Citibank 2010 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2010 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.79

understanding or cause confusion across comparative financial statement

periods. For example, the FASB’s financial instruments and balance sheet

offsetting projects could, among other things, significantly change how

Citigroup classifies, measures and reports financial instruments, determines

the impairment on those assets, accounts for hedges, and determines when

assets and liabilities may be offset. In addition, the FASB’s leasing project

could eliminate most operating leases and instead capitalize them, which

would result in a gross-up of Citi’s balance sheet and a change in the timing

of income and expense recognition patterns for leases.

Moreover, the FASB continues its convergence project with the

International Accounting Standards Board (IASB) pursuant to which U.S.

GAAP and International Financial Reporting Standards (IFRS) are to be

converged. The FASB and IASB continue to have significant disagreements on

the convergence of certain key standards affecting Citi’s financial reporting,

including accounting for financial instruments and hedging. In addition,

the SEC has not yet determined whether, or when, U.S. companies will be

required to adopt IFRS. There can be no assurance that the transition to

IFRS, if and when required to be adopted by Citi, will not have a material

impact on how Citi reports its financial results, or that Citi will be able to

meet any transition timeline so adopted.

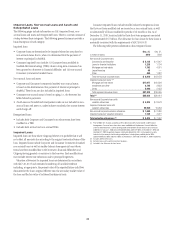

Citigroup’s financial statements are based in part on

assumptions and estimates, which, if wrong, could cause

unexpected losses in the future, sometimes significant.

Pursuant to U.S. GAAP, Citigroup is required to use certain assumptions and

estimates in preparing its financial statements, including in determining

credit loss reserves, reserves related to litigation and regulatory exposures,

mortgage representation and warranty claims and the fair value of certain

assets and liabilities, among other items. If the assumptions or estimates

underlying Citigroup’s financial statements are incorrect, Citigroup may

experience significant losses. For additional information on the key areas

for which assumptions and estimates are used in preparing Citi’s financial

statements, see “Significant Accounting Policies and Significant Estimates”

below, and for further information relating to litigation and regulatory

exposures, see Note 29 to the Consolidated Financial Statements.

Citigroup may incur significant losses as a result of

ineffective risk management processes and strategies, and

concentration of risk increases the potential for such losses.

Citigroup seeks to monitor and control its risk exposure across businesses,

regions and critical products through a risk and control framework

encompassing a variety of separate but complementary financial, credit,

operational, compliance and legal reporting systems, internal controls,

management review processes and other mechanisms. While Citigroup

employs a broad and diversified set of risk monitoring and risk mitigation

techniques, those techniques and the judgments that accompany their

application may not be effective and may not anticipate every economic and

financial outcome in all market environments or the specifics and timing of

such outcomes. Market conditions over the last several years have involved

unprecedented dislocations and highlight the limitations inherent in using

historical data to manage risk.

Concentration of risk increases the potential for significant losses. Because

of concentration of risk, Citigroup may suffer losses even when economic and

market conditions are generally favorable for Citigroup’s competitors. These

concentrations can limit, and have limited, the effectiveness of Citigroup’s

hedging strategies and have caused Citigroup to incur significant losses,

and they may do so again in the future. In addition, Citigroup extends large

commitments as part of its credit origination activities. Citigroup’s inability

to reduce its credit risk by selling, syndicating or securitizing these positions,

including during periods of market dislocation, could negatively affect its

results of operations due to a decrease in the fair value of the positions, as

well as the loss of revenues associated with selling such securities or loans.

Although Citigroup’s activities expose it to the credit risk of many different

entities and counterparties, Citigroup routinely executes a high volume of

transactions with counterparties in the financial services sector, including

banks, other financial institutions, insurance companies, investment banks

and government and central banks. This has resulted in significant credit

concentration with respect to this sector. To the extent regulatory or market

developments lead to an increased centralization of trading activity through

particular clearing houses, central agents or exchanges, this could increase

Citigroup’s concentration of risk in this sector.

A failure in Citigroup’s operational systems or

infrastructure, or those of third parties, could impair its

liquidity, disrupt its businesses, result in the disclosure of

confidential information, damage Citigroup’s reputation

and cause losses.

Citigroup’s businesses are highly dependent on their ability to process and

monitor, on a daily basis, a very large number of transactions, many of

which are highly complex, across numerous and diverse markets in many

currencies. These transactions, as well as the information technology services

Citigroup provides to clients, often must adhere to client-specific guidelines,

as well as legal and regulatory standards. Due to the breadth of Citigroup’s

client base and its geographical reach, developing and maintaining

Citigroup’s operational systems and infrastructure is challenging,

particularly as a result of rapidly evolving legal and regulatory requirements

and technological shifts. Citigroup’s financial, account, data processing or

other operating systems and facilities may fail to operate properly or become

disabled as a result of events that are wholly or partially beyond its control,

such as a spike in transaction volume, cyberattack or other unforeseen

catastrophic events, which may adversely affect Citigroup’s ability to process

these transactions or provide services.

In addition, Citigroup’s operations rely on the secure processing, storage

and transmission of confidential and other information on its computer

systems and networks. Although Citigroup takes protective measures to

maintain the confidentiality, integrity and availability of Citi’s and its clients’

information across all geographic and product lines, and endeavors to

modify these protective measures as circumstances warrant, the nature of

the threats continues to evolve. As a result, Citigroup’s computer systems,

software and networks may be vulnerable to unauthorized access, loss or

destruction of data (including confidential client information), account