Citibank 2010 Annual Report Download - page 199

Download and view the complete annual report

Please find page 199 of the 2010 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

197

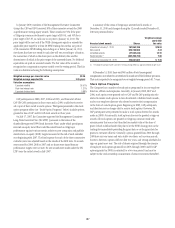

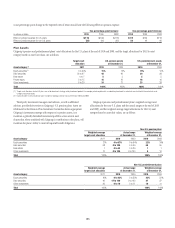

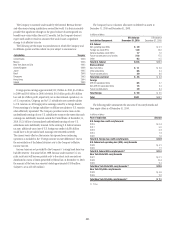

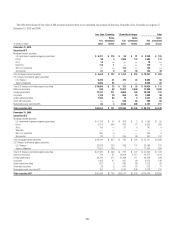

Level 3 Roll Forward

The reconciliations of the beginning and ending balances during the period for Level 3 assets are as follows:

In millions of dollars U.S. pension and postretirement benefit plans

Asset categories

Beginning Level 3

market value at

Dec. 31, 2009

Realized

gains

(losses)

Unrealized

gains

(losses)

Purchases,

sales,

issuances

Transfers in

and/or out of

Level 3

Ending Level 3

market value at

Dec. 31, 2010

Equity securities

U.S. equity $ 1 $ (1) $ — $ — $ — $ —

Non-U.S. equity 1 (1) — — — —

Debt securities

U.S. corporate bonds 1 — — 3 1 5

Non-U.S corporate bonds — — — 1 — 1

Hedge funds 1,235 (15) 85 (220) (71) 1,014

Annuity contracts 215 (44) 55 (39) — 187

Private equity 2,539 148 292 (59) — 2,920

Other investments 148 (66) (66) (16) 4 4

Total assets $4,140 $ 21 $366 $(330) $(66) $4,131

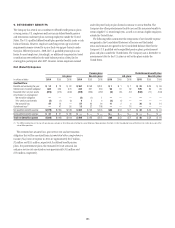

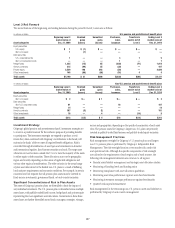

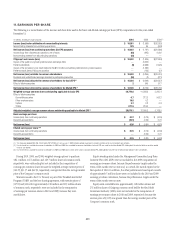

In millions of dollars Non-U.S. pension and postretirement benefit plans

Asset categories

Beginning Level 3

market value at

Dec. 31, 2009

Realized

gains

(losses)

Unrealized

gains

(losses)

Purchases,

sales,

issuances

Transfers in

and/or out of

Level 3

Ending Level 3

market value at

Dec. 31, 2010

Equity securities

Non-U.S. equity $ 2 $— $ 1 $— $ — $ 3

Debt securities

Non-U.S. corporate bonds 91 — — 16 — 107

Hedge funds 14 — — — — 14

Annuity contracts 187 (5) (1) — — 181

Other investments 18 — 4 — (14) 8

Total assets $312 $ (5) $ 4 $ 16 $(14) $313

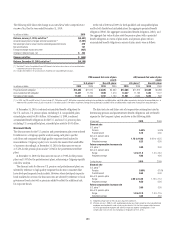

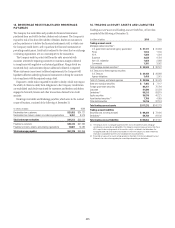

Investment Strategy

Citigroup’s global pension and postretirement funds’ investment strategies are

to invest in a prudent manner for the exclusive purpose of providing benefits

to participants. The investment strategies are targeted to produce a total

return that, when combined with Citigroup’s contributions to the funds, will

maintain the funds’ ability to meet all required benefit obligations. Risk is

controlled through diversification of asset types and investments in domestic

and international equities, fixed-income securities and cash. The target asset

allocation in most locations outside the U.S. is to have the majority of the assets

in either equity or debt securities. These allocations may vary by geographic

region and country depending on the nature of applicable obligations and

various other regional considerations. The wide variation in the actual range

of plan asset allocations for the funded non-U.S. plans is a result of differing

local statutory requirements and economic conditions. For example, in certain

countries local law requires that all pension plan assets must be invested in

fixed-income investments, government funds, or local-country securities.

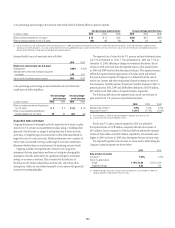

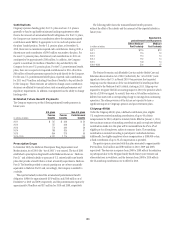

Significant Concentrations of Risk in Plan Assets

The assets of Citigroup’s pension plans are diversified to limit the impact of

any individual investment. The U.S. pension plan is diversified across multiple

asset classes, with publicly traded fixed income, hedge funds and private equity

representing the most significant asset allocations. Investments in these three

asset classes are further diversified across funds, managers, strategies, vintages,

sectors and geographies, depending on the specific characteristics of each asset

class. The pension assets for Citigroup’s largest non-U.S. plans are primarily

invested in publicly traded fixed income and publicly traded equity securities.

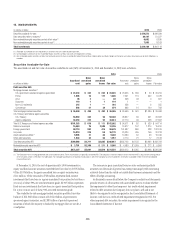

Risk Management Practices

Risk management oversight for Citigroup’s U.S. pension plans and largest

non-U.S. pension plans is performed by Citigroup’s Independent Risk

Management. The risk oversight function covers market risk, credit risk

and operational risk. Although the specific components of risk oversight

are tailored to the requirements of each region and of each country, the

following risk management elements are common to all regions:

Periodic asset• /liability management and strategic asset allocation studies

Monitoring of funding levels and funding ratios•

Monitoring compliance with asset allocation guidelines•

Monitoring asset class performance against asset class benchmarks•

Monitoring • investment manager performance against benchmarks

Quarterly risk capital measurement •

Risk management for the remaining non-U.S. pension assets and liabilities is

performed by Citigroup’s local country management.