

losses from derivatives was $45 billion as of December 31, 2010 and

$41 billion as of December 31, 2009, respectively.

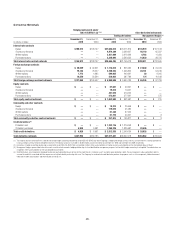

The amounts recognized in Principal transactions in the Consolidated

Statement of Income for the years ended December 31, 2010 and

December 31, 2009 related to derivatives not designated in a qualifying

hedging relationship as well as the underlying non-derivative instruments

are included in the table below. Citigroup presents this disclosure by business

classification, showing derivative gains and losses related to its trading