Citibank 2010 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2010 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.55

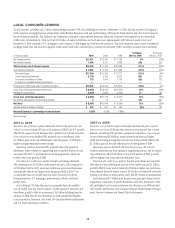

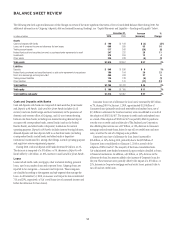

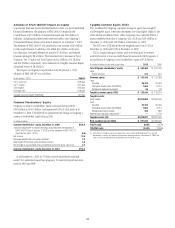

During 2010, average Consumer loans (net of unearned income) of

$495 billion yielded an average rate of 9.4%, compared to $456 billion and

7.8%, respectively, in the prior year. Average Corporate loans of $189 billion

yielded an average rate of 4.5% during 2010, compared to $190 billion and

6.3%, respectively, in the prior year.

For further information on Citi’s loan portfolios, see generally “Managing

Global Risk—Credit Risk” and Notes 1 and 16 to the Consolidated

Financial Statements.

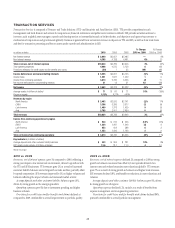

Trading Account Assets and Liabilities

Trading account assets includes debt and marketable equity securities,

derivatives in a receivable position, residual interests in securitizations and

physical commodities inventory. In addition, certain assets that Citigroup has

elected to carry at fair value, such as certain loans and purchase guarantees,

are also included in Trading account assets. Trading account liabilities

includes securities sold, not yet purchased (short positions), and derivatives

in a net payable position, as well as certain liabilities that Citigroup has

elected to carry at fair value.

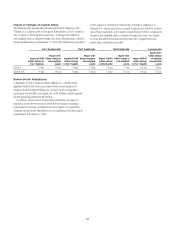

During 2010, Trading account assets decreased by $26 billion, or 8%,

primarily due to decreases in debt securities ($17 billion, or 53%), derivative

assets ($9 billion, or 15%), equity securities ($8 billion, or 17%) and U.S.

Treasury and federal agency securities ($7 billion, or 24%), partially offset

by a $16 billion, or 21%, increase in foreign government securities. Average

Trading account assets were $337 billion in 2010, compared to $350 billion

in 2009.

During 2010, Trading account liabilities decreased by $9 billion, or

7%, primarily due to a $4 billion, or 7%, decrease in derivative liabilities,

and a $4 billion, or 6%, decrease in securities short positions (primarily

U.S. Treasury securities). In 2010, average Trading account liabilities were

$128 billion, compared to $139 billion in 2009.

For further information on Citi’s Trading account assets and Trading

account liabilities, see Note 14 to the Consolidated Financial Statements.

Federal Funds Sold (Purchased) and Securities

Borrowed (Loaned) or Purchased (Sold) Under

Agreements to Resell (Repurchase)

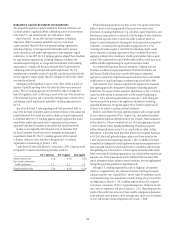

Securities sold under agreements to repurchase (repos) and securities

lending transactions generally do not constitute a sale of the underlying

securities for accounting purposes and, as such, are treated as collateralized

financing transactions. Similarly, securities purchased under agreements to

resell (reverse repos) and securities borrowing transactions generally do not

constitute a purchase of the underlying securities for accounting purposes

and so are treated as collateralized lending transactions. Reverse repos and

securities borrowing transactions increased by $25 billion, or 11%, during

2010. For further information on repos and securities lending transactions,

see “Capital Resources and Liquidity—Funding and Liquidity” below.

Federal funds sold and federal funds purchased consist of unsecured

advances of excess balances in reserve accounts held at the Federal Reserve

Banks to and from third parties. During 2009 and 2010, Citi’s federal funds

sold and federal funds purchased were not significant.

For further information regarding these balance sheet categories, see

Notes 1 and 12 to the Consolidated Financial Statements.

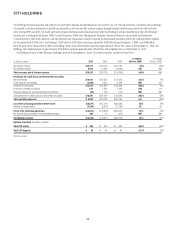

Investments

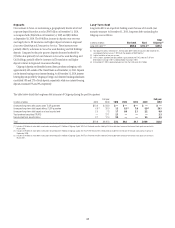

Investments consists of debt and equity securities that are available-for-sale,

debt securities that are held-to-maturity, non-marketable equity securities

that are carried at fair value, and non-marketable equity securities carried at

cost. Debt securities include bonds, notes and redeemable preferred stock, as

well as certain loan-backed securities (such as mortgage-backed securities)

and other structured notes. Marketable and non-marketable equity securities

carried at fair value include common and nonredeemable preferred stock.

Non-marketable equity securities carried at cost primarily include equity

shares issued by the Federal Reserve Bank and the Federal Home Loan Banks

that Citigroup is required to hold.

During 2010, investments increased by $12 billion, or 4%, primarily due

to a $34 billion, or 14%, increase in available-for-sale (predominantly U.S.

Treasury and federal agency securities), offset by a $22 billion decrease in

held-to-maturity securities (predominantly asset-backed and mortgage-

backed securities).

For further information regarding Investments, see Notes 1 and 15 to the

Consolidated Financial Statements.

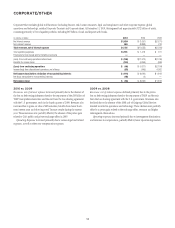

Other Assets

Other assets consists of Brokerage receivables, Goodwill, Intangibles and

Mortgage servicing rights in addition to Other assets as presented on the

Consolidated Balance Sheet (including, among other items, loans held-

for-sale, deferred tax assets, equity-method investments, interest and fees

receivable, premises and equipment, end-user derivatives in a net receivable

position, repossessed assets, and other receivables). During 2010, Other

assets decreased $4 billion, or 2%, primarily due to a $2 billion decrease in

brokerage receivables, a $2 billion decrease in mortgage servicing rights

and a $1 billion decrease in intangible assets, partially offset by a $1 billion

increase in goodwill and a $1 billion increase in other assets.